Understanding the Forex Correlation Strategy

Post on: 4 Июнь, 2015 No Comment

One of the easiest and most effective strategies to adopt is the forex correlation strategy. This strategy relies on certain correlations that exist between many different currency pairs, as well as between currency pairs and certain outside stimuli. The Forex, being a global market, is affected by global news and economical affairs.

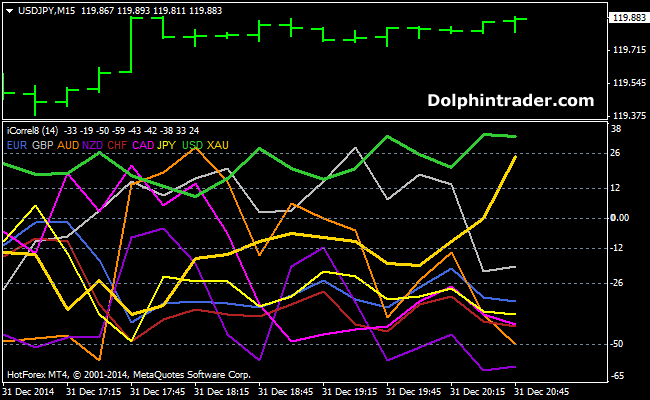

Correlation is fairly simple to define between a currency pair. Every trade is really a buying and selling of two currencies. The correlation between these two currencies is graded on a scale between -1 and +1.

When a pair has a positive correlation, then the two currencies are moving in the same direction in value. The higher the number, the closer the two currencies are. +1 signifies a perfect positive correlation between the pair.

When a pair has a negative correlation, then the currencies are moving away from each other in value. The lower the number, the more divergent these two figures. If the value is -1, then it means the currency pair is moving in perfect negative correlation.

Outside Correlation

There are also correlations between currencies and outside stimuli. One such example is the stock market, which often has an impact on various currencies. When the Dow increase, the CHF and euro tend to climb. Likewise, the USD tends to drop.

If the Dow were to drop instead, then USD would climb and the euro would fall. Understanding and planning for these correlations is a key part of succeeding in the forex market via the correlation strategy.

Constant Analysis

There is no certain correlation value between currencies that is set in stone. As a matter of fact, the correlation between these currencies is constantly changing. Traders who utilize this strategy must constantly analyze the market and track changes to monitor the current correlations.

As a trader using the correlation strategy, you should monitor three month correlation patterns, as well as one year correlation patterns between currencies that you trade. The more time you spend analyzing patterns, the more you will begin to see them throughout the market.

The correlation strategy relies on your ability to identify the compatibility of currencies based on the correlation between one another and the outside world. Both signals can mean profit as long as you act accordingly and make the best of every opportunity.

The forex market offers profit potential to anyone who is willing to learn what they can and take a chance. Over time, the forex has gotten a bit of an unpleasant reputation as a “gamblers market”. This isnt helped any by the millions of online scams claiming they can help you become a millionaire overnight via the foreign exchange market.

If the forex were a gamblers market, then the same professionals who have been trading for years wouldnt continue to make consistent profits with minimal losses. There are plenty of people around the world who trade forex for a living .

While luck undoubtedly plays its role from time to time, achieving success in the forex market is all about strategizing and analyzing. Successful traders adopt particular forex trading strategies that suit them best and then analyze the market consistently; searching for their symbols, cues, or markers that signal them to trade.

Some traders even rely on software to remove the emotion and fear from their trades. Thats only recommended for those with confidence in the programs, but software can still be of use to any trader in some ways.

Learning and implementing the forex correlation strategy may be what you need to boost those forex profits. Its a strategy used widely by many successful traders.