Trading Reversals with CCI and Camarilla Pivots

Post on: 28 Июнь, 2015 No Comment

Trading Reversals with CCI and Camarilla Pivots

63 views

DailyFX.com

Talking Points

- CCI is a Classic Oscillator

- Traders Can use Overbought / Oversold Values

- Time Entries with Camarilla Pivots Levels

Timing entries is an important step to consider when developing a trading strategy. This is especially true for scalpers and day traders looking to take advantage of intraday market price swings and reversals. Normally, technical oscillators such as CCI (Commodity Channel Index) can be used in tandem with support and resistance to identify potential areas to enter the market. To do so, today we will review using CCI with camarilla pivots.

Learn Forex Overbought / Oversold CCI

(Created using FXCMs Marketscope 2.0 charts)

CCI (Commodity Channel Index)

If you are already familiar with RSI. Rate of Change, or other oscillators you are one step closer to trading with CCI. Like many oscillators, CCI uses a mathematical equation to depict overbought and oversold levels for traders. Pictured below is CCI, which uses a +100 reading to indicator overbought conditions, while a reading below -100 represents an oversold level.

Normally 70-80% of the readings printed by CCI fall between overbought and oversold levels. Traditionally traders will wait for the market to move to an extreme and then use these values for buy or sell signals with momentum returning to the market. As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative price levels over time. Knowing this, reversal traders will wait for the indicator to move outside of one of these points before reverting back in the direction a support and resistance value. Now that you are familiarized with CCI, lets look at an example using the indicator in conjuncture with pivot points.

Learn Forex AUDUSD & CCI

(Created using FXCMs Marketscope 2.0 charts)

Reversals & CCI

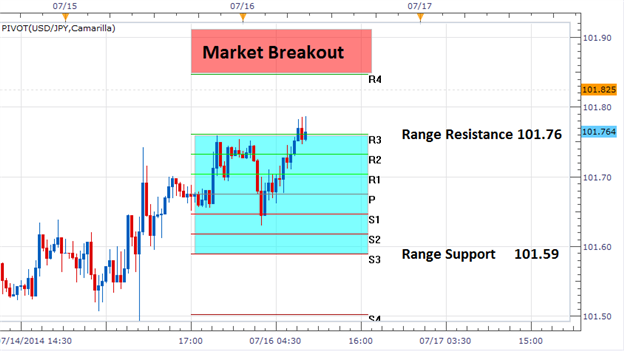

The use of support and resistance lines, such as camarilla pivots, can also be used in conjuncture with oscillators like CCI. The benefit of this, is that camarilla pivots outlines an area for traders to plan for a market reversal. Intraday resistance is typically found at the R3 resistance pivot, while support for the days range is found at the S3 pivot point.

The key to using CCI with camarilla pivots is to line an entry signal near support and resistance, along with an overbought or oversold reading of CCI. Looking at the example above, we can see resistance formed at the R3 pivot near .9315. Instead of immediately entering into the market, traders can wait to take an entry signal when the indicator closes back below the +100 overbought area. The same can be said of price testing support. In the event that price bounces, traders can use the indicator to signal momentum of the market heading back up towards resistance.

As you can see, CCI is a useful tool for timing market entries that can easily be worked into a day trading strategy! To learn more about CCI, as well as gain access to a complete scalping strategy sign up for the DailyFX CCI training course linked below. Registration is free, and the course will include videos, checkpoint questions, and rules for the Lon-NY day scalping strategy. Get started using the link below!