Trading Risks Forex Execution Risks for Dealing Desk NDD

Post on: 23 Июль, 2015 No Comment

No Dealing Desk and MetaTrader 4

In the interest of providing our clients with the best possible trading experience, we feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM.

Here you will find information detailing the execution risks associated with FXCM’s forex execution types. Select a product/execution type to get started:

No Dealing Desk Forex Execution Trading Risks

HIGH RISK INVESTMENT

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade products offered by Forex Capital Markets, LLC (FXCM LLC) you should carefully consider your objectives, financial situation, needs and level of experience. FXCM LLC is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association (NFA #0308179). FXCM provides general advice that does not take into account your objectives, financial situation or needs. The content of this website must not be construed as personal advice. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore, you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with trading on margin. FXCM recommends you seek advice from an independent financial advisor.

FXCM MARKET OPINIONS

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

INTERNET TRADING RISKS

There are risks associated with utilizing an internet-based deal-execution trading system including, but not limited to, the failure of hardware, software, and internet connection. Since FXCM does not control signal power, its reception or routing via the internet, configuration of your equipment or reliability of its connection, we cannot be responsible for communication failures, distortions or delays when trading via the internet. FXCM employs backup systems and contingency plans to minimize the possibility of system failure, which includes allowing clients to trade via telephone.

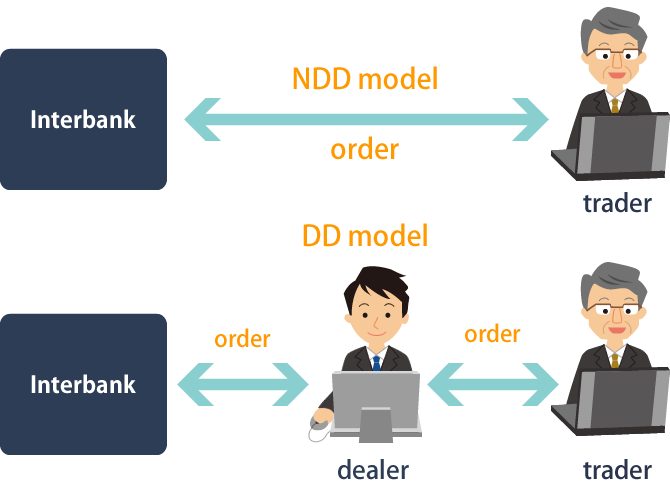

NO DEALING DESK EXECUTION MODEL

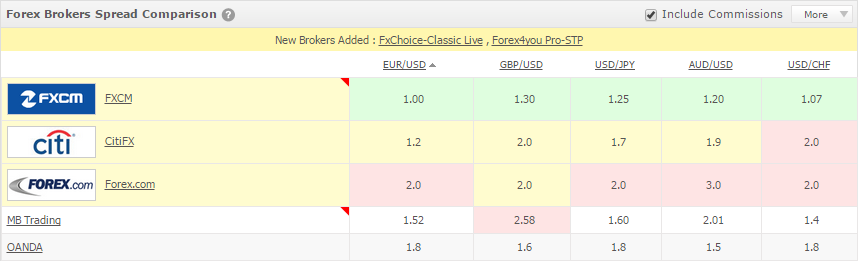

FXCM provides forex execution via a straight through processing, or No Dealing Desk execution model. In this model FXCM passes on to its clients the best prices that are provided by one of FXCM’s liquidity providers (which include global banks, financial institutions, prime brokers and other market maker) with no markups. In some instances, accounts for clients of certain intermediaries are subject to a markup. In this model, FXCM does not act as a market marker in any currency pairs. As such, FXCM is reliant on these external providers for currency pricing. Although this model promotes efficiency and competition for market pricing, there are certain limitations to liquidity that can affect the final execution of your order.

SLIPPAGE

FXCM aims to provide clients with the best execution available and to get all orders filled at the requested rate. However, there are times when, due to an increase in volatility or volume, orders may be subject to slippage. Slippage most commonly occurs during fundamental news events or periods of limited liquidity. Instances such as trade rollover (5pm EST) is a known period in which the amount of liquidity tends to be limited as many liquidity providers settle transactions for that day. For more information on why rollover occurs, see the section on Rollover Costs. During periods such as these, your order type, quantity demanded, and specific order instructions can have an impact on the overall execution you receive.

Examples of specific order instructions include:

- Good ‘Til Cancelled (GTC) Orders — Your entire order will be filled at the next available price(s) at the time it is received.

- Immediate or Cancel (IOC) Orders — All or part of your order will be filled at the next available price with the remaining amount cancelled should liquidity not exist to fill your order immediately.

- Fill or Kill (FOK) Orders — The order must be filled in its entirety or not at all.

The volatility in the market may create conditions where orders are difficult to execute. For instance, the price you receive in the execution of your order might be many pips away from the selected or quoted price due to market movement. In this scenario, the trader is looking to execute at a certain price but in a split second, for example, the market may have moved significantly away from that price. The trader’s order would then be filled at the next available price for that specific order. Similarly, given FXCM’s No Dealing Desk model for forex execution, sufficient liquidity must exist to execute all trades at any price.

FXCM provides a number of basic and advanced order types to help clients mitigate execution risk. One way to mitigate the risk associated with slippage is to utilize the Market Range (Max Deviation for MT4 users) feature on FXCM’s Platforms. The Market Range feature allows traders to specify the amount of potential slippage they are willing to accept on a market order by defining a range. Zero indicates that no slippage is permitted. By selecting zero on the Market Range, the trader is requesting his order to be executed only at the selected or quoted price, not any other price. Traders may elect to accept a wider range of permissible slippage to raise the probability of having their order(s) executed. In this scenario the order will be filled at the best price available within the specified range. For instance, a client may indicate that he is willing to be filled within 2 pips of his requested order price. The system would then fill the client within the acceptable range (in this instance, 2 pips) if sufficient liquidity exists. If the order cannot be filled within the specified range, the order will not be filled. Please note, Market Range orders specify a negative range only. If a more preferential rate is available at the time of execution traders are not limited by the specified range for the amount of positive price improvement they can receive.

Additionally, when triggered, stop orders become a market order available for execution at the next available market price. Stop orders guarantee execution but do not guarantee a particular price.

LIQUIDITY

During the first few hours after the open, the market tends to be thinner than usual until the Tokyo and London market sessions begin. These thinner markets may result in wider spreads, as there are fewer buyers and sellers. This is largely due to the fact that for the first few hours after the open, it is still the weekend in most of the world. Liquidity may also be impacted around trade rollover (5PM EST) as many of our multiple liquidity providers momentarily come offline to settle the days transactions which may also result in wider spreads around that time due to a lack of liquidity. In illiquid markets, traders may find it difficult to enter or exit positions at their requested price, experience delays in execution, and receive a price at execution that is a significant number of pips away from your requested rate.

In addition to the order type, a trader must consider the availability of a currency pair prior to making any trading decision. As in all financial markets, some instruments within that market will have greater depth of liquidity than others. Ample liquidity allows the trader to seamlessly enter or exit positions, near immediacy of execution, and minimal slippage during normal market conditions. However, certain currency pairs have more liquid markets than others.

At FXCM the following are considered examples of Exotic Currencies which may have limited liquidity: