Trading Forex with Bollinger Bands

Post on: 30 Сентябрь, 2015 No Comment

Trading Forex with Bollinger Bands

Indicator | by IndicatorForex.com | Thursday, 12 April 2012 06:52 UTC

The Bollinger Bands are very popular trading indicator that give powerful volatility analysis for traders, and have been used for decades for Stocks, Commodities and Forex. In this article we will discuss the most accurate and predictive trading mechanisms for the Bollinger Bands.

The formula of the Bollinger Bands is very simple: the middle bollinger bands is a simple moving average of the last 0 bars, and the upper and lower bands are calculated by adding and subtracting the standard deviation of price to the middle band. The difference between the upper and lower band is twice the standard deviation. This means that a big distance between the upper and lower bands means that price is volatility, and a small distance indicates low volatility and a period of a squeeze.

The first method to use the Bollinger Bands is to gauge trendrange. If the Bollinger middle band is flat it means that price is ranging and that the trend is weak, and if the middle band is trending in a direction, it means that price is in strong range. This can help you filter your trades: in ranging markets you should only trade reversal chart patterns and signals, and in trending markets you should look for places to catch the trend in tactical places (retracements) and with MT4 indicators .

Once you’ve determined the market condition, you can also use the bands to actually signal trading signals: when price is in range, the lower and upper bands often serve as support and resistance levels, respectively. Therefore we enter a short trade if price hits the upper band and reverses, and will enter a long trade if price hits the lower band and reverses upwards. It is recommended to confirm these signals using an existing supportresistance level that is confirmed by price-action, to make the signals more accurate.

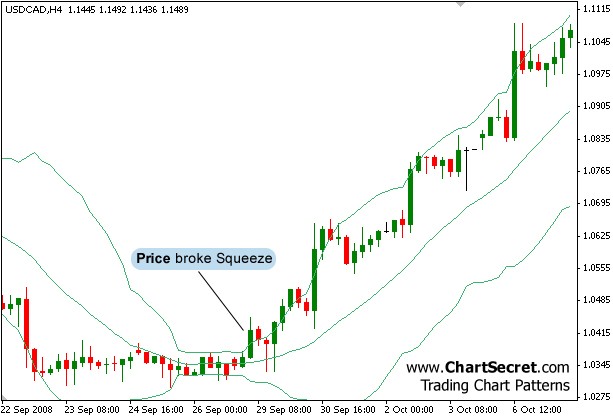

Another trading mechanism that incorporates the Bollinger Bands is the Squeeze.

A squeeze occurs when the volatility is low and price is a very tight range, ‘squeezed’ between the two Bollinger bands. Usually this squeeze results in a very big breakout of the range, and a beginning of a strong trend. Traders can take advantage of this by setting orders right outside the range, to catch the price at the beginning of the trend and harvest the profits. However, this trading method is not so reliable as in many cases price breaks to one side just to reverse and eventually create a trend to the opposite direction.

The Bollinger Bands are very powerful trading tools that you can use to improve your trading and your win rate.