Trading Correlations Introduction to pairs trading

Post on: 4 Апрель, 2015 No Comment

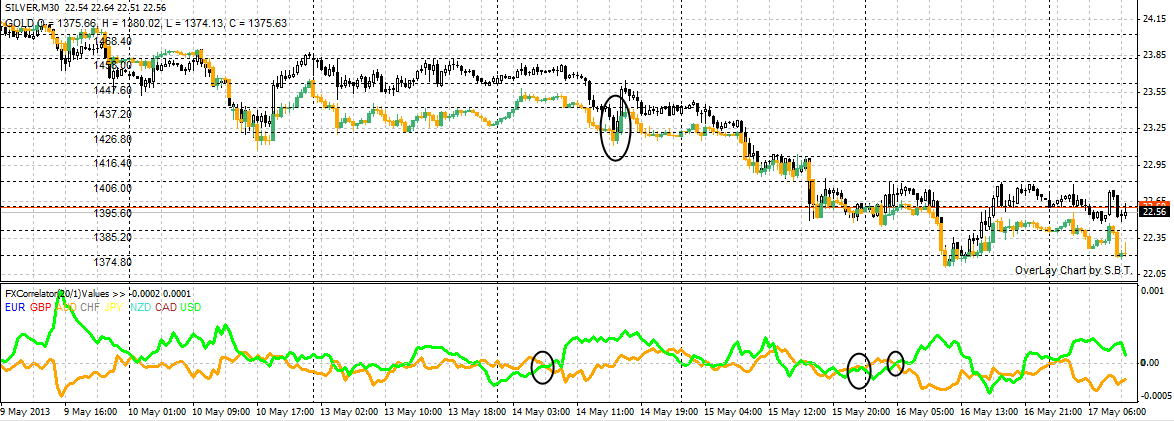

Trading currency or stocks correlation, or pairs trading as it is often referred involves buying one currency pair or stocks and shorting an inversely correlated currency or stock. The basic premise of currency correlation trading is to maximize the profits when a bias of one currency pair is extreme.

Currency correlation can be used in many different ways and for different purposes. One of the common reasons for trading currency correlation has to do with the swap rates. For example, if you were to short AUDUSD, which attracts a negative overnight rollover fees, finding an inversely correlated currency pair whose long position would attract positive swap rates would reduce any additional fees that might incur.

Pairs trading or correlation trading is considered to be a market neutral trading strategy and is referred to as statistical or relative arbitrage or convergence trading. This approach was originally discovered by Alfred Winslow by his hedge fund in 1949. It was later made famous by Gerry Bamberger in the 1980s at Morgan Stanley. Pairs trading can be applied to not just the forex market but also to stocks and ETFs. The approach is found to be more profitable in the stocks as picking two inversely correlated stocks, and if possible from different sectors ensures twice the risk, while remaining market neutral.

How to find currency correlation

In order to find a correlation between two currency pairs, the historical prices are first compared to each other. Most forex traders would know that EURUSD and USDCHF are historically inversely correlated. Meaning that when the EURUSD rises, the USDCHF tends to fall and vice-versa. Therefore a long position in EURUSD could warrant a short position in USDCHF thus ensuring twice the profits.

A general thumb rule of trading correlations are:

- > +0.9 implies positive correlation. Meaning, the two pairs move in the same direction

- < -0.9 implies negative correlation. Meaning, the two pairs move in the opposite direction

Some well known inversely correlated currency pairs include:

- USDCAD/NZDUSD

- AUDCAD/EURAUD

- EURUSD/USDDKK

and some positive correlation currency pairs are:

- EURUSD/EURHKD

- USDCHF/USDDKK

The chart below shows a correlation between EURUSD and USDDKK on a daily time frame. It is easy to see how these two currency pairs move inverse to each other with the mean price of USDDKK at 5.5 and EURUSD as 1.35

Currency Correlation: USDDKK, EURUSD

How to pick the right currency pairs for correlation trading

Because currency pairs tend to fluctuate as they move, it is often difficult to find the correctly correlated currency pair. It can also get tedious to visually test historical correlations. To make it easy, MarketInOut offers a Forex Correlation tool which automatically backtests currency correlations over a 30 day period.

Forex Correlation Tool Scanner

For best performance, trade only those correlations that are 0.9 or higher. For example, the image below shows how strong USDCHF and USDDKK are correlated. Click here to register with MarketInOut.com and start using the currency correlation indicator.

Benefits of pairs trading

By picking the right currency pairs, the profits can be maximized and stretched across different currency pairs. For example, it is never a smart idea to have an over exposure to one currency. Currency correlation ensures that the risks are spread across different currency pairs. In the example of USDCHF and EURUSD, besides the main exposure to the US Dollar, the risk is also spread across the Swiss Franc and the Euro.

Positive and negative swaps between trading the correctly correlated pairs could help in minimizing the extra fees that might come out especially when shorting a positive swap currency pair.

Pairs trading can also be termed as based on reversion to the mean form of trading. Comparing two currency pairs gives traders insights into the key price levels to watch for.

Pairs trading requires a bit more finesse and tactical decision making than one would when trading just one currency pair.