Trade Forex with a Directional Strategy

Post on: 29 Июль, 2015 No Comment

Trade Forex with a Directional Strategy 5.00 / 5 (100.00%) 1 vote

Before the 1970s, foreign exchange trading was a restricted activity subjected to numerous regulations and limited to a few powerful institutions. Now it is a relatively free market that welcomes traders of all types. Countless entities are involved in this market from the largest banks to individual investors. As a consequence, forex trade volume has seen phenomenal growth with 2013 figures estimating roughly $5.3 billion per day. Those who wish to dip their toes in the market would do well to learn the different techniques used by investors to maximize their profits. It is helpful to divide them into two: those that trade forex with a directional strategy and those who dont. Well focus here on the first group.

Having a directional strategy means following the movement of the market and making decisions based on the perceived direction. For instance, if the economy is projected to rise long-term then people could hold on to their investment for a good length of time in anticipation of great rewards. If the economy is volatile or on a downward spiral, then most traders will opt to take short-term positions which seize opportunities when they appear and try to minimize losses. There are numerous ways to implement these concepts in practice, including the following:

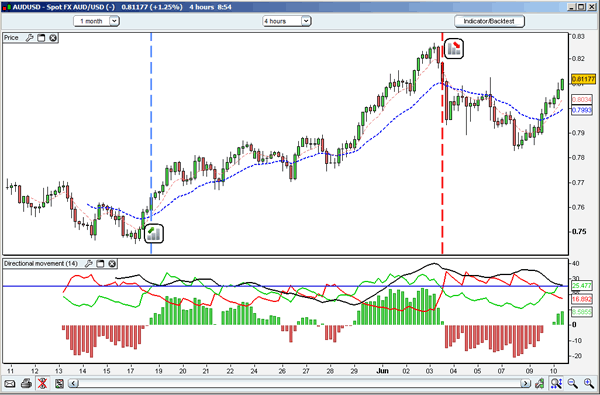

Trend-following Strategy

This is grounded on the idea that price movements tend to create certain trends. Keen observers will be able to predict where the graph is headed based on historical data. One simply chooses price points which, when reached, triggers a trading decision that is appropriate for the situation.

Moving-average Crossover

A short-term moving average is closely monitored in conjunction with a long-term moving average. The relative positions of these two points dictate buy signals for the traders. This system is not 100% foolproof. Sometimes false signals may be generated causing confusion. This can be remedied by rigid testing and experimentation with regards to the time periods used as well as other variables.

Breakout Systems

This strategy involves the detection of a new high or a new low over a certain time period and using the data to catch a possible trend. The system will then choose a position based on the observations. Traders may be advised to take a long position if the price keeps rising for several days or a short position if the closing price goes under the lowest level in the chosen timeframe. The shorter this timeframe, the greater the systems sensitivity to fluctuations. The downside is a high incidence of whipsaws.

Pattern Recognition Strategies

Those who trade forex with a directional strategy for a long time have become familiar with patterns. These can repeat through time so spotting them is essential, as well as knowing what is likely to happen next. Technical analysis is used to find different patterns such as flags and triangles across graphs. Only advanced traders typically employ it due to the nature of this technique.