Trading Steps Day Trading with defined trading strategy

Post on: 16 Март, 2015 No Comment

Thursday, May 21, 2009

Day Trading with defined trading strategy

For Day Traders & Swing Traders, it is important to have a view on the mrket. This ensures that your trades will get some advantage from a favorable market. If your view, based on world markets, key news for the day, — is negative, then you shuld be taking bearish positions in the market. The positions will not be taken blindly. The actual trade still needs a technical setup — for example, sell when the RSI falls below 50, or when the 20 Bar Moving Average falls below the 50 bar average, or something similar. But now, the actual trade is supported by the environment. Sometimes, your view will go wrong. That is only to be expected. Yet, the rewards of being right will far outweigh the mstakes. The most important advantage is clarity of vision during the trading day.

4 comments:

Traders might find scenario based trading useful.

Use your strategy to enter and exit in addition to this strategy.

For today example of this stragegy is :

1st scenario: BUY

American markets closed negative. Nifty yesterday closed at 4219 and low was 4205.

It made a lower low yesterday.

Now today Nifty may witness a gap-down opening. So it may go below 4205 at start of the session itself.

So lower lows are continued.

Thus this gap-down marks a buyng oppurtunity for intraday targets.

Exactly When will you buy?

When Nifty makes a higher high on 15 minutes chart.

2nd scenario: SELL

If Asian markets are rallying at the time of our market opening. Nifty may open flat to positive. In that case we will go up or come down.

If we go Up then wait for a suitable level to short and bring market below 4205.

NOTE: 4330 is the stoploss for your shorts.

If we come down then SELL and keep your targets below 4205.

I want your suggestions, so that I can tweak it furthur.

Sir, do u use Twitter.

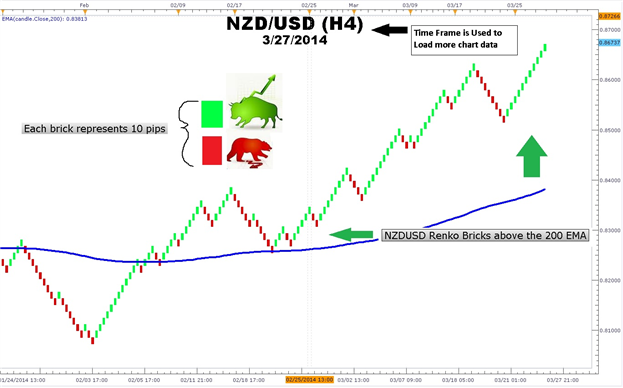

one more strategy for day trading would be to buy oversold on 5-min chart when the trend is up on the daily chart.

for example-the price is above 20-day EMA on the daily chart, hence construed to be short term bullish. on the 5-min chart buy when stochastics goes below 20 & then rises above.

namaskar sukhani ji,

thanks for your views regarding developing a vision for trading.

btw i bought 3600 call based on your closing strategy given on wednesday but unfortunately had to book heavy losses on thursday as the call bought at 104 came down to 61.

how do you think i should have avoided making such a big loss. in the early morning/afternoon i did get a chance to square off the position on an almost cost to cost basis but did not square off thinking eventually it may end up giving me profits.

don’t you think it would have been better had you given a stop loss. moreover if cnbc gives a closing strategy, one they must sometime during the next day announce the exit strategy. moreover whatever closing strategies are given must be as a rule discussed and their success or failure reviewed by cnbc on the next day.

i am an ardent fan of yours and really love going through your posts.