Walter`s Forex Trend Trades Page 20 Traders Laboratory

Post on: 19 Июль, 2015 No Comment

Re: Walter`s Forex Trend Trades

OK let me brief a little bit where I am and where I am heading at this point of this research.

I had been doing some parallel research of a scalping alternative using Vmar`s. but at this point I just droped that alternative. lol..

I have decided that at this point I will only focus on the surefoot trade that I take from the 5 min chart. I will call this trade VMAR Icon Trade. so I will try not to mix other things but getting really focused on this aproach.

I am so glad to see other people are combining vmar`s with their own methods, thats the real idea here. offcourse as usuall I will share my entire specific aproach that you can take as much as you want for your trading, be it some aspects of vmar`s or be the whole thing.

So SO so so. from now on my inputs in the thread will really be focusing into VMAR Icon`s .

I thought as I am getting more specific here I could share some diferent way of looking at the structure of the trade. this can organize the overall routine of the trader as he attempts to do a VMAR Icon trade.

Probably this will sound a little bit for newbies. but its nice to go into the basics as it organizes the entire process of this trade.

this was the original structure of our trend trade :

To open position.

_Trend Definition

_Pullback Definition (dips and rallys)

_Timing Entry Definition

To Close Position.

_Stop Definition

_Exit Definition

Now a trader that trades VMAR Icon`s would have basicly three stages of his trade. (this words are my invention, not conventional)

_SETUPING

_TIMING

_EXITING

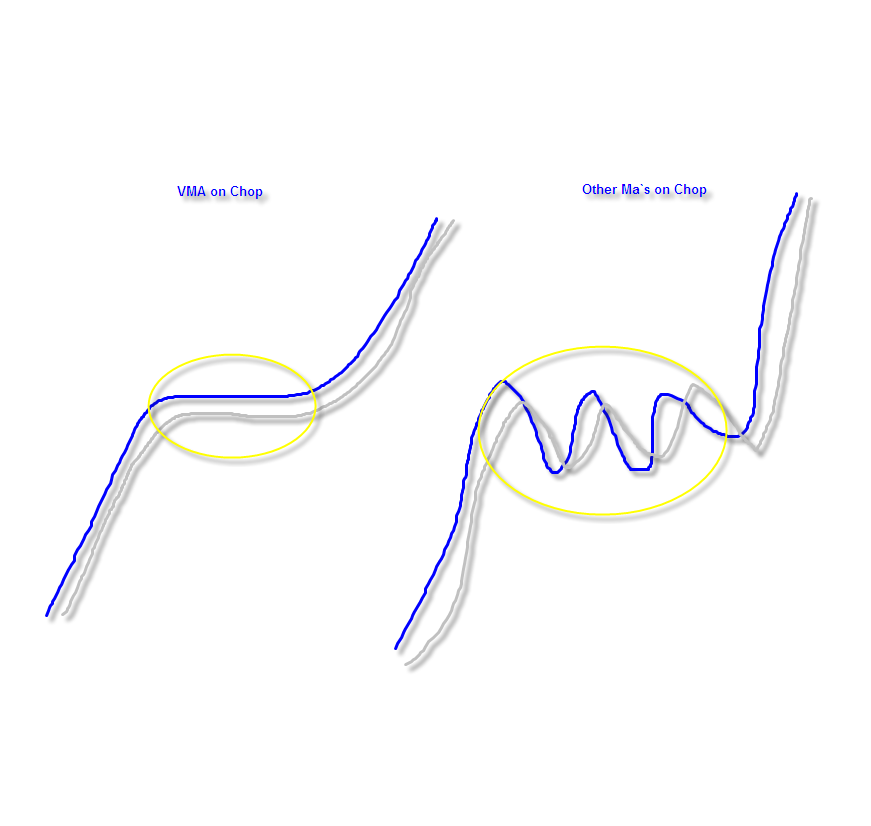

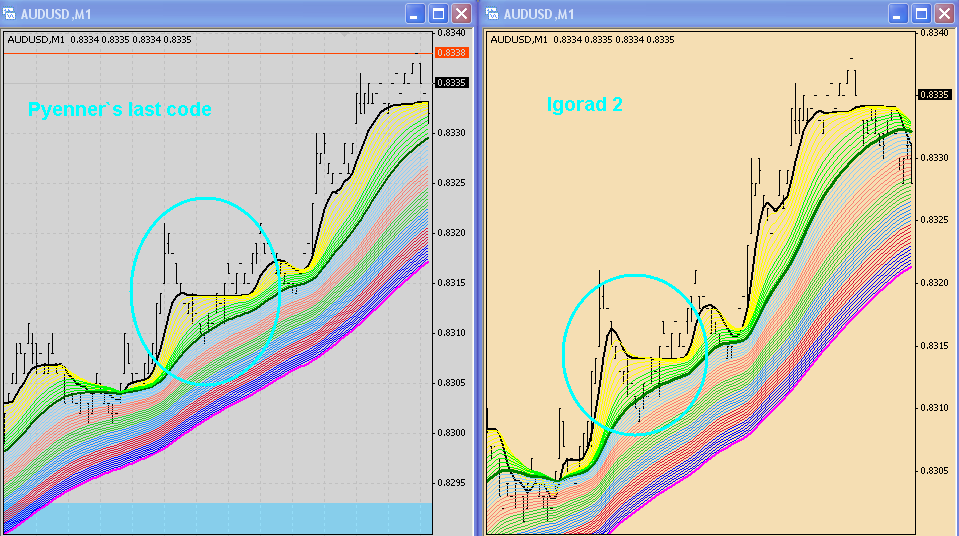

this graph shows how the trend trade structure fits on this three stages that a trader will go thru:

So notice how trend and pullback definitions are all discounted on the VMAR Icon Pattern. thats the SETUPING phase of a trade. actually the first one on any trade.

The second phase is TIMING, when you have a setup in place you will fine tune your entry.

and Third and last, once inside the trade you are focused on EXITING being a stop loss or neutral trade or a succesfull wining trade.

this three phases are how the traders work are organized. very simple routine he goes thru. no confusion here. sounds a little stupid maybe. but you know sometimes traders are thinking on timing when they still dont even have their setuping been correctly identified. others had open a trade and are looking for new setups instead of monitoring correctly their exiting. so this is how a trade has to be managed in terms of FOCUS

First you are working for the SETUPING division of your trading company..

Second they re-asign you to the TIMING section, you dont have nothing to do with the setuping any more.

Third after you open your trade they send you to the fifth floor to the EXITING department where you will focus exclusive on closing your trade.

after that they will give you a brake. some coffe, maybe some relaxing and again the process starts on the SETUPING division once again.

Is your trading organized like this. Good ¡¡ you can call yourself a trader, you still have a mambo on the entire process. well maybe its time to organize it. this is one way you can implement it.

On next post I show you the basic structural routine thru the charts and your trading platform as you trade a VMAR Icon trade. this structure will be used on my coming posts about this trade so we can talk on the same language here. cheers Walter.

Attached Thumbnails

- Share

- Share this post on Digg Del.icio.us Technorati Twitter