Trading with Stochastics

Post on: 10 Август, 2015 No Comment

Stochastics are amongst the most popular technical indicators when it comes to Forex Trading. Unfortunately most traders use them incorrectly. In this article we will review the correct way to use this popular technical indicator.

George Lane developed this indicator in the late 1950s. Stochastics measure the current close relative to the range (high/low) over a set of periods.

Stochastics consist of two lines:

%K Is the main line and is usually displayed as a solid line

%D Is simply a moving average of the %K and is usually displayed as a dotted line

There are three types of Stochastics: Full, fast and slow stochastics. Slow stochastics are simply a smother version of the fast stochastics, and full stochastics are even a smother version of the slow stochastics.

Interpretation:

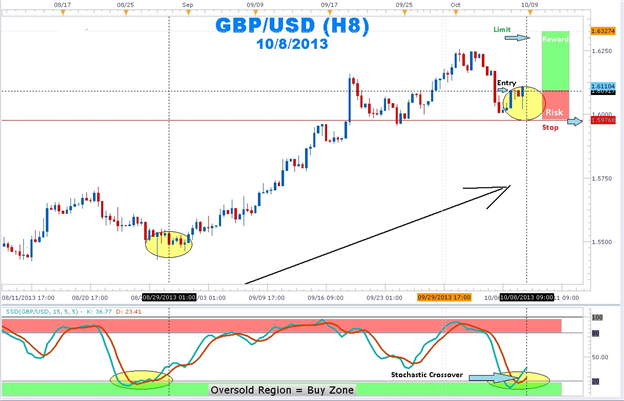

Buy when %K falls below the oversold level (below 20) and rises back above the same level.

Sell when %K rises above de overbought level (above 80) and falls back below the same level.

The interpretation above is how most traders and investors use them; however, it only works when the market is trendless or ranging. When the market is trending, a reading above the overbought territory isnt necessary a bearish signal, while a reading below de oversold territory isnt necessary bullish signal.

Trending market

When the market is trending is necessary to adapt the oscillator to the same conditions: When the market is trending up, then the signals with the higher probability of success are those in direction of the trend Buy signals, on the other hand when the market is trending down, selling signals offer the lowest risk opportunities.

Thus when the market is trending up, we will only look for oversold conditions (when the stochastics fall below the oversold level [below 20] and rises back above the same level) to get ready to trade, and in the same way, when the market is trending down we will only look for overbought conditions (when the stochastics rise above de overbought level [above 80] and falls back below the same level.

Taking all overbought/oversold signals during a trending market will lead us to many whipsaws. If you are not comfortable with the number of signals given, try expanding your trading to other currency pairs.

Trend-less market

During a ranging market we could use the interpretation explained above to trade off stochastics.

Divergence

Divergence trades are amongst the most reliable trading signals in the Forex market. A divergence occurs either when the indicator reaches new highs/lows and the market fails to do it or the market reaches new highs/lows and the indicator fails to do it. Both conditions mean that the market isnt as strong as it used to be giving us opportunities to profit from the market.

Stochastics can also be used to trade off divergences.

Price Action

A Price Action can be incorporated into any kind of system or Forex strategy. When using divergences or overbought/oversold condition with a price action approach, the probability of success of our signals increases enormously. Why? Because price dictates at the end, how all indicators will behave, it also gives us a lot of information about the probable direction it will take in the future.

Feel free to comment and if you like it, don’t forget to FB “like it!” (link is at the top of the page)