Using Trailing Stop Orders with Your Online Broker Stock Trading To Go

Post on: 16 Март, 2015 No Comment

Trailing stop orders can be a great and effective order type to use as insurance in protecting your stock positions. Not only do they change on the fly as the stock price changes, but they can be used as both buys and sells. This article will explain both ways to use this order.

As some may know, there are several different ways to buy and sell stock:

We are exploring trailing stop orders here, but to just note trailing stops and stop orders are the two most advanced stock order types. Market orders are the simplest and easiest to utilize, and limit orders are arguably the most effective order in the books.

Trailing Stop Basics

The concept behind these orders is very simple. The order uses one of two parameters, price or percentage, to calculate when to trigger an awaiting market order.

- Price Price in a dollar amount. If stock XYZ is trading at $100 a share, the price is $100 a share. Price can also be referred in pennies as well, for instance $.40.

- Percentage With trailing stops, the percentage is as of the current stock price. So, if we used 2%, and our stock XYZ was at $100 a share, well then we are referring to $2.

It is important to understand the difference between Price and Percentage because these are the main factors taken into consideration when applying a trailing stop order.

Trailing Stops (SELL)

To place a trailing stop order on a stock, you have to have already purchased the stock and be holding a position in that stock / security.

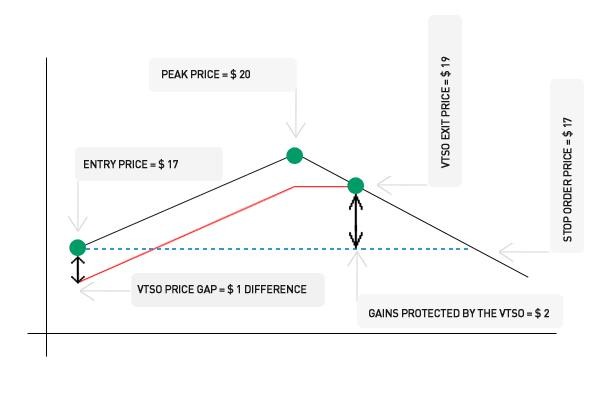

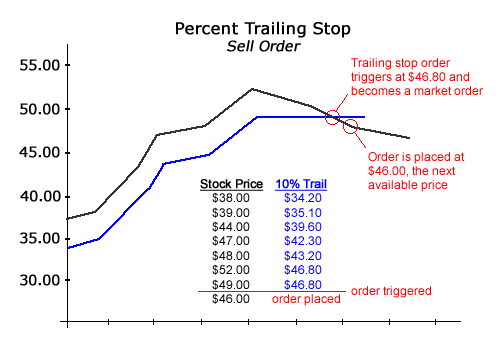

The main use for a trailing stop on the sell side is to simply protect your profits in a rising market or limit your losses in a down market. To calculate the activation price of the order, we simply take the current stock price and subtract the parameter we chose to use (price or percentage).

- Price Example Stock XYZ is trading at $100 a share, and we set a price parameter of $3.50. Well since stock XYZ is currently at $100 a share, if the stock falls below $96.50 ($100 $3.50) a share, our position will be automatically sold.

- Percentage Example With Stock XYZ at $100 a share, lets say we set a percentage parameter of 5%. That means that at $100 a share, our order will be triggered if the stock falls under $95 a share ($100 5% or $5).

The whole point as you can see is to protect yourself on the downside. Now, important to note, the activation price here can RISE, but not DECREASE. Once stock XYZ hits $100 a share, our order is LOCKED at the price less our parameter. As the stock rises, our activation price RISES, but it doesnt matter how fast the stock falls, our activation price will maintain at its current price. Once the activation price hits and the order is triggered, a market order is simply placed automatically and your shares are sold.

Trailing Stops (BUY)

The main use for a trailing stop on the buy side is to only take a position in a stock when the stock price reaches our current activation price. A stock may continue to fall in value, but until it bounces and goes up xx price or percentage, shares will not be automatically purchased for us.

- Price Example Stock XYZ is trading at $100 a share, and we set a price parameter of $3.50. Well since stock XYZ is currently at $100 a share, we will not be automatically purchased shares until the stock hits $103.50 ($100 + $3.50).

- Percentage Example With Stock XYZ at $50 a share, lets say we set a percentage parameter of 5%. That means that at $50 a share, our order will be triggered only if the stock reaches $52.50 ($50 + 5% or $2.50).

With trailing stops on the buy side, our activation price can DECREASE, but not INCREASE. As the stock falls, our activation price falls with it (trails the stock price). But until our activation price is hit, we will not be purchased a position in that given stock / security.

One last thing to note about trailing stop orders is that the only way they are canceled is in the event of corporate action. This could be for example a dividend payment or a stock split. The only other way they can be canceled is if you cancel them manually yourself.

Enjoy this post?! Browse our full Stock Education database with over 100 stock education articles!