Trading the Trend—What Does It Mean for the Forex Trader

Post on: 1 Май, 2015 No Comment

By Dianne L. Fecteau

Trading a trend sounds simple. After all, most traders know the trend is your friend. The assumption is that the momentum of the trend will carry you along, making sure your trades are profitable.

The biggest profits often result from entering a strong trend. For example, had you bought EURUSD in April of this year at around 1.30, you could have made 1,000 to 1,300 pips before it started trading sideways at the beginning of June. Most people would correctly say the pair was in a strong, upwards trend. So, the conclusion would be to buy and ride that trend, trailing your stop.

But an uptrend doesnt go up forever. And a strong trend doesnt mean you cant lose money. What if you had entered the Euros undeniably strong trend in early June at the high of 1.43? You could have lost 300 pips in three days had you traded without tight stops. If you have deep pockets and the patience to wait it out, this might not bother you. But most small traders have neither.

During all trends, up or down, pairs tend to stop and catch their breath. Often they retrace, sometimes deeply. Frequently they go into a range, a period of sideways movement, also called a consolidation or congestion area. The highs of this range are resistance; the lows are support.

In these ranges its impossible to trade with the trend unless you only buy the lows. But then, to take profits, you must sell at the top of the range because you have no guarantee the pair will continue upward. This is because sometimes these ranges mean the trend is reversing.

If you examine Chart 1 below, you see that during June to September, 2009, the pair was consolidating, pausing before resuming its upward trend. So you would have wanted to shift your trading strategy from a trend strategy to one of buying at the low of the range, support, and selling at the high, resistance.

Notice on chart 1 that even though the Euro broke out of the sideways range, it broke out only to move higher into another sideways range. Normal trend tradingbuying and setting the stop at a reasonable level below, would have resulted in you getting stopped out several times during the upward move from early June to the present.

The pair was in an overall uptrend. But only during the first two months of that uptrend could you buy and move a trailing stop. Approximately a third into the uptrend, you needed to shift trading strategies and buy and sell against support and resistance.

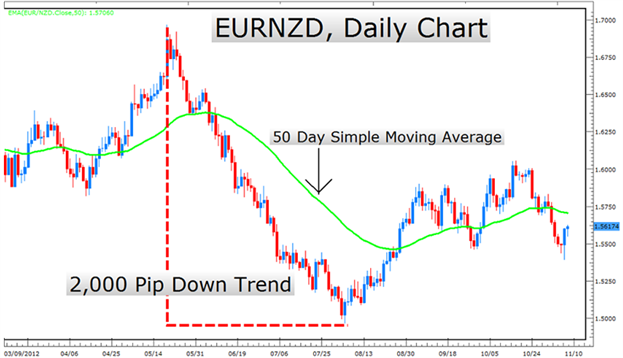

Now look at another strong upward trend in the Euro2008, a time when rap stars and Brazilian super models wanted to be paid only in Euros. This is Chart 2 below. You see a strong upward trend, one sideways period, a brief breakout, and then a steep decline into the lows of March, 2009.

In 2008 you could have traded the trend until April, 2008 with the trailing stop. Then, in order to keep generating profitable trades, your trading strategy would have shifted into sideways tradingbuying at support and selling at resistance. Eventually, in early August, you would have bought at the bottom of the range. Your tight stop would have been taken out rather quickly with the plunge downward.

Forex traders learn that trading the trend means recognizing not all trends are the same. They learn that they need to be agile, willing to shift from one strategy to the other, depending on how the trend unfolds. By doing this they can increase profits and minimize losses.

Dianne Fecteau, 2009.