Top 7 Facts You Need to Know about the Elliott Wave Theory in Forex

Post on: 18 Апрель, 2015 No Comment

It’s probably no secret to you that bullish and bearish movements in foreign exchange markets can be predicted. But, did you know that the practice had begun a long time ago?

Ever since the 1920s, market cycles have been discovered to be results of different reactions to outside influences. “As the Elliott Wave Theory, the brainchild of American accountant, Ralph Nelson Elliott, states, in spite of showing utterly confusing movements, trends in stock markets are actually repetitive in nature” said by John, A Forex Analyst from MTrading India.

Here are other facts about the theory:

1. Although the theory has been used since the 1920s, it wasn’t until Robert Prechter and AJ Frost made it rise to popularity in the 1970s. In the book, The Elliott Wave Principle – The Key to Stock Market Profits, which the two co-published, they name it a factor that could’ve prevented a great market crash. Moreover, they imply that if only traders paid enough attention to the indicators, a bull market in the 1970s could’ve been predicted.

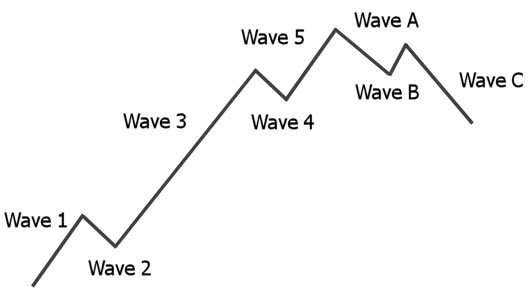

2. An Elliott Wave degree consists of trends and countertrends. It can be formed with a corrective wave, which succeeds a formation of an impulse wave.

3. Certain rules contribute to the theory’s effectiveness. Since they make sure that alternate counts or different valid interpretations are kept to a minimum number, there’s usually a single result that can satisfy the guidelines. In most cases, the main alternate count or the top count is the result that can meet the guidelines.

4. The theory can be applied by focusing on different charts that indicate market action, then, identifying completed wave structures. With the output, traders can form interpretations regarding the market’s current position and the direction it is most likely headed.

5. The theory can be used for everyday trading since it’s known to assign a particular category depending on how large and how small waves are. The list of categories includes cycle, supercycle, grand supercycle, minor, intermediate, primary, sub-minuette, minuette, and minute.

6. The theory is also known for giving traders a technique for determining turning points in stock markets. For high odds of success and for you to gain advantage over others regarding the best time to enter and exit transactions, it can be used as a guideline.

7. Using the Elliott Wave Theory isn’t difficult. But, neither is it simple without years of hard work and practice. For its application to be made rather effortless and to guarantee that wave counts are counted correctly, a number of Elliott Wave software programs can be availed of.