Types of Forex Analysis

Post on: 1 Июнь, 2015 No Comment

There are two main types of Forex analysis, technical analysis and fundamental analysis. As a trade, you need to know both of these to succeed.

What is Technical Analysis?

Using technical analysis, traders analyse historical price movements in order to predict future movements. This may not sound very effective, but it is. In financial markets, price movements repeat themselves. This is because humans move price and humans are hard wired to follow patterns. The easiest way to explain this concept is to show you.

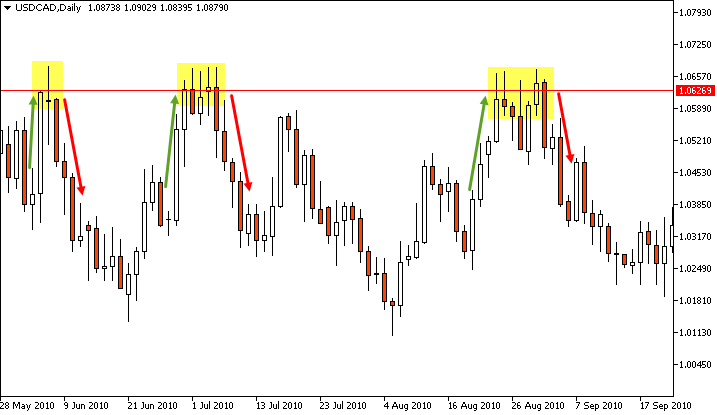

Above, you can see that whenever price approaches the 1.0625 area, it moves away. This indicates that you might want to consider selling USD/CAD next time it reaches 1.0625.

Why would you sell?

Well, the last three times price reached 1.0625 it reversed. So, using technical analysis, we assume that price might reverse again.

Technical analysis is the most common way to trade the Forex market.

Technical analysis is a self-fulfilling prophecy. If hundreds of thousands of traders are looking at the same analysis, they will trade the same way. The fact that they are all trading the same way pushes price in that direction.

USD/CAD reversed from 1.0625 twice in a row. Next time price reaches 1.0625, thousands of traders short expecting a reversal. The fact that so many traders are shorting causes price to fall.

Technical analysis is not as easy as it sounds. If you make a mistake in your analysis, you may short when most traders go long. Learning to use technical analysis properly takes a lot of practice.

Don’t worry though.

. I have you covered. After the Forex Education academy you will graduate to the free Forex course. In the course you will learn to put safeguards in place to protect your account.

What is Fundamental Analysis?

Fundamental analysts base their trades on a countries economic strength. Economic news can often have a large impact on price. You can keep track of economic news releases by using a Forex calendar .

Fundamental analysis uses economic data to predict moves in currencies. By interpreting economic data, you can gauge the strength of a countries economy. For example, if Europe has a strong economy and the U.S. has a weak economy, a fundamental trader might go long. This is because the trader expects the Euro to rise in value against the Dollar.

Fundamental traders tend to hold trades for weeks, or even months. This is because economic factors don’t usually cause immediate spikes in currency value. A good example of this is interest rates.

One of the most important economic indicators for fundamental traders are interest rates. Countries with high interest rates are attract more foreign investments. If you had a choice to invest your money at a 0.5% interest rate or a 5% interest rate, you would obviously pick the 5%.

Over a long period high interest rates cause a currencies value to rise as people invest in the currency. So, if the U.S. had a 1% interest rate and Europe has a 0.05% interest rate, the U.S. dollar may rise in value against the Euro. This means that a fundamental trader would short EUR/USD.

Which is better, technical or fundamental analysis?

Now that you know both types of Forex analysis, which one is better? Neither! Both technical and fundamental analysis have their strengths and weaknesses. Ignoring fundamental analysis often leads to being caught out by news based moves and vice versa. The key is to find a balance between the two.

My trading strategy is based on price action which is a form of technical analysis. However, I am always wary of news releases. You will learn more about this when you check out my strategy later.