Tips For Creating Profitable Stock Charts

Post on: 16 Март, 2015 No Comment

Tips For Creating Profitable Stock Charts

Charts are a technical trader portal to markets. With so many advances in the analysis platforms, the dealer is able to see a wide range of market information. But with so much data available, it is important, good-looking charts is to create better, not hinder, a trader’s market analysis. The faster a dealer to interpret market information, the faster he or she can react to changing conditions. Is spending the time to clean, easy to read charts and improve areas of work to develop a dealer location picture and the ability to decipher market activity. Read a few tips for you as you make the best stock charts. (To learn about technical analysis and technical trading, check out Introduction to Types of Trading: Technical traders and Technical Analysis. Introduction)

Colors

While it may be fun to experiment with different colors, graphics, and support many chart analysis platforms hundreds of color choices we should not forget that a lot of time is spent on the table his eye. Choose colors that are easy to see, is a must. Not only does the individual colors on the chart to have to be visually appealing, they must all work together to create a well-contrasted diagram.

In general, the table background is best, neutral colors, white, gray and black work well. Bright or neon colors can be unbearable even for a short time and may complicate chart indicators to see.

Once a pleasant, neutral background color is selected, the dealer can fine-tune the rest of the graphics: things like grid lines, axis, colors and price must be chosen. Again, it’s a good idea to leave them in a neutral color, but one that contrasts with the chart background. A light gray background with black or dark gray grid, axis and price components, for example, creates an easy-to-read table. (For more information, see Charting Markets into the future.)

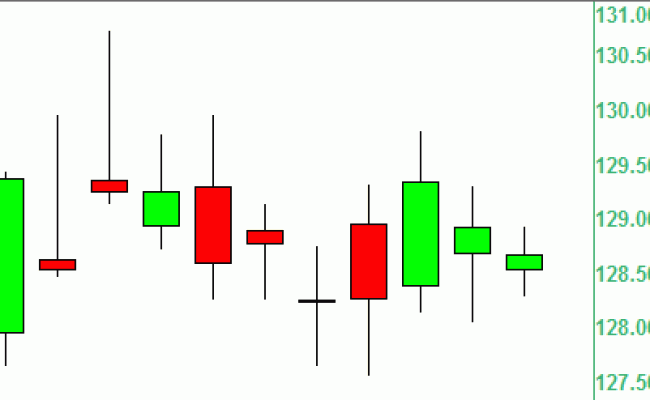

Price bars and counters to the graph should be plotted and really stand out of the chart background. After all, it is what a dealer is to actually observe. Price bars in red (for the bottom bars) and green (for up bars) also appears on each of the neutral background colors. In addition, most analysis platforms, a variety of shades of red and green continues to increase visibility to choose. Price bars in black (for the bottom bars) and white (for up bars) stand out very well against a gray background. The indicators should be in contrasting colors so that all data is easily recognized and interpreted.

Another idea to consider, is intended to use different colors for charts that serve different purposes. For example, some graphics will be used to determine entry and exit decisions, while others are simply watching for learning purposes. If more than one symbol is traded, traders could look to facilitate a different background color for each ticker to quickly isolate data for each share.

Layout

Designing the entire workspace (all from the charts and other market data displayed on a dealer-monitors) also requires consideration. After more than one monitor is very helpful in creating a simple easy-to-interpret the work area, because it followed more opportunity, more securities.

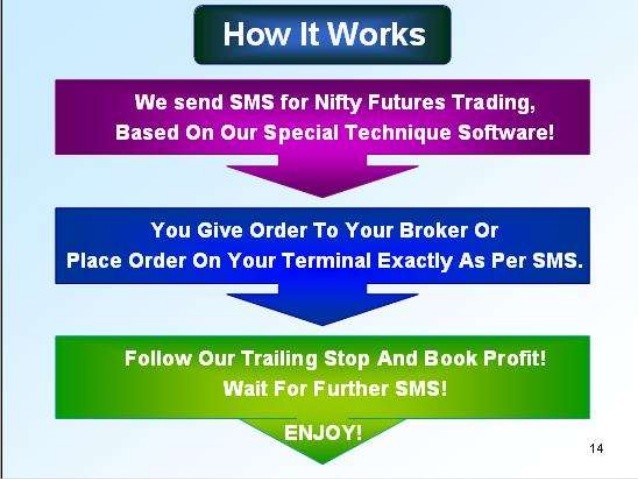

Ideally, a monitor can be used for order entry, and all remaining monitors are used for charts and other market analysis tools. If the same display used on several charts, such as a stochastic oscillator, it is a good idea, as indicators in the same place on each card instead of using the same colors. This makes it easier to find and compare the specific indicator on various charts. Figure 1 shows an example of a two-monitor workspace, with the order entry screen on the left monitor, and chart analysis right on the monitor screen.

Figure 1: A two-monitor workstation with order entry and chart analysis screens.

Charts created by Tradestation

To be disruptive market data, ensures that all data (including indicators) is relevant, useful, and is used regularly. If it is not, remove from the table, it will only create confusion. Carefully choose what is not included on charts in a matter of trial and error, you must experiment with different data to distinguish between necessary and important to identify analytical tools. More than four or five windows open or graphics on the same screen can be confusing. (This relatively unknown tool could help you get a faster trend of the asset. To learn more, read A Look At Kagi Charts.)

A substantial price chart overlays are — those indicators which can be drawn directly on the price bars. These include instruments such as moving averages and Bollinger Bands. Charts can also be sub-charts to house additional indicators such as the Consumer Confidence Index (CCI) and the Relative Strength Index (RSI). Remember, the indicators in the same way to make each card so it is easier to find and interpret the data.

Fonts and Sizing

With bold fonts and allow dealers to clear numbers and words to read with greater ease. Font size should be, how many cards are in a monitor, the relative importance of written information, and ultimately the dealer is able to read the fine print, expressed to be determined. It is helpful to experiment with different fonts and sizes, to a convenient choice is found. Once the font and size is decided, you should use the same selection on all charts. Again, the continuity in the preparation of charts that are easy to read and interpret to help.

Saving Charts

If a dealer is a diagram and / or workspace setup that he or she is happy, it can be stored for later use (see the platform help for directions). It is not necessary to the charts and workspaces each time the analysis platform is open to reformat. There is also a good idea to take a screenshot for backup purposes instead. Since the launch of the charts and work areas is time consuming, it is to have a dealer in the best interest to provide a quick method to recover lost setups. (Choose a broker with whom you feel comfortable, but also the one who offers a trading platform that is for your trading style. For more information check out nine tricks of successful traders.)

Completion

Although time consuming, development of efficient charts and workspaces is worth the trouble. The ability to quickly access and interpret market data is an essential part in the competitive environment trading arena. A dealer can make all the right information to smart trading decisions, but if he or she can not find and interpret the data that fast, it’s useless. Creating high-performance chart setups, dealers increase their situational awareness and thus more efficiently and profitably in the markets.