Use Leverage Bitcoin Trading Volatility Beats Forex Part 1

Post on: 19 Июнь, 2015 No Comment

18 Feb 2013 | Forex

Bitcoin is notorious for its price volatility. In the 13 months from January 2012 through the end of January 2013, bitcoin fluctuated from a low of $3.88 to a high of $21.43 and has risen further since then. Its safe to say that no other forex currency appreciated that much in the same time frame. For some, this is a point of concern. But for those who actively trade bitcoin, this unique price volatility means one thing: more opportunity! Most of the information currently available on the interwebs about bitcoins volatility is anecdotal and uninformative, so we decided to analyze bitcoin and forex trading data over the past year to understand exactly how much more volatile bitcoin is, how its volatility differs from that of traditional currencies, and its implications on trading.

In our analysis, we compared the prices of all bitcoin trades in the 13 months from January 2012 through the end of January 2013 with the minute-by-minute price of EURUSD over the same time period. We spliced trading data by days, weeks and months and found some pretty cool results. Were also going to save some of the nitty gritty findings from our analysis for Part 2. But before we get into it, we take a break for this word from our sponsor.

Leverage Offered By Traditional Forex Companies Is Indeed Too Good To Be True

Although forex companies often entice customers with extremely high leverage ratios (some companies offer up to 50:1 leverage), the truth is that theyre compensating for extremely small changes in currency price. In fact, if they didnt offer leverage, traditional forex would be so devoid of profit opportunity that no retail trader would participate in it. By offering substantial leverage, traditional forex companies do allow you to convert small price changes into worthwhile returns, but there are some strings attached. First, most forex companies dont actually fill orders and instead bet against their customers. By incentivizing you to lever your trades to the extreme, they increase the likelihood that you will hit a margin call at some point in your trading career and lose the majority of your capital. As they are on the other side of the trade, that means they gain all of your losses. Second, for trades held longer than 24 hours, they can earn substantially more interest on the capital you borrow. End result: traditional forex companies are often incentivized to seduce you into losing situations. The increased volatility associated with bitcoin, however, offers some opportunities to reduce these hazards.

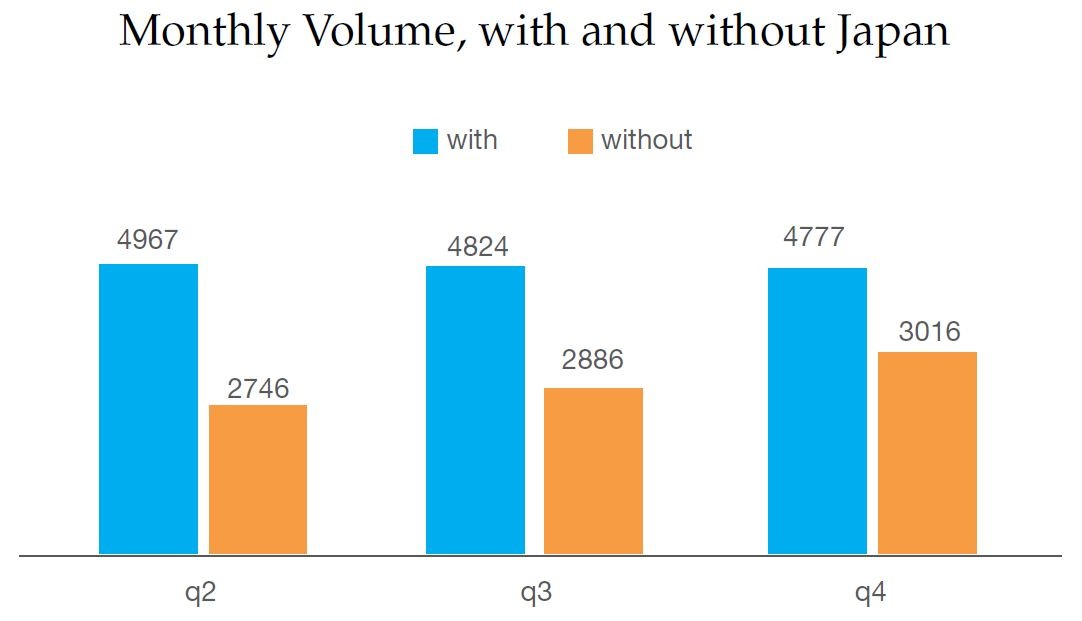

Price Volatility = Free Implied Leverage

According to our trading data from the past 13 months, bitcoins price volatility offers the equivalent of up to 18.6x leverage from trading the classic EURUSD currency pair. And even more, you get this leverage without paying interest or risking margin calls–its free! What we found most interesting is that there is essentially no leverage benefit to holding a trade for longer than 24 hours, unless you plan on holding onto the position long term (i.e. a year a more). Your implied leverage for holding a trade for one week instead of one day reaches 7.2x versus 6.8x; not much to brag about considering the substantial impact on your trading strategy. Furthermore, if you are going to trade monthly, you might as well just hold onto your positions as long term investments, where you will earn 18.6x versus 7.6x leverage. The chart below sums up our surprising results best.

Diversifiers Rejoice: Bitcoin and Currency Volatility Are Uncorrelated!

Another interesting result we found from our analysis is that bitcoin volatility is almost completely uncorrelated to the volatility of EURUSD. Over every single one of the holding periods we analyzed (day, week and month in this case), correlation ranged from 0.01 to 0.09. Considering correlation is measured on a scale of -1.0 to 1.0, our results imply essentially zero correlation. This has positive implications on bitcoins potential for portfolio diversification and arbitrage opportunities.

We also took a look at price correlation between bitcoin and EURUSD, and it was uncorrelated as well (the result on daily price change was -0.06).

How Much Leverage Is Too Much Leverage?

Leverage (and especially free leverage) is great, but it has limits to its proper use. Furthermore, while we have looked at volatility as quantified by standard deviation in this piece, your trading strategy needs to be resilient against long-tail price swings. The largest one day bitcoin price swing in the data set we analyzed was 53% above the days minimum price. At 2:1 leverage, a trader on the wrong side of this position would have been wiped out completely. The average daily price swing as a percent of the days minimum price over the same period was 5.6%, which means 20:1 leverage puts you at risk on an average day, without accounting for even likely deviations from the mean.

More interesting analysis is on its way! We kept finding more and more useful information as we analyzed this set of trading data. Well dive into more results that can help your trading strategy in Part 2 of this series.