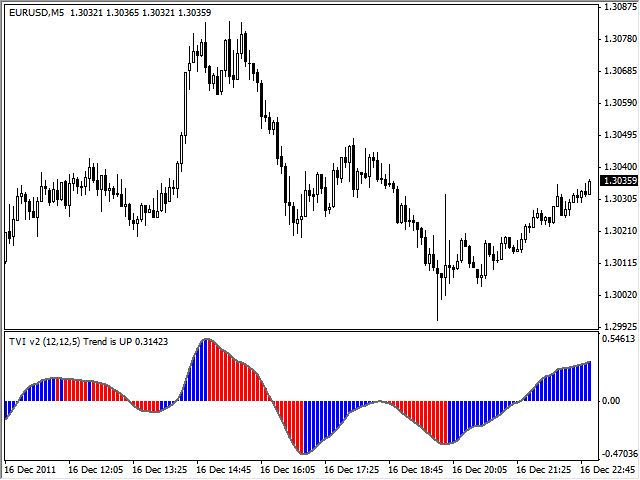

Volume indicator

Post on: 19 Март, 2017 No Comment

Volume — Quick Summary

Trading with Volume indicator offers the following features:

Volume confirms the strength of a trend or suggests about its weakness.

A rising volume indicates rising interest among traders, while a falling volume suggests decline in interest.

Extreme Volume readings Climax Volume often highlight price reversals.

Volume indicator

Why Volume? Volume is the second most valuable data after the price itself.

Large volume signifies that there is large number of market participants involved, including financial institutions. The last ones bring the highest turnover to the market, and if they are trading, it means the interest to the price at certain point and/or to the trend overall is high.

Small volume tells that there are very little participants in the market, neither buyers no sellers have any significant interest in the price. In addition, no financial institutions will be involved, thus a market is going to be moved only by individual traders and so the move will be weak.

Volume and Trend

Volume helps to learn about the health of a trend.

An uptrend is strong and healthy if Volume increases as price moves with the trend and decreases when price goes counter trend (correction periods).

When price is going up and volume is decreasing, it tells traders that a trend is unlikely to continue. Price may still attempt to increase at a slower pace, but once sellers get the grip on it (which will be signified by an increase in volume on a down candle), the price will fall.

A downtrend is strong and healthy if volume increases as price moves lower and decreases when it begins retracing upwards.

When price is falling and volume is decreasing, the downtrend is unlikely to continue. Price will either continue to decrease, but at a slower pace or start to rise.

Volume and Reversals

To understand the nature of spike in volume before a trend reversal, traders need to know how the data for volume indicator is gathered in Forex.

Forex volume cannot be measured precisely as it is done, for example, in Equity market, where every share traded equals 1 volume, and selling 200 shares means 200 in volume. Forex by nature cannot count how many contracts and what sizes of contracts were traded at any given time, because the market is wide and decentralized. Therefore to count volume in Forex the number of ticks/changes in price is used. 1 tick measures 1 volume. As it moves up and down volume adds up.

When volume rises, it means lots of participants are actively selling and buying currencies. When volume spikes at certain price level, traders know that there was lots of interest shown by traders to that price level. If there is a lot of interest, it means the level is an important one.

This simple observation of a volume indicator allows identify important Support and Resistance levels, which would certainly play significant role in the future.

Where Volume spikes are distinctively extreme (larger than any historical spikes around) Climax Volume traders should look for clues from the price itself. Candles that have a narrow range, spinning tops/bottoms, dojies, stars, other candles with extremely large tails have highest chances to become the price turning points.

Single volume spikes only bring price to a halt. A lot of stand-alone average volume spikes occur during fundamental economic announcements on daily basis. News can cause spike in volume for a single day and then volume disappears again.

Reversals, however, happen not over one day but a series of days. If higher than average volume stays on the market for several to many days a huge volume spike volume climax will crown a point of market reversal.

Volume and Breakouts

Volume indicator helps to validate all kinds of breakouts.

When market is consolidating on a low volume, a sudden pick up in volume would signify that a breakout is due.

Breakout occurring on rising volume is a valid breakout, while a breakout that caused no interest from traders as it is happening on a low volume is more likely a false one.

Trend lines and other breakouts are validated or voided the same way.

Reading Volume Indicator step by step

We’ll compare the weeks, not individual days.

Week 1: as price falls, volume rises compare to previous week – interest to downtrend among traders grow.

Week 2: volume peaks and begins to decrease as price move higher – sellers are still interested in downtrend, buying the currency is going on a lower volume.

3: volume is lower than previous weak, confirming that there is still very little interest in buying the pair.

4: Sellers push down, but this time volume doesn’t increase – it is about equal to week 3.

5: Both sides lost interest as the market drifts sideways on low trading range.

6: market finally finds dome buying interest as the week ends on higher than previous week volume. Buyers seem to be going active.

7: Buyers going full steam – volume rises – it is a healthy uptrend.

8: Correction came – volume drops, no one is interested in Selling the pair – confirmation of a healthy volume.

9: Volume picks up again once price finds its uptrend.

10: Exhaustion gap is seen on the chart, followed by a doji candle with a spike in volume – a highlight of a market turning point. Market ends trading on a lower volume.

11: Even Sunday was busier than usual. The new week market begins with an attempt to rise higher, however volume suggests that the interest to the upper side is much lower.

12, 13 and 14: market attempts to move upward, but volume decreases, signaling that the trend is no longer healthy and a change is coming soon.

15 and 16: some interest arises among traders as the market moves to the downside, Sellers anticipate that this is a moment of a trend change, a volume of new Short orders come.

17, 18 and 19: as the market attempts to rise, volume drops, telling that there is no interest to the upside.

20, 21 and 22: volume picks up again as Sellers take over. A pause on week 21 with a sharp rise in price is met by even higher volume on week 22.

23, 24, 25, and 26: market rises, volume drops – confirmation that remaining traders lose interest in that upward move.

27 and 28: Price begins to decline, volume picks up – interest to the downside is present.

29, mid 30: sideways pattern pause the trend and the volume with it.

30, 31 and so on – trend picks up making new lows, volume confirms healthy trend by rising when price is falling and pausing or falling when price is moving sideways or going into correction.