Trailing Stop Loss Forex Trade Management Technique

Post on: 18 Август, 2015 No Comment

Some traders sometimes do have the wrong belief that they are smart enough to trade without a stop loss. In the end, they would need nobody to tell them that they had taken the wrong steps in their trading decisions; the trade result would do the talking. Experience, they say, is the best teacher, but this is a case of learning the hard way. To prevent running into losses when trading, trailing stop loss is a more potent form of stop loss to use.

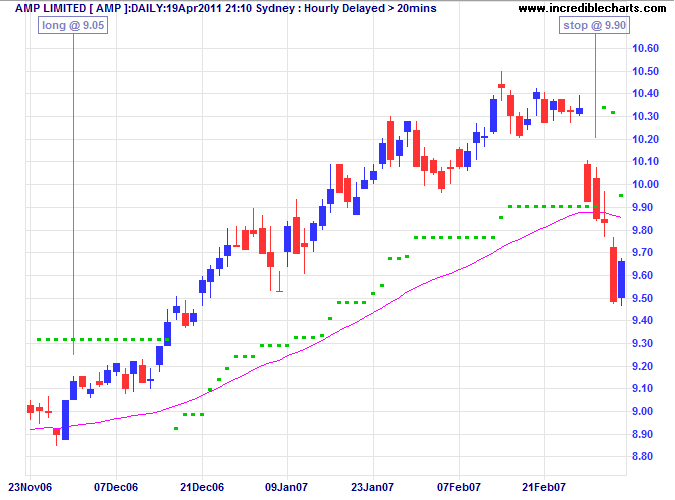

The fact that the trailing stop loss order shifts when the order starts to make profit as the market moves makes it an effective and useful means of ensuring profit on a trade whenever the condition permits it. Whenever the market movements favor a trade position and profit is made, the trailing stop loss appreciates according to the magnitude of pips stipulated in the trailing stop rules. On the contrary, should the market go in undesired direction, the stop loss will remains at the point where it last trailed, and should the market price hit the stop loss, it will exit the trade automatically.

Trailing Stop Loss Example

Let us try making this more understandable with the aid of an example. Suppose a trader buys EUR/USD at 1.3000, and he placed his stop at 1.2800. Now, let us say that the market price appreciated by 100 points. Should the trader shift his stop loss to the breakeven point, the profits realized would serve as the risk of trading, and he would be able to ride the profits if there is to be further upward movements.

Trailing Stop Loss Protect Your Forex Profits

And as long as the market movements favor a trader and generate profit, there will be a continuous shift of the trailing stop loss in an effort to lock in profits as specified levels are attained by the market price. The trailing stop loss also regulate the extent of loss should there be a downturn in the market trend so that it does not leave the trader broke with his live account completely emptied of funds. Protection against and readiness for uncertainty in forex trading is one of the essential rules of forex. A trader must not let his guard down for losses. Survival in the forex market is somehow tied to how well a trader makes use of the trailing stop loss.

What if you just couldnt trade forex effectively with a day time job?

Dont give up hope, its NOT impossible. Trailing Stop Loss will expand your trading capabilities to greater trading success learn more by clicking the link above.