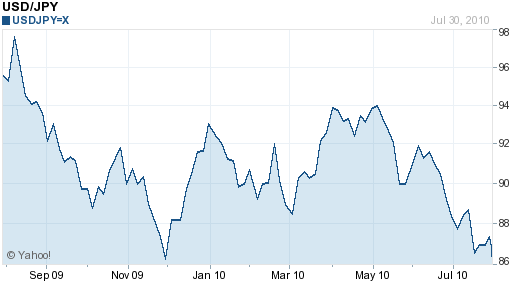

USDJPY US Dollar Japanese Yen Exchange Rate Forecast

Post on: 20 Июль, 2015 No Comment

Monthly Chart

Prepared by Joel Kruger

Bullish

US Dollar / Japanese Yen Interest Rate Trading Bias: Neutral

Negligible central bank interest rate differentials and forecasts leave little clear bias for the US Dollar/Japanese Yen. Yet an overall downtrend shows few signs of slowing, and we have little reason to call for any significant reversal. The more significant USDJPY mover remains the spread between US Treasury bond yields and Japanese Government Bonds.

A substantial downtrend in the US 10-Year Treasury Yield has left it hovering near record-lows (much like the USDJPY). One gets the sense that we may need to see a noteworthy upgrade in US interest rate expectations and broader fundamental outlook for any real moves in the bond yield or the US Dollar/Japanese Yen exchange rate.

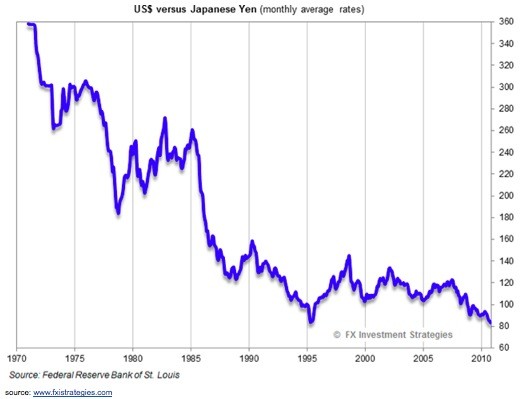

US Dollar / Japanese Yen Valuation Forecast

USDJPY Valuation Forecast: Neutral

Source: Bloomberg

The Yen remains heavily overvalued against the US Dollar and by all accounts ought to become more so as risk aversion grips financial markets, amounting to a seemingly perfect safe haven that offers both abundant liquidity and compelling store-of-value properties courtesy of a very low inflation rate. The latter quality has been undermined however as Japanese officials demonstrate unequivocally that they are prepared to intervene to weaken the currency, leaving USDJPY locked in a narrow range. Fundamentally supported upward momentum will be hard to come by in the near term, with the Feds newly-minted Operation Twist initiative weighing on Treasury yields and continued risk aversion pushing the Yen higher against the non-USD majors with some spillover. Indeed, if not for the threat of action on the part of Japanese authorities, the pair is likely to have been in near-freefall at this point. On balance, while the bias is bullish from a purely valuation-based standpoint, a place on the sidelines seems to be most prudent.

What is Purchasing Power Parity?

One of the oldest and most basic fundamental approaches to determining the fair exchange rate of one currency to another relies on the concept of Purchasing Power Parity. This approach says that an identical product should cost the same from one country to another, with the only difference in the price tag accounted for by the exchange rate. For example, if a pencil costs 1 in Europe and $1.20 in the US, the fair EURUSD exchange rate should be 1.20. For our purposes, we will use the PPP values provided annually by Bloomberg. We compare these values to current market rates to determine how much each currency is under- or over-valued against the US Dollar.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.