What are The Best Forex Trading Times

Post on: 13 Август, 2015 No Comment

24 Hours Forex Trading

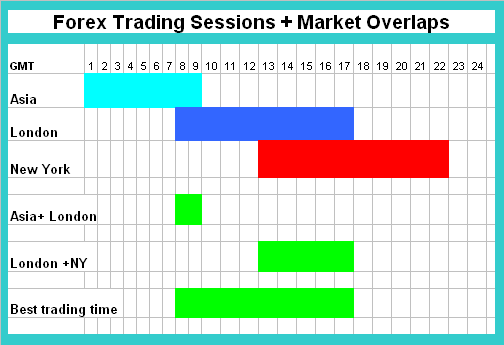

The world is a vast place and as such, we have Different Time Zones . So when one country ends its trading day, another starts. In other words, this means that Forex almost never stops! The major Financial Markets in the world have overlaping times. The heaviest trading takes time during this overlapping period and presents abundant trading opportunities.

Traders new to the world of Currency Exchange Trading tend to think that since the market is open twenty four seven, they may trade whenever they choose during the day. Although this is true, it requires some clarity. When it comes to Currency Trading, some hours present better opportunities than others. This suggest better profit potential. Therefore choosing good trading times should be an important factor to consider once you enter the world of trading forex.

What are the Best Trading Times?

Forex Trading opens in New Zealand . followed by Australia . Asia (and particularly Japan ), the Middle East . Europe (with London being the main financial center) and then America .

Trading Sessions GMT (Greenwich Mean Time):

Okay, Since I operate in the GMT Time Zone . here are the main Forex Trading Hours in this time zone.

Tokyo Open: 11:00 pm Tokyo Close: 08:00 am

London Open: 07:00 am London Close: 04:00 pm

New York Open: 12:00 pm New York Close: 09:00 pm

Sydney Open: 09:00 pm Sydney Close: 06:00 am

Tokyo Open: 11:00 pm Tokyo Close: 08:00 am

London Open: 08:00 am London Close: 05:00 pm

New York Open: 01:00 pm New York Close: 10:00pm

You can see that in between each main trading session, there is a period of time where two sessions are Open At The Same Time . From 07:00-08:00 am GMT, the Tokyo session and London session overlap, and from 12:00 — 04:00 pm GMT, the London session and the New York session overlap.

Such division of the market into trading sessions allows traders to determine their own Individual Trading Time . The important thing that should be mentioned is that all sessions have their own features and peculiarities.

When traders for the Asian Markets are starting to close and exit their trades, their European counterparts are just beginning their day.

While there are Several Financial Centers all around Europe . it is London that Forex Traders keep their eyes on. London trading session is the largest in volume and number of transactions. Historically, London has always been at a center of trade, because of its strategic location. Traders have dubbed it as the Forex Capital of the World with thousands of businessmen making transactions every single minute. About 30% of all forex transactions happen during the London session.This affects the market volatility so it is the time of active market movements. New York Trading Session is least active, but very Liquid . Besides, during the time when the London session has not yet closed and the New York session is already open the majority of deals are executed. I often find that a lot of traders try to trade at these times. But each to their own as they say.

Trading Times To Your Advantage:

There is so much liquidity during the European Session and countless transactions take place that almost any pair can be traded. With this knowledge it may be best to stick with the Majors (EUR/USD, GBP/USD, USD/JPY, and USD/CHF) . as these normally have the tightest spreads. Also worth noting is that these pairs that are normally directly influenced by any news reports that come out during the European session. You may also try the yen crosses (more specifically, EUR/JPY and GBP/JPY ), as these tend to be pretty volatile at this time. Because these are Cross Pairs, the Spreads might be a little wider though.