Volatility in the Forex Market

Post on: 19 Июнь, 2015 No Comment

Updated: March 08, 2013 at 4:59 AM

Volatility is a useful concept for forex traders that can give them a sense of the risk involved in trading a particular currency pair. This can assist them in more intelligently choosing an appropriate size for a trading position based on how much risk they can tolerate. Learn to asses risk based on volatility.

Nevertheless, you will need to be clear about what sort of volatility you are referring to when speaking to other traders since a number of different usages of the term are fairly common in the forex market.

Types of Volatility

Several different ways of using the term volatility are in common usage among forex, currency futures and currency option traders. These include:

In its most informal sense, the term volatility used without any other modifiers is sometimes used to qualitatively describe the degree to which markets trade erratically, i.e. showing substantial swings between highs and lows.

For example, a trader might refer to a whippy market that trades significantly in both directions as being especially volatile.

Historical volatility, on the other hand, can be mathematically defined as the annualized standard deviation of price movements from the average price observed over a period of time.

This calculated form of volatility can be especially useful in determining the risk that trading a currency pair might involve, based on what it has done in the past.

Furthermore, implied volatility in the forex market is the annualized volatility implied in the market-determined prices of currency options for a particular expiration date.

This market determined form of volatility can be used to assess what the expected future risk for trading in a particular currency pair might involve, since it factors in option traders’ expectations for future price swings.

Nevertheless, implied volatility is not constant and can vary substantially with expiration date and strike price. To help illustrate this phenomenon, the implied volatility curve shows how the level of implied volatility changes with respect to expiration date.

Also, the volatility smile or skew curve shows how the implied volatility changes with respect to strike price for currency options of a given maturity date.

Leverage and Volatility

When retail forex traders speak about leverage. they are generally referring to the size of a trade they can control given a certain quantity of money put on deposit as margin or collateral.

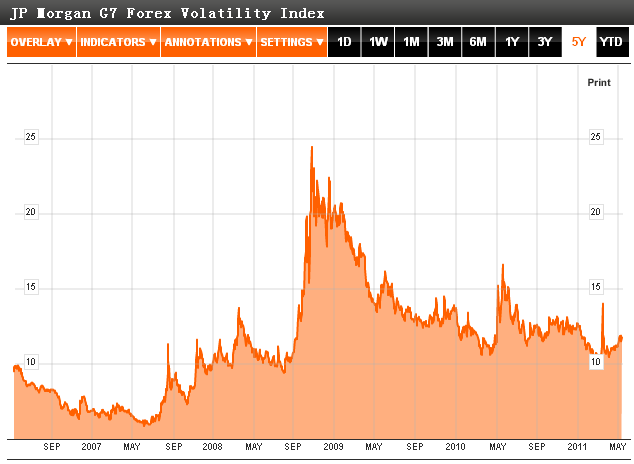

Leverage in the forex markets makes up an important tool for retail traders because of the relatively lower volatility in the currency markets, which tends to range between 10% and 20% on an annualized basis.

Compare this volatility range to the much higher volatility often seen in the stock market. For example, a stock can move five or ten percent in just one session.

Furthermore, currencies typically move in just tenths of a percentage or pips, with a large move being 3% for the week. A move up or down of five or ten percent in one session represents a huge move in a currency pair, and while possible, such moves are actually quite rare.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.