Triangular arbitrage Understanding Triangular Arbitrage Financial Web

Post on: 5 Апрель, 2015 No Comment

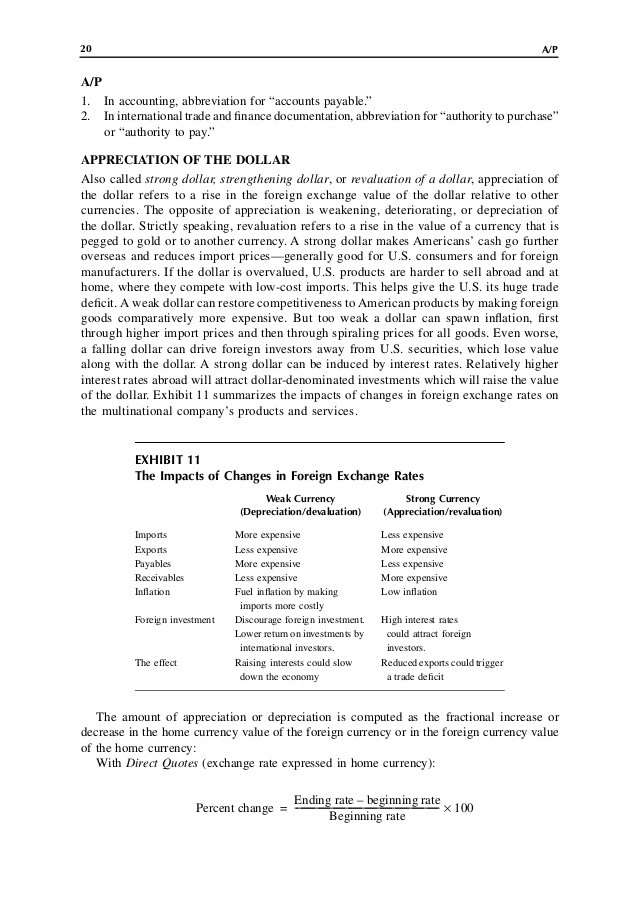

The major purpose of the book is to triangular triangular arbitrage illustrate that triangular arbitrage triangular arbitrage in the foreign exchange market can be profitable.

Definition of Triangular Arbitrage The process of converting one currency to triangular arbitrage another, converting it triangular arbitrage again to a third currency and, finally, converting it back to the original currency within triangular a short time span.

In the world of finance, arbitrage is the practice of taking advantage of a state of imbalance.

It represents suntrust the idea of buying something and selling it near instantaneously at a profit.

The process of converting one currency to another, converting it again to a third currency and, finally, converting it back to the original currency.

Triangular aladdin summary Arbitrage in the Foreign Exchange Market.

Triangular Arbitrage financial definition of Triangular Arbitrage.

triangular arbitrage

Triangular Arbitrage A series of three currency trades in which the exchange rates do not exactly match up.

arbitrage

In order to have a triangular arbitrage, you must compare the exchange rate of three currency pairs that have correlating currencies.

Are you talking about futures/forwards — spot arb or are you talking about a projected spot price.

Triangular arbitrage involves placing offsetting transactions in three forex currencies to exploit a market inefficiency for a theoretical risk free trade.

Due to Japanese investors arbitrage taking advantage of interest rate arbitrage, a large number of yen forward contracts will be bought.

Triangular arbitrage is a bit of forex jargon that sounds cool.

Triangular arbitrage is nothing more than determining whether an arbitrage opportunity exists amongst three currencies with three exchange rates; the complicating factor is that the exchange rates each have a bid rate and an ask rate.

Triangular Arbitrage F-Forex, Diary of a quant forex trader.

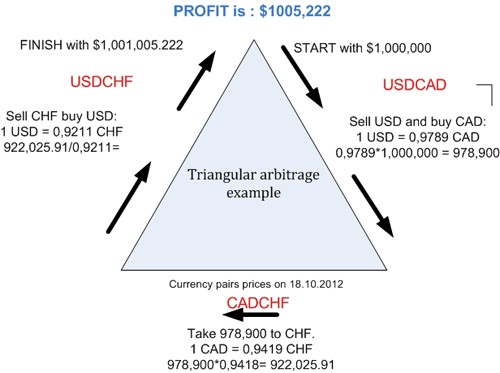

If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had 1,000,000 to use.

How to Calculate Arbitrage in Forex: 3 Steps (with Pictures).

Definition of triangular arbitrage: The process of taking one currency and converting it to another currency only to convert it back to original.

Triangular Arbitrage — Forex TSD — forex forum.

This will cause an upward pressure on the one-year forward.

Calculate the profit on a triangular arbitrage opportunity, given the bid-ask quot;tions for the currencies of three countries involved in the arbitrage.

triangular arbitrage

Triangular arbitrage examples — Download as Word Doc (.doc triangular arbitrage /.docx PDF File (.pdf Text file (.txt) or read online.

If the market prices do not allow for profitable arbitrage, the prices are said to constitute an arbitrage equilibrium or arbitrage-free market.

Triangular Arbitrage 101 — Market Formula Forex Trader.

Triangular arbitrage — Wikipedia, the free encyclopedia.

Understanding triangular arbitrage requires some knowledge auto of how currencies are converted through the available exchange rates in the market.

Triangular arbitrage — Wikipedia, the free encyclopediaTriangular Arbitrage Financial Exam Help 123Triangular Arbitrage in the Foreign Exchange Market