Understanding Leverage and Rollover in the Forex Market

Post on: 22 Сентябрь, 2015 No Comment

Like any market, forex can be a bit daunting when you start out. Lets start eliminating some of the things you need to know. Heres information on leverage and rollover, two things you need to be aware of when forex trading.

Leverage is very common in the FX market, and this is why forex trading is so popular among traders (and those who wish to start); large returns can be made from a small investment. Although this is double edgedit also means money can be lost quickly if proper risk measures are not taken.

FX brokers will commonly give 10:1 and up to 400:1 leverage (up to 50:1 in US). This means that for every dollar you deposit you receive a minimum of $100 in capital you can trade with, if the leverage is set at 100:1. Lets assume that you choose to have 100:1 leverage in your account, and you deposit $1000. You will have $100,000 in total buying power you can make money off of. To open a position worth $10,000 will mean that you put up $100 in margin. This is your good faith assurance of the trade, and as long as you maintain a total of $100 in your account that trade can stay open.

A $10,000 dollar trade is called a mini lot and each pip movement will result in a profit or loss of $1.00 approximately (will be based on what currency pair you are trading). A $1,000 dollar trade is called a micro lot and each pip movement will reflect a gain or loss of $0.10. A standard lot is $100,000 worth of currency and thus each pip movement is worth $10.00. Currency pairs differ in how much they move on average each day (see: How Much the Forex Spread Affects Day Traders ). Some currency pairs frequently see moves of 150+ pips a day where others will almost always be under 100 pip movements. A pip is the smallest movement increment of currency pairs, similar to what a penny would be in the stock market. Current volatility stats are available on the Forex Daily Stats page.

Forex Rollover or Swap

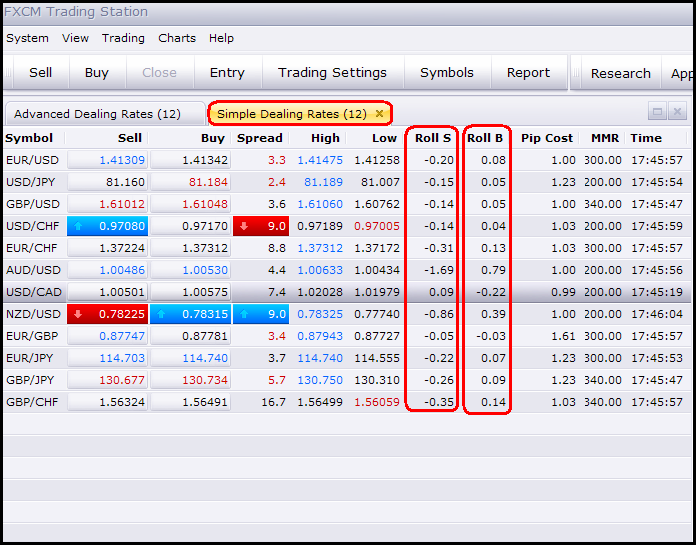

Brokers will commonly roll over positions in your account. This means that each day you will be credited or debited the difference in the interest rates of the currency pairs you are holding. This is not interest on your margin or the leverage your broker has given you. If one country has an interest rate of 4% and another has a 2.5% interest rate, this difference will be credited or debited from your account depending on if you are long or short the higher interest currency, respectively. In this way you can earn an additional income stream by having bought a higher interest rate bearing currency and holding it till just after 5:00 PM ET. Interest rates are yearly, therefore, the debit or credit is usually fairly small on a daily basis, but since leverage allows large positions to be taken, rollover/swap is something you should be note on every trade that youll be holding overnight.

If you are long (bought) the lower interest rate currency, then youll be debited the difference in interest, which can slowly widdle profit or add to the loss on a trade.

Under a brokers trading specifications page they should publish how much you will be credited or debited each night based on whether you are long or short various currency pairs.

Over 225 pages, forex basics to get you started, 20+ forex trading strategies, how to create your trading plan for success.

You May also Like:

How to Interpret Forex Sentiment Indicators Looking at trader positions and opinion to gauge when a market is likely to keep trending or reverse.

Best Time of the Day to Day Trade Forex The best time to trade major forex pairs based on hourly volatility studies.

Dealing with Decreasing Volatility in the Forex Market – When volatility drops (or rises) your strategies may need to altered. Here is how to monitor volatility, and things to consider.