Trading Divergences In Forex

Post on: 10 Август, 2015 No Comment

Oct 2011 04

Trading Divergences In Forex

Forex trading involves understanding and exploiting a handful of different concepts than those present in most common trading strategies. Forex trading, which allows the trader to benefit from relative moves in the exchanges rates between two or more currencies, are relative value trades. This means that it a successful trade is dependent not on the move of a single asset’s value, but on the relative price move between multiple assets. Central to this idea is the concept that an exchange rate has an equilibrium level over time and yet experiences divergences from this level. These divergences can be exploited in order to earn a profit. The concepts that follow give an overview of that equilibrium level, the factors that lead it to fluctuate, and how to take advantage when a price divergence is identified.

Macroeconomic Factors That Set Equilibrium Levels

Foreign exchange levels are set by market forces reacting to perceived changes in the relative value between two or more currencies. The biggest factors in setting these levels are interest rates, inflation and gross domestic product (GDP ); essentially investors are looking at the purchasing power of one currency relative to another. A disparity between interest rates means that the currency of the country with the higher rates will give the investor additional protection of his or her purchasing power. By buying risk-free securities in that country in that currency, the investor is protected. This preference will likely drive up the price of that currency relative to the lower interest rate country’s currency.

On the flip side, inflation tends to be a negative factor on interest rates for a given country’s currency. Inflation is by definition the destruction of purchasing power over time. An investor buying that currency will figure this destruction into the relative value he or she assigns between the two currencies. This calculation becomes more complicated by the fact that interest rates are inflation move independently, but affect each other. The GDP element must be considered as well, because investors will prefer the currencies of countries with solid and stable growth rates. These three factors each push and pull on these relative relationships to set the equilibrium level of foreign exchange rates between currencies. The goal of the forex trader is to gauge the direction of these rates and construct trades that can profit from these movements.

Factors That Cause Divergences and Fluctuations

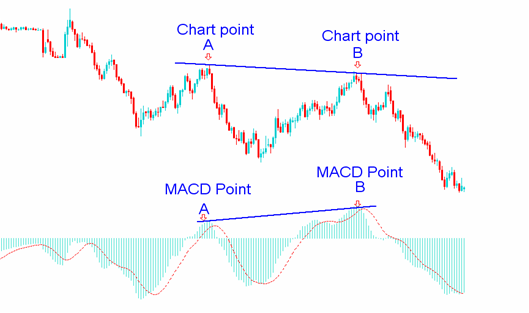

In addition to these levels being set be actual levels in each of the above factors, future expectations play a significant role as well. There is, for example, an ongoing interplay between actually rising prices and inflation expectations. These, in turn, have an impact on realized interest rates and monetary and fiscal policy of governments. Expectations are influenced by a multitude of factors and can change very quickly. The result of these rapid changes is that there are short-term fluctuations in foreign exchange prices away from what various model suggest are the “correct” levels. These divergences and fluctuations are used by some traders to construct trading strategies.

Trading Divergences in Forex

Based on the divergences explained above, some traders will construct strategies that look to capitalize on the existence of these divergences, and there eventual movement back to equilibrium. When one currency becomes overvalued based on one of these moves, a trade can be made to sell that currency relative to the other. The belief is that as exchange rates normalize, a profit can be earned by being short the overvalued currency and long the undervalued one. As the two currencies balance, the cheaper currency should appreciate against the other one. Of course, this involves the risk that either a new equilibrium has been reached, or that the expectation that created the divergence will persist beyond the duration that the trader can remain in the trade.