Trading the Powerful Stochastic Momentum Index

Post on: 18 Июнь, 2015 No Comment

Article Summary: Price action is the cleanest indicator in the world but it can be hard for many traders to read ( Register here for our Free Price Action Course ). Beyond price action there are indicators that help you see how the current price is acting in relation to the overall trend or range so you know if youre looking at a high probability entry or not. By being sensitive to turning points, the Stochastic Momentum Index (SMI) can help you see whats happening now and help you see what probable outcomes may be next.

Oscillators are commonly known as overbought or oversold indictors. This can be helpful when you first see an oscillating indictor on the chart but in terms of trading success, looking at oscillators only in term of overbought or oversold alone can be dangerous. This article will expand your view on oscillators and introduce you to a new oscillator that can help you pinpoint and trade market turning points more effectively.

The Stochastic Momentum Index (SMI) was introduced by William Blau in 1993 as a way to clarify the traditional stochastic oscillator. SMI helps you see where the current close has taken place relative to the midpoint of the recent high to low range is based on price change in relation to the range of the price. This is a heavy way to start an article but important to know because if you know where price has closed in relation to the recent range or trend then you have a good idea if a turning point is upon you or if the current move still has room to run. By taking the range of historical prices, you have the ability to anticipate trend changes.

Learn Forex: Like Most Oscillators SMI is bound between 100 and -100

(Created using FXCMs Marketscope 2.0 charts)

One thing youll quickly notice about the SMI is that it is much faster than the traditional stochastic so knowing how to read the indicator is key. Youll see the default setting below and those are the ones well stick with to find trading opportunities with this adaptable and effective indicator. However, you are able to slow down the indicator by increasing the periods over which the SMI is reading.

Learn Forex: SMI Default Settings Once Loaded

(Created using FXCMs Marketscope 2.0 charts)

Three Ways to Trade This Indicator

Here are the more popular methods to use this indicator to find trading opportunities.

Overbought / Oversold Level Crossover

As stated earlier, if youre not recognizing clear support and resistance showing you a range than blindly trading off overbought or oversold signals can be dangerous. Its been said that markets can trend far longer than you can stay solvent as a way to say trading against the defined trend is tough game to play. The popular overbought or oversold levels are +/- 40 on the indicator.

Learn Forex: Trading History On EURUSD Entering On Overbought / Oversold SMI Signals

(Created using FXCMs Marketscope 2.0 charts)

Signal Line Crossover

The signal line crossover will present many trades resulting in a lower win percentage (# of trade closed at a profit / total # of trades). However, there is a method you can use to filter out lower probability crossovers. The method would be adding a neutral zone to the indicator at the levels of +/- 15.

Learn Forex: Utilizing the Neutral Zone Can Help You Stay In Good Trades Longer

(Created using FXCMs Marketscope 2.0 charts)

The way you can view this neutral zone will be filtered in the most recent trend you placed. Therefore, if you entered a buy trade based on a SMI crossover at -40 or less and then you notice a crossover in the +/- 15 neutral zone, you would not reverse the position but rather watch how the market reacts to relative support on the current move higher. If the market moves nicely through the neutral zone with the trend in tact then you can tighten your stops or add to your trade if you wish.

(Created using FXCMs Marketscope 2.0 charts)

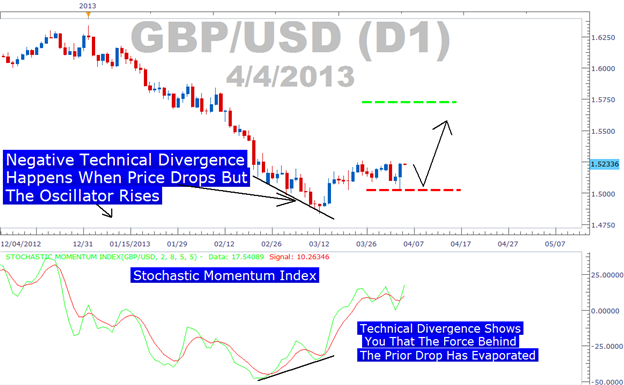

SMI Divergence

Technical divergence can happen on the buy or sell side of the chart. Divergence isnt very common but thats makes for a more effective signal when generated. Divergence happens when prices are making higher highs and the SMI is not. This can happen on the sell side when price is making lower lows and the SMI is not which would give you an opposing buy signal when price breaks relative resistance.

Learn Forex: Technical Divergence Allows You To Enter A Trade After Opposing Forces Have Left

(Created using FXCMs Marketscope 2.0 charts)

Closing Thoughts

Youve been introduced to multiple methods of adding the SMI to your trading toolbox. Whether youre taking trades off of extreme crossovers, simple signal line crossovers, or SMI divergence, the SMI can help you spot many opportunities that are not easily seen with price action alone. However, whatever tool you use, we always recommend to keep you trade size appropriate and in line with your overall risk management goals.

—Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@fxcm.com.

To be added to Tylers e-mail distribution list, please click here.

Take this free 20 minute Price Action — Candlesticks course presented by DailyFX Education. In the course, you will learn about the basics of price action and how to use the clues the market is providing to place trades.

Register HERE to start your FOREX learning now!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.