Trading The MACD Divergence

Post on: 16 Август, 2015 No Comment

Moving average convergence divergence (MACD), invented in 1979 by Gerald Appeal, is one of the most popular technical indicators in trading. The MACD is appreciated by traders the world over for its simplicity and flexibility because it can be used either as a trend or momentum indicator.

Trading divergence is a popular way to use the MACD histogram (which we explain below), but, unfortunately, the divergence trade is not very accurate it fails more than it succeeds. To explore what may be a more logical method of trading the MACD divergence, we look at using the MACD histogram for both trade entry and trade exit signals (instead of only entry), and how currency traders are uniquely positioned to take advantage of such a strategy. (To learn more, see The Greatest Currency Trades Ever Made and Technical Analysis .)

MACD: An Overview

The concept behind the MACD is fairly straightforward. Essentially, it calculates the difference between an instruments 26-day and 12-day exponential moving averages (EMA). Of the two moving averages that make up the MACD, the 12-day EMA is obviously the faster one, while the 26-day is slower. In the calculation of their values, both moving averages use the closing prices of whatever period is measured. On the MACD chart, a nine-day EMA of the MACD itself is plotted as well, and it acts as a trigger for buy and sell decisions. The MACD generates a bullish signal when it moves above its own nine-day EMA, and it sends a sell sign when it moves below its nine-day EMA.

The MACD histogram is an elegant visual representation of the difference between the MACD and its nine-day EMA. The histogram is positive when the MACD is above its nine-day EMA and negative when the MACD is below its nine-day EMA. If prices are rising, the histogram grows larger as the speed of the price movement accelerates, and contracts as price movement decelerates. The same principle works in reverse as prices are falling. See Figure 1 for a good example of a MACD histogram in action.

Figure 1: MACD histogram. As price action (top part of the screen) accelerates to the downside, the MACD histogram (in the lower part of the screen) makes new lows

Source: FXTrek Intellicharts

The MACD histogram is the main reason why so many traders rely on this indicator to measure momentum. because it responds to the speed of price movement. Indeed, most traders use the MACD indicator more frequently to gauge the strength of the price move than to determine the direction of a trend. (To learn more, see Momentum Trading With Discipline . )

Trading Divergence

As we mentioned earlier, trading divergence is a classic way in which the MACD histogram is used. One of the most common setups is to find chart points at which price makes a new swing high or a new swing low. but the MACD histogram does not, indicating a divergence between price and momentum. Figure 2 illustrates a typical divergence trade.

Figure 2: A typical (negative) divergence trade using a MACD histogram. At the right-hand circle on the price chart, the price movements make a new swing high, but at the corresponding circled point on the MACD histogram, the MACD histogram is unable to exceed its previous high of 0.3307. (The histogram reached this high at the point indicated by the lower left-hand circle.) The divergence is a signal that the price is about to reverse at the new high, and as such, it is a signal for the trader to enter into a short position.

Source: Source: FXTrek Intellicharts

Unfortunately, the divergence trade is not very accurate, as it fails more times than it succeeds. Prices frequently have several final bursts up or down that trigger stops and force traders out of position just before the move actually makes a sustained turn and the trade becomes profitable. Figure 3 demonstrates a typical divergence fakeout. which has frustrated scores of traders over the years. (To learn more, see Using Double Tops And Double Bottoms In Currency Trading . )

Figure 3: A typical divergence fakeout. Strong divergence is illustrated by the right circle (at the bottom of the chart) by the vertical line, but traders who set their stops at swing highs would have been taken out of the trade before it turned in their direction.

Source: Source: FXTrek Intellicharts

One of the reasons that traders often lose with this set up is they enter a trade on a signal from the MACD indicator but exit it based on the move in price. Since the MACD histogram is a derivative of price and is not price itself, this approach is, in effect, the trading version of mixing apples and oranges.

Using the MACD Histogram for Both Entry and Exit

To resolve the inconsistency between entry and exit. a trader can use the MACD histogram for both trade entry and trade exit signals. To do so, the trader trading the negative divergence takes a partial short position at the initial point of divergence, but instead of setting the stop at the nearest swing high based on price, he or she instead stops out the trade only if the high of the MACD histogram exceeds its previous swing high, indicating that momentum is actually accelerating and the trader is truly wrong on the trade. If, on the other hand, the MACD histogram does not generate a new swing high, the trader then adds to his or her initial position, continually achieving a higher average price for the short.

Currency traders are uniquely positioned to take advantage of this strategy because with this strategy, the larger the position, the larger the potential gains once the price reverses and in Forex (FX), you can implement this strategy with any size of position and not have to worry about influencing price. (Traders can execute transactions as large as 100,000 units or as little as 1,000 units for the same typical spread of three to five points in the major pairs.)

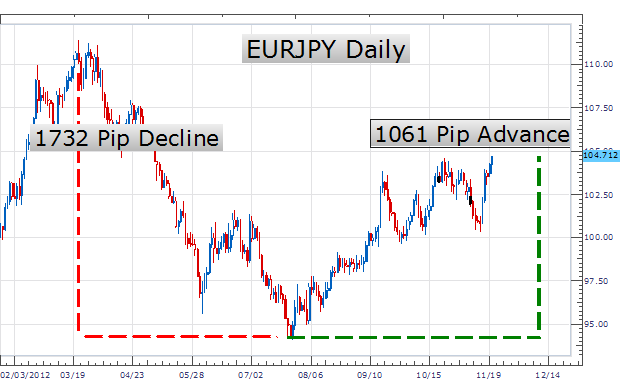

In effect, this strategy requires the trader to average up as prices temporarily move against him or her. This, however, is typically not considered a good strategy. Many trading books have derisively dubbed such a technique as adding to your losers . However, in this case the trader has a logical reason for doing so the MACD histogram has shown divergence, which indicates that momentum is waning and price may soon turn. In effect, the trader is trying to call the bluff between the seeming strength of immediate price action and the MACD readings that hint at weakness ahead. Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor. Figure 4 illustrates this strategy in action.

Figure 4: The chart indicates where price makes successive highs but the MACD histogram does not foreshadowing the decline that eventually comes. By averaging up his or her short, the trader eventually earns a handsome profit as we see the price making a sustained reversal after the final point of divergence.

Source: Source: FXTrek Intellicharts

The Bottom Line

Like life, trading is rarely black and white. Some rules that traders agree on blindly, such as never adding to a loser, can be successfully broken to achieve extraordinary profits. However, a logical, methodical approach for violating these important money management rules needs to be established before attempting to capture gains. In the case of the MACD histogram, trading the indicator instead of the price offers a new way to trade an old idea divergence. Applying this method to the FX market, which allows effortless scaling up of positions, makes this idea even more intriguing to day traders and position traders alike.