Trading with the Alligator Indicator

Post on: 20 Май, 2015 No Comment

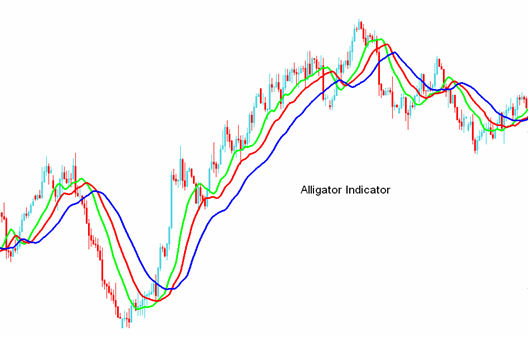

This article is the first in a series which will be looking at the forex indicators created by renowned trader Bill Williams. The Alligator indicator was first introduced to the financial markets by Bill Williams in 1995. Traders who use the MT4 platform on Forex4you will easily see the Bill Williams set of indicators when they click on Insert > Indicators > Bill Williams. This displays all the indicators invented by Bill Williams including the Alligator indicator.

Bill Williams Alligator indicator is composed of three simple moving averages that have been likened to the jaws, teeth and lips of an alligator. These are:

1) 13-day simple moving average set to a default shift value of 8, and colored blue. This moving average can be likened to the jaws of the alligator.

2) 8-day simple moving average with a default shift value of 5 and colored red. This moving average can be likened to the teeth of the alligator.

3) 5-day simple moving average with a shift value of 3 and assigned a green color. This moving average can be likened to the lips of the alligator.

The colour coding helps to distinguish the moving averages on the chart. We see the various moving averages as applied to the chart in the charted trade examples we shall be explaining below.

The Use of the Alligator Indicator in Forex Trading

The Alligator indicator is basically used to determine the trend of the currency pair, with a cross of the faster simple moving average over the slower moving averages used as the entry signal.

On the Forex4you platform, the Alligator indicator can be accessed either from the Indicators tab in the Navigator window located to the left of the trading platform interface, or using the pathway stated in the first paragraph of this piece.

One question traders have on their minds is: why are the moving averages referred to as the jaws, teeth and lips of the alligator? These are the names assigned to the moving averages in Bill Williams book Trading Chaos, which described the use of the indicator.

It is pretty easy to determine when to buy or sell a currency pair with the Alligator indicator, especially when the market is trending. As earlier stated, this occurs when the faster moving average crosses the slower moving average. In this case, we are talking of the 8-day moving average crossing the 13-day moving average either in an upward direction for a long trade signal, or in a downward direction for a short trade signal.

SHORT TRADE

My personal experience has shown that the hourly, four hourly and daily charts are where the Alligator indicator works best. Other traders may have different experiences, but what I have stated is my personal experience. These are charts where we get to see assets showing some sort of trend and not just market noise, and that is where we feel traders should make their trades from.

Here we see a signal to take a short entry position:

Here we can see that the red simple moving average crosses the blue simple moving average in a downward direction. Now it is not just about the cross, because moving averages tend to lag behind the price and give delayed signals. Therefore the trader needs to pinpoint the exact price at which to enter the trade position. The best way to pick a good signal which will not turn into a fakeout when the moving averages eventually cross is to look at the candlesticks at the time that the red moving average crosses the blue moving average. If the candlestick formation at that point supports the move, then it is ok to open the trade at the open price of the next candlestick.

Looking at point A on the chart above, we see a bearish harami formation, which occurs at roughly the same time that the red moving average crosses the blue moving average, so it is safe to take a short trade here. At point B, we see two bearish pinbars, so it is also safe to take a short trade at point B.

LONG TRADE

On this chart, we see a signal to make a long entry:

The same strategy is applied in this case. Look to the candlesticks to see if they support the move that the moving averages are showing. At point A, we see a bullish engulfing pattern which supports the bullish cross of the red moving average over the blue moving average, so point A on this chart is a safe place to take a long trade, usually at the open of the candle following the bullish engulfing pattern. At point B, we also see a bullish pinbar, and although not a very convincing signal, still played out well in the upward direction.

USING THE ALLIGATOR INDICATOR IN RANGE-BOUND MARKETS

The trade based on the Alligator indicator works best when used on currency pairs that naturally trend. An example would be the GBPJPY, EURUSD, etc. It is harder to pick out profitable signals on currency pairs that are naturally range-bound. But even on the trending currencies, there will be occasions when there is a range-bound situation. A look at our first chart showing the short trades will show these periods, located between point A and point B. At these times, we will see that the 3 moving averages will be interwoven with each other; a situation Bill Williams described as the sleeping alligator.

When this is the case, something else has to be brought to the mix. Something that will serve to give traders some direction. The truth is that no Alligator signal is accurate in a range-bound market. At this time, the trader will need the help of another tool to identify when the market is going to stay range-bound for some time, and when the market is ready to start trending. To this end, we will look on to another Bill Williams indicator, the Fractals.

When applied to the chart, the Fractals will appear as a series of Up and Down arrows which we will see on the chart example below.

Using the Fractal with the Alligator

To identify when the market is range-bound, see if you can draw a horizontal line to connect two price highs and two price lows, completing the lines with vertical lines on each side to form a rectangle. This rectangle should be able to encapsulate the candlesticks if the market is going to be range-bound for some time.

Next, apply the Fractals indicator to the chart by clicking the Insert > Indicators > Bill Williams > Fractals.

Look to see where the Fractal arrow is pointing when a candlestick breaks through the trend lines drawn above. For instance, you would be looking for a down arrow fractal on a candle that has made a downside break, or for an up arrow fractal on a candle that has made an upside break. Then check to see that the red moving average has crossed the blue moving average in the corresponding direction, and open the trade based strictly on the breakout principle we have discussed in one of our earlier articles. We see an example for a short entry below:

In this example, we see the range-bound area demarcated by the red rectangle, and also the key fractal down arrow that shows where the breakout will occur. We then wait for the red moving average to cross the blue moving average downwards and then open the short trade from the breakout candle using the principles discussed under the article on breakout trades.

The long trade example is shown below:

Please note that there will be occasions when the Fractal arrow points in one direction and the moving average cross will be in the opposite direction. Where such a conflict exists, please do not trade. Wait for the Fractals and the Alligator to align themselves properly before taking the trade.

So this is where our discussion on the Alligator indicator ends. Traders should feel free to practice trading with this tool, while remembering to factor in fundamental influences on the trends of the currency pair they will be trading with this indicator.