Weekly Market Technical Analysis Outlook – June 3rd to June 7th 2013 » Learn To Trade

Post on: 30 Апрель, 2015 No Comment

Weekly Market Technical Analysis Outlook – June 3rd to June 7th 2013

Weekly Market Technical Analysis Outlook – June 3rd to June 7th 2013

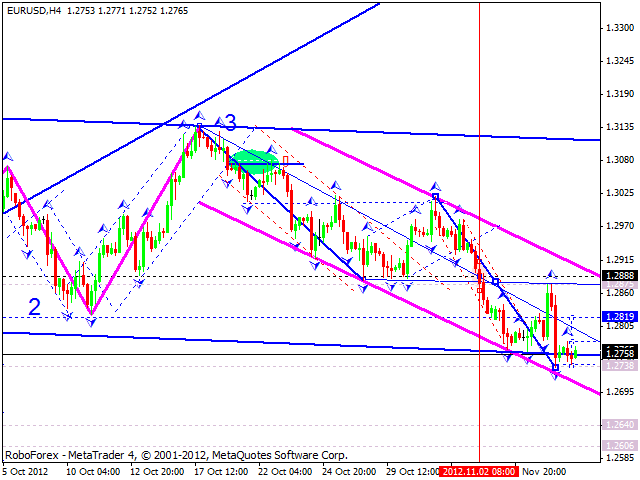

EURUSD Euro/dollar hovering near key support

The EURUSD has shown renewed strength over the last three trading sessions as it shot up and busted through 1.2950 and 1.3000 resistance late last week. The market did rotate modestly lower on Friday, giving back some of its recent gains as it moved down to retest the key level near 1.2950, which is now support. However, the market did show some rejection of that level as we can see it ended Friday up off the lows.

If the market holds above 1.2950 on a daily closing basis this week, we could see the recent move higher continue and can look for price action buy signals to trade up toward 1.3200 resistance. Whereas a daily close back below 1.2950 would open the door for another move lower. The next key resistance comes in up around 1.3200, and if the market does push up into that resistance in the coming days we could then watch for price action sell signals forming near that there to trade back down toward support.

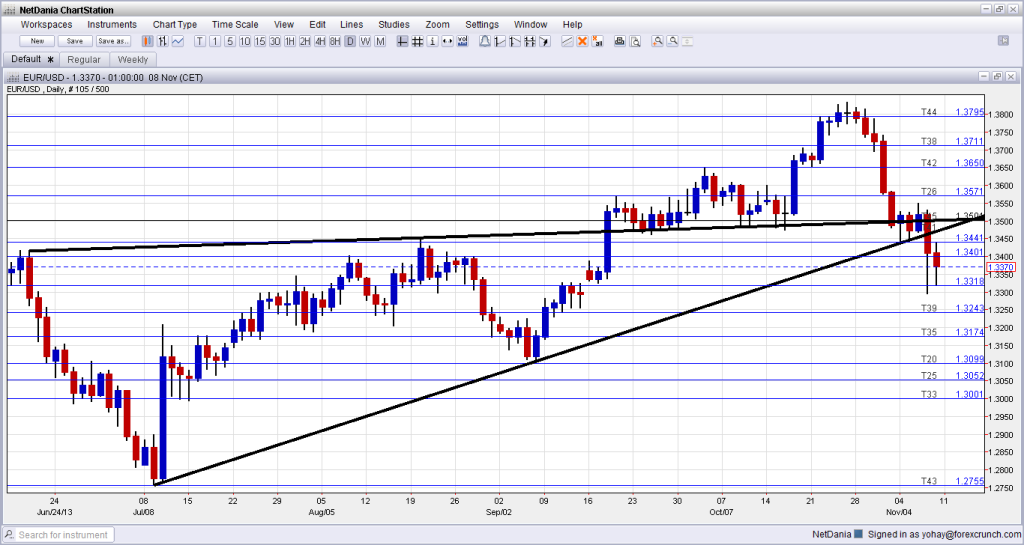

AUDUSD Aussie/dollar weakness continues

The AUDUSD continued losing ground last week and has now had 4 straight weeks of significant losses. We needed to zoom out to the monthly chart to get a good view of the next upcoming key support level, as you can see in the chart below. Its apparent that around 0.9385 theres a very key long-term support, thus, given how weak this market has been lately we would not be surprised to see a move down into that support near 0.9385 before this market makes a significant retrace higher. The market will need to break down past the low of the counter-trend pin bar at 0.9527 from last Wednesday to extend the downtrend, but if that happens a quick move down to re-test 0.9385 would be highly likely. Traders should keep an eye out for sell signals on the 1 hour, 4 hour or daily charts on any retraces back to resistance this week to trade back in-line with the downtrend. Obviously, if a very large bullish long-tailed pin bar reversal signal forms that would change the dynamics here a little bit, but until we see obvious signs of such a reversal, we remain bearish biased.

In the daily AUDUSD chart below, we can see the market continued to weaken on Friday despite the bullish counter-trend pin bar that formed on Thursday, reflecting the strong selling pressure in this market right now. This week, we remain bearish on this market and would could consider a short entry if an obvious price action sell signal forms from resistance.

GBPUSD Sterling/dollar facing resistance close overhead

The GBPUSD has retraced to the upside recently, showing strength the last three days of last week after finding support down near 1.5025 1.5000. Theres been a lot of selling over the last month so its hard to get excited about the upside just yet. If the market can remain strong early this week and it breaks decisively above 1.5260 resistance, we could see a move up to test the next resistance around 1.5360 1.5400 area. However, given all the resistance levels coming in close overhead, we feel more comfortable watching for obvious 4 hour or daily chart price action reversal signals or false break trading strategies to sell from resistance rather than looking for buy signals just yet.

USDJPY Dollar/yen moves down closer to key support zone

The USDJPY has continued to weaken since we last discussed it in our May 27th commentary. As a result, we are adjusting down the key support area we last discussed near 100.00 to include the area between 100.00 98.50. What the market does in this support zone this week will be important. If it holds firm there and forms an obvious daily chart buy signal, we could see the uptrend pick back up. However, if the market sails right through it and closes below 98.50, it would be a very bearish sign and could signal more downside to come. Alternatively, we could just see consolidation take hold between 100.00 98.50 this week if the market drifts down into that zone.

Want more commentary? – If you would like to receive more market commentary and trade setups, I publish a daily newsletter for members which includes more charts and analysis covering Forex, Indices and Commodities. For more info, click here.

Upcoming important economic announcements (New York time):

9:30pm EST: Australia – Retail Sales m/m