Using Bond Spreads As A Leading Indicator For Fx

Post on: 8 Апрель, 2015 No Comment

Using Bond Spreads As A Leading Indicator For Fx

back to contents page

Any trader can attest that interest rates are an integral part of investment decisions and can drive markets in either direction. FOMC rate decisions are the second largest currency-market-moving release, behind unemployment data. The effects of interest rate changes have not only short-term implications, but also long-term consequences on the currency markets. One central banks rate decision can affect more than a single pairing in the interrelated forex market. Yield differentials fixed income instruments such as London Interbank Offered Rates (LIBOR) and 10-year bond yields can be used as leading indicators for currency movements. In FX trading, an interest rate differential is the difference between the interest rate on a base currency (appearing first in the pair) less the interest rate on the quoted currency (appearing second in the pair). Each day at 5:00 p.m. EST the close of the day for currency markets, funds are either paid out or received to adjust for interest rate differences. Understanding the correlation between interest rate differentials and currency pairs can be very profitable. In addition to central bank overnight rate decisions, expected future overnight rates along with the expected timing of rate changes are also critical to currency pair movements. The reason why this works is that the majority of international investors are yield seekers. Large investment banks, hedge funds, and institutional investors have the ability capital-wise to access global markets. Therefore, they are actively shifting funds from lower-yielding assets to higher-yielding assets.

Interest Rate Differentials: Leading Indicator, Coincident Indicator, or Lagging Indicator?

Since most currency traders consider present and future interest rate differentials when making investment decisions, there should theoretically be some correlation between yield differences and currency pair prices. However, do currency pair prices predict rate decisions, or do rate decisions affect currency pair prices? Leading indicators are economic indicators that predict future events; coincident indicator are economic indicators that vary with economic events; lagging indicators are economic indicator that follow an economic event. For instance, if interest rate differentials predict future currency pair prices, interest rate differentials arc said to be leading indicators of currency pair prices. Whether interest rate differentials are a leading, coincident, or lagging indicator of currency pair prices depends on how much traders care about future rates versus current rates. Assuming efficient markets, if currency traders care only about current interest rates and not about future rates, one would expect a coincident relationship. If currency traders consider both current and future rates, one would expect interest rate differentials to be a leading indicator of future currency prices.

The rule of thumb is that when the yield spread increases in favor of a certain currency that currency will generally appreciate against other currencies. For example, if the current Australian 10-year government bond yield is 5.50 percent and the current U.S. 10-year government bond yield is 2.00 percent, then the yield spread would be 350 basis points in favor of Australia. If Australia raised its interest rates by 25 basis points and the 10-year government bond yield appreciated to 5.75 percent, then the new yield spread would be 375 basis points in favor of Australia. Based on historical evidence, the Australian dollar is also exacted to appreciate against the U.S. dollar in this scenario.

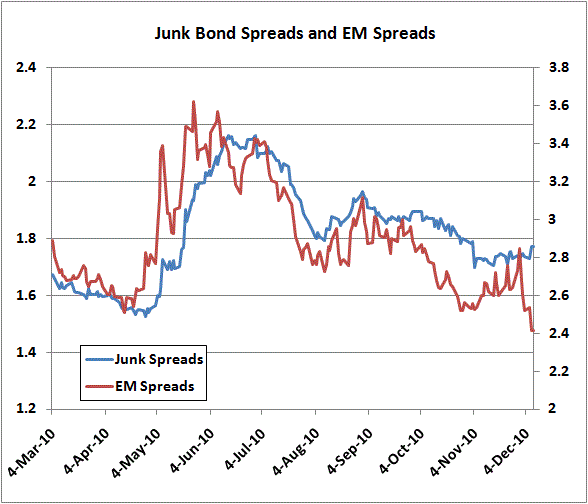

Based on a study of three years of empirical data starting from January 2002 and ending January 2005, we find that interest rate differentials tend to be a leading indicator of currency pairs. Figures 9.15, 9.16, and 9.17 are graphical representations of this finding.

These figures show three examples of currency pairs where bond spreads have the clearest leading-edge correlation. As one would expect from the fact that traders trade on a variety of information and not just interest rates, the correlation, though good, is not perfect. In general, interest rate differential analysis seems to work better over a longer period of time. However, shifts in sentiment for the outlook for the path of interest rates over the shorter term can still be a leading indicator for currency prices.

Figure 9.15 AUD/USD and Bond Spread

Figure 9.15 GBP/USD and Bond Spread

Figure 9.17 USD/CAD and Bond Spread

Calculating Interest Rate Differentials and Following the Currency Pair Trends