Using MACD Indicator for Forex Trading Strategy

Post on: 3 Май, 2015 No Comment

MACD indicator is one of the most popular technical analysis tools out there I see it every day on people’s charts. Required along the bottom of the price graph, a lot of people use it but not everybody knows how to use it most effectively what’s begin by understanding what MACD is. MACD is short for moving average convergence divergence the most common formula that is by default you got almost all charting packages use the 12,26,9 formula the way it works is the MACD why is made up of the difference between the value of the 12 day in the 26 day exponential moving average of the a nine day exponential moving average of the MACD superimposed over the MACD as the signal line that the is a is what’s known as a censored oscillator in other words the MACD fluctuates above and below a centering line typically known as the zero line these types of oscillators are good for identifying strength or weakness or direction of momentum behind of securities move as we talked about formula here are two exponential moving average of 12,26 quieted right on a price chart the faster moving averages

the 12 and the slower you use the red line 26,12 above zero typically with something oscillators when the oscillators above the zero line we are in a bullish mode and when the oscillators below zero line with your marriage this other line drawn here is the nine exponential moving average the nine. EMA of the MACD of this blackline itself you know the moving averages and of themselves are known to be lagging indicators and this chart represents that pretty well as you can see this move down turn right about here and it wasn’t all about 567 days later that the moving averages actually a a real there in these are exponential moving actually faster than a regular simple simple moving averages would be slower you again here’s the change in direction and then the crossover in the moving averages didn’t happen to you all week and a half later one last time the change in direction happens way down here in about 67 days later the change in crossover in the moving average now the on the other hand is is much faster and much more responsive to the change so as you can see the change over the crossover in MACD crossing signal line happens here this blueline and the red line shows how much but more later it was that the actual moving averages cross here again the MACD crossovers and here is the actual moving average crossovers and then again finally the MACD crossing over and it wasn’t until much later that that the moving average actually actually crossed over now remember how MACD is created.

Forex MACD Indicator Trading Strategy

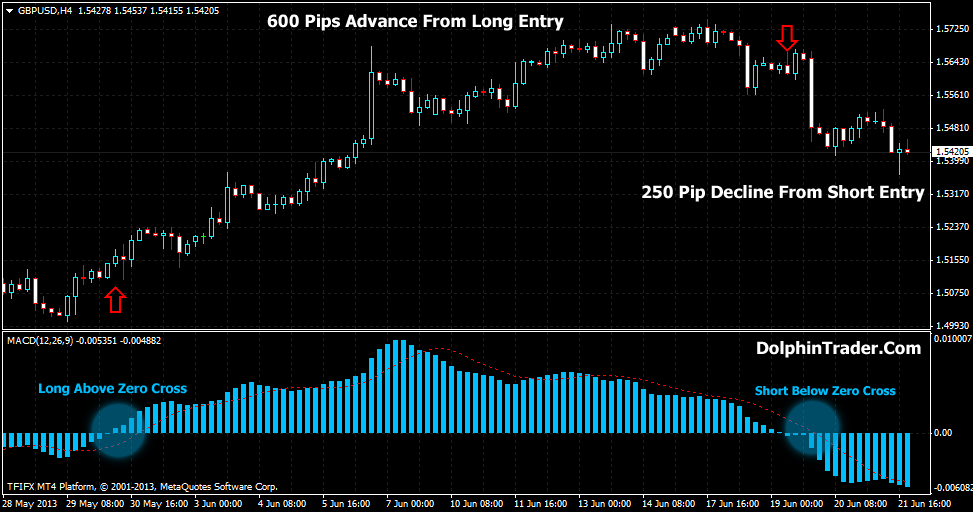

The MACD indicator is the difference between the 12 day on the 26 day so if MACD crosses above the zero line this indicates that the 12 day has crossed above the 26 th day and so as you see the MACD crossing the zero line here is really representative of where the true moving averages are doing crossover it has MACD is rising this is telling us that the gap between the 12 day in the 26 day is widening therefore indicating that a bullish momentum is increasing as MACD crosses down below the zero line we know that the 12 day has crossed down below the 26 day and as it continues in its downward path we can understand and assume that the distance between the two moving averages is widening therefore bearish sentiment is increasing the momentum is is strengthening in the downward trend as long as that the MACD line is is into sent I would like to point out that the histogram represents the difference between MACD and it’s nine day EMA if you notice that is the histogram gets larger this is this is representing how wide the distances between the MACD and the nine day EMA the histogram is positive when the MACD is above it’s 9 day EMA so in this case here’s where the MACD indicator is crossed over and it’s above the nine day the histogram goes positive at that point and the histogram goes the MACD is below the nine day EMA now another powerful tool in in the MACD is the creation of divergences let me point some out here in March and April on this chart you can see price was increasing by this resistance line drawn above the price but MACD the as you can see was falling the peaks in the MACD were getting lower this was kind of a heads up that that there was a change imminent here’s another divergence where price is creating lower lows shown by this sub descending support line but the MACD indicator was having higher low so again here’s a heads up a divergence between MACD and action in price MACD telling us warning us that there was the momentum of this down move was weakening and therefore change was imminent one more time another example of the divergence lower lows in price higher levels in MACD and then immediately followed by a MACD crossover and a change in direction.

MACD indicator actually has some predictive qualities as we discussed most indicators technical indicators are lagging indicators especially moving averages in other words they take too long before they give you the signal to the move after the move is already. MACD produces some lagging signals as well but also has some forecasting capabilities active produces signals from three sources the MACD signal line crossovers are the most common signal that MACD sends out and unfortunately there. The most unreliable also unfortunately there the ones that most traders are aware of and actually take action them here to tell you that there are some other signals that MACD sends out that are more reliable. And although there less frequent they produce bigger moves. MACD centerline crossovers are really the equivalent of the 12 EMA crossing the 26 EMA. Yes they are lagging but they are fairly reliable for longer-term moves the most powerful in my opinion signal that MACD produces is the divergent divergence that MACD has list price although again is the least frequent signal that MACD sends out. It is the most powerful produces the biggest moves and is also the most reliable signal so let’s review moving average crossovers or MACD crossing signal line crossovers as we mentioned earlier are the most common signal here is a bullish MACD crossing the signal line sometimes known as the trigger.

To prove to be a very good signal and very timely as well remember that I mentioned that the moving average crossing the signal line the MACD crossing signal line is the most common. It is very successful it many times will be a false signal causing whipsaw take action the redeeming saving grace of the signal is that it can also be used to confirm what I mentioned is the most reliable signal and that was the divergence. And I will talk about that when we get to the divergences this chart shows a good example of the bullish centerline cross over this is where the MACD line is below the centerline also known as the zero line as it crosses over it goes into what we would consider bullish territory so this in and of itself is a long signal MACD crossing the zero line to the upside of course once MACD U-turns rolls over crosses the zero line to the negative side then a centerline cross over in that case of course would be considered a bearish let’s not forget that the MACD as it crosses the zero line is representative of the 12 in there no longer plotted here on the chart but the 12 mood EMA crossing the 26 EMA to the upside and the opposite would be true on the top side to 12 EMA crossing down over the 26 EMA would be represented by the MACD crossing through the zero line to the bearish side those the centerline crossovers have been proven to be very much a lagging signal that is also proven to be fairly reliable for longer-term moves now the one we’ve been waiting for the divergence this although the let least frequent signal that MACD generates it is in my opinion the most powerful and most reliable to refresh your memory is prices coming down prices making lower levels as we see in this descending support line but MACD indicator is making higher lows diverging with the actual price this is an example of where that final moving average or MACD crossover over the signal line confirms the divergence so it’s not so much this signal line being crossed here that is the signal but it’s the signal line being crossed is the comes confirmation that I divergence has occurred and then of course followed up by the lagging indicator of the actual moving averages crossing over represented here by the MACD crossing through the zero line is the confirmation and a confluence are congruence of all the signals working together indicating a bullish move is underway here’s another chart and another example of the divergence in this case it is a bearish divergence have a strong uptrend designated by this ascending support line drawn blue as prices making higher highs MACD made some lower highs the confirmation of the MACD is MACD for a second time right here crossing through the signal line at a lower level than the previous level at the same time again when price was diverging this is a clear sign that the momentum in this uptrend is weakening the confirmation of course is when price breaks through the strong uptrend line and trades below it for several days if you need further confirmation this horizontal support line is then broken leading and paving the way for subsequent down move in part three we will combine all the signals of the MACD indicator.