Using an Economic Calendar to Improve Your Trading

Post on: 17 Октябрь, 2015 No Comment

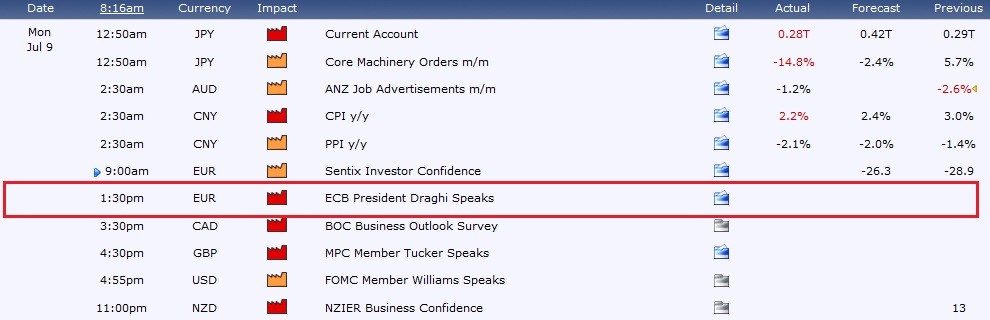

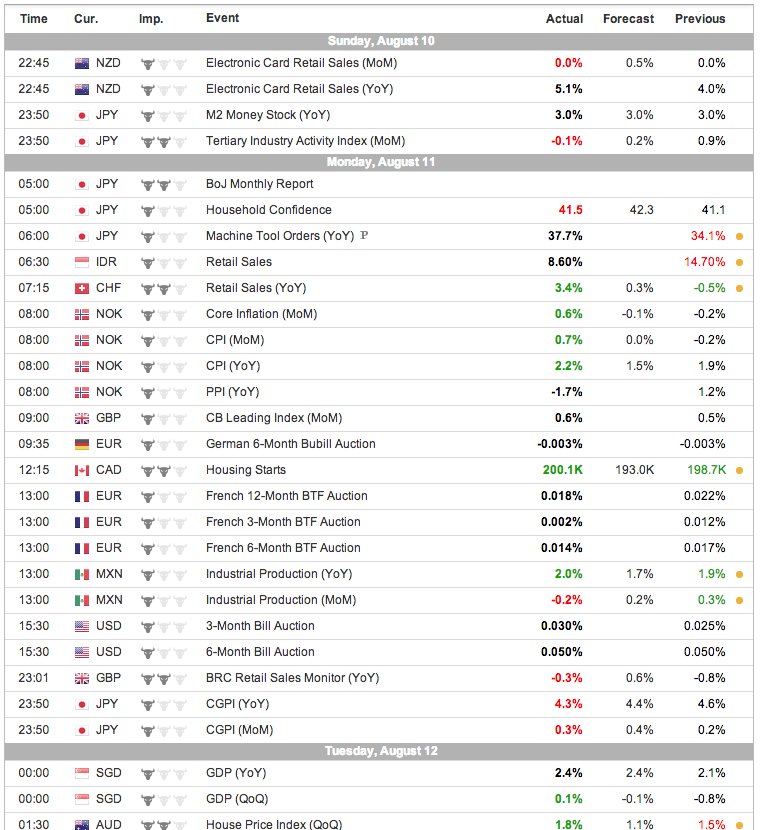

The typical economic calendar contains a chronological list of upcoming economic data releases along with their priorities. Besides being one of the mainstays of fundamental analysis, the economic calendar can be used by a forex trader to significantly enhance their performance and timing of trades.

The economic calendar can also warn traders about potentially volatile trading conditions that often surround the release of key economic data. Many currency traders use the economic calendar as a timing tool to help them identify the best time to establish or liquidate positions.

Using an Economic Calendar to Predict Volatility

Economic releases tend to exaggerate moves in the exchange rate — sometimes provoking wild swings in both directions — and this volatility often provides excellent opportunities for short term traders looking to profit from such rapid moves.

Conversely, more conservative traders might wish to avoid such sharp swings by liquidating their existing positions altogether, rather than risking a costly stop loss order being triggered.

Furthermore, establishing medium or long term positions based on an economic release might require more fx analysis research than can readily be performed immediately after the event occurs.

Economic Data with the Most Impact

Interest rate decisions by the major central banks make up the most influential piece of information affecting forex trading. Nevertheless, major geopolitical events such as elections, issues of state solvency and the breakout of war can exert an even more dramatic influence on the forex market .

After central bank rate decisions and macro-events, major economic data releases often cause a substantial increase in market volatility that depends on the magnitude of the disparity observed versus the consensus forecast. Economic data is rapidly discounted by the forex market, with exchange rate revaluations determined by how the number compared to expectations.

The most important economic numbers affecting the FX market consist of a nation’s GDP, the Consumer Price Index, Producer Price Index and Retail Sales numbers, to name just a few.

Other less significant numbers can also affect the market, especially if they substantially diverge from the market’s consensus. Minor economic data which impact the exchange rate of currency pairs include Purchasing Managers Indexes, Consumer Confidence indicators, and Housing and Construction market data.

Depending on the currency, some nations also release economic information unique to their countries that can also affect their currencies’ respective exchange rates. An example of this is the Japanese Tankan reports.

Trading on News Releases

Timing your trade after a major release can be risky. Anticipating what the market will do if the number is significantly higher or lower than the analysts’ consensus is the most important element to consider before making a post-release news trade.

Another major consideration for the forex trader is the size of the move seen post-release. Does the resulting move justify the observed divergence in the data, or has the market taken things too far? Discerning the direction and magnitude of the move, and allowing for these factors before taking a position, is the work the news trader must do.

After establishing a position in the wake of a major release, the news trader would optimally place or watch a stop-loss order and have a clear idea in mind of where they expect to take a profit. They might even enter both orders with their broker as soon as possible to avoid a loss of discipline, although the risk of being whip-sawed during volatile trading conditions is considerable.

This type of short-term news trading based around an economic calendar generally seems most suitable for disciplined traders with a background in fundamental analysis and the ability to quickly analyze and react to new information as it is released.