What are Managed Futures

Post on: 16 Март, 2015 No Comment

Managed Futures is an industry that is comprised of professional money managers commonly known as Commodity Trading Advisors (CTAs) that manages assets on behalf of their clients. They are often investing in the global futures markets such as currencies, interest rate, equity, metal, energy and agricultural markets. They are required to register with the Commodity Futures Trading Commission (CFTC), a federal government agency and are Members of the National Futures Association (NFA), a self-regulatory organization authorized by Congress in 1982.

Eight reasons why one should invest in managed futures Fortress Capital opinion

At Fortress Capital, we believe that every investment decision should be carefully considered in light of ones financial condition and wherewithal.

( 1 ) Managed futures have often outperformed alternatives. Empirical evidence suggests that using managed futures as a means of diversification or speculation entails potentially better risk-adjusted rewards for any investment portfolio. Correlation between stocks and commodities is nearly zero, so commodity futures have often experienced positive performance during times when the US stock market was lackluster. Increased awareness of the benefits of managed futures has resulted in a more than a tripling of assets under management from $37.9 billion in 2000 to $213 billion in Q4 2009 (Source: Barclay Group, LTD). Many analysts agree that diversifying into futures improves overall performance of portfolios, especially if it is in the hands of an experienced professional.

Managed futures: CASAM CISDM CTA Equal Weighted: 2) U.S. stocks: S&P 500 Total Return: 3) International stocks: MSCI World: Source: Bloomberg: All material is property of MSCI. Use and duplication subject to contract with MSCI. Time period: 01/1980- 02/2008 For inclusion in the CISDM indices, a CTA or CPO must have a minimum of $500,000 under management and at least a 12- month track record. Past Performance is not necessarily indicative of future results. Keep in mind that these indices and website rankings have criteria and limitations associated with them.

Demo Link

We offer fully integrated futures trading platform. Theres full integration lets you access and trade your futures account within a signal. This gives you the best of both worlds – robust order routing and account management of futures, real-time account management, and he said Knowles advanced analytics and charting all in one application.

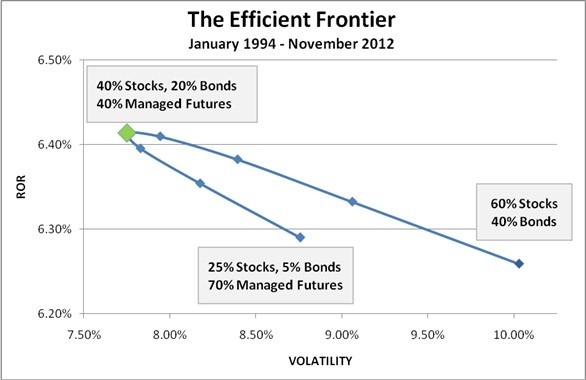

( 2 ) Little or negative correlation leads to better risk-versus-reward ratios. Losing a bet from flipping three quarters is statistically less likely than losing a bet from flipping one quarter. Diversification offers long-run advantages when one allocates a portion of their assets to less or negatively correlated markets with similar potentials for return. Managed futures represent potential hedges against such factors as inflation risk and business cycle movements which may adversely affect a pure stock/bond portfolio.

( 3 ) Percentage-based costs mean CTAs primarily target consistent returns. Commodity Trading Advisors (CTAs) typically have percentage-based profits as their largest source of income. Because incentive fees mean CTAs make more money when you do, they have incentives to make as much profit as possible for their investors.

( 4 ) Commodity portfolios make diversification easy. CTAs often target many markets using multiple strategies, which reduces your volatility risk. Not every investor has the ability to stare at a computer screen all day for this specific purpose. Managed futures provide every investor the opportunity to diversify through professional managers.

( 5 ) Flexibility means not being a bull or a bear. Managed futures programs are not the same as mutual funds: CTAs are not limited to only buying. They can buy and sell futures, write or purchase options, and speculate in bull or bear markets.

( 6 ) The potential for global market exposure is simple. By their very nature, commodities are markets dependent upon global factors. Furthermore, foreign exchange and index futures allow for global diversification without the need for a microscope on several thousand foreign stocks and bonds.

( 7 ) You have the ability to choose. There are many CTAs out there and they all want your business. That not only means that you can be choosy about risks and rewards, but also about capital requirements and fees/costs. You have options so find what works for you.

( 8 ) CTAs have history. The managed futures business has existed for several decades and the most consistent CTAs are the ones who have a long-term track record.

Fortress Capital is here to Help You

Fortress Capital has worked with many CTAs (Commodity Trading Advisors), and are in a unique position to offer to their clientele a wide variety of CTA programs that matches each investors risk tolerance and investment objectives.

Please call us to Request a free consultation from our Managed Futures Advisors.

Risk Disclaimer: PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. BE ADVISED THAT THERE IS SUBSTANTIAL RISK OF LOSS WHEN INVESTING IN FUTURES AND DERIVATIVE MARKETS, INCLUDING MANAGED FUTURES, FUTURES OPTIONS, AND FOREX. NO SYSTEM OR CTA TRADING PROGRAM CAN GUARANTEE PROFITS OR FREEDOM FROM LOSS. THESE INVESTMENTS MAY NOT BE SUITABLE FOR ALL INVESTORS.

Fortress Capital is legally obliged to inform investors of a potential conflict of interest in recommending CTAs, given that Fortress Capital is compensated through fees or commissions by CTAs. This material and any views expressed herein are provided for information purposes only and should not be construed in any way as an endorsement or inducement to invest in any specific program. Before investing in any program, you must obtain, read and examine thoroughly its disclosure document or offering memorandum.

Any performance included herein is based upon information that has been compiled by Fortress Capital from CTA disclosure documents and by third party independent CTA tracking services such as the Barclay Group, Ltd. Such information has not been independently reviewed or audited by Fortress Capital or its affiliates and therefore neither Fortress Capital nor its affiliates make any representation as to its accuracy or completeness.