The Vital Importance of Choosing The Right Day Trading Software_2

Post on: 21 Июль, 2015 No Comment

Computer applications have done it easy to automate trading, generally for brief tenure complete activities like day trading, creation a use of trade module really popular. The discuss continues on a distinction intensity that can be practically subsequent from day trade activities, as brokerage and commissions are pronounced to take divided a vital apportionment of accessible distinction potential. It so becomes really critical to name a right day trade module with a cost advantage analysis, comment of a qualification to sold trade needs/ strategies, as good as a facilities and functions we need.

Day trading is a time firm trade activity where buy or sell positions are taken and sealed on a same trade day, with an aim to make increase in smaller cost differentials on vast sequence volumes by visit shopping and selling, customarily on leverage .

What is day trade software?

Day trade module is an programmed mechanism program, customarily supposing by brokerage firms to assistance clients lift out their day trade activities in an fit and timely manner. They capacitate traders to reap increase that would be formidable to grasp by small mortals. For e.g. a day merchant might find it unfit to manually lane twin technical indicators (like 50 and 200 day moving averages ) on 3 opposite bonds of his or her choice, though an programmed day trade module can simply do it and place trades once a set criteria is met.

The facilities and functions accessible might differ from one module to a subsequent and might come in opposite versions. Apart from brokers, eccentric vendors also yield day trade software, that tends to have some-more modernized features.

How day trade module works?

Three elementary facilities of any day trade module include:

- Functionality permitting a setup of trade plan (based on technical indicators/ news/ trade signals /pattern recognition), in a trade system

- Automated sequence fixation duty (usually with Direct Market Access ), once a criteria are met

- Analytical collection to continue comment of existent land (if any), marketplace developments and facilities to accordingly act on them

Any day trade module will need a one-time setup of trade plan with environment a trade limits, putting a complement on live information and vouchsafing it govern a trades.

Here is a elementary example. Assume a batch ABC is dual-listed on both NYSE and NASDAQ batch exchanges. You are looking for arbitrage opportunities and there is a day trade module accessible for it. You setup a following:

- Select ABC batch for arbitrage and name twin markets (NYSE and NASDAQ) for trading

- Assuming both legs of intraday trade costs we a sum of 0.1 USD per share for brokerage and commission; we aim to demeanour for cost differentials between a twin markets in additional of that amount. So we set (say 0.2 USD or above) as a cost differential – i.e. a module should govern a coexisting buy and sell sequence only if a bid and ask prices on a twin markets (NYSE and NASDAQ ) are incompatible by 0.2 USD (or more)

- Set a no. of shares to be bought and sole in one sequence (say 10,000 shares)

- Let this setup go live.

Say a module identifies that ABC has quotes of 62.10 USD during NYSE and 62.35 USD during NASDAQ (differential of 0.25 USD) for orders some-more than set extent of 10,000 shares. The day trade module will trigger trade as it matches a tangible criteria, and will send orders to a twin exchanges (buy during revoke labelled and sell during aloft priced). If all goes well, this day trade module will make (62.35 – 62.10 – 0.1 = 0.15) * (10,000) = 1,500 USD of net distinction for a merchant in a flash.

Further enhancements in a above module might embody stop-loss facilities contend if usually your buy trade gets executed, though not a sell trade. How should a day trade module ensue with a prolonged position? A integrate of options can be enclosed as extended facilities in a software:

- Continue to demeanour for sell opportunities during identified prices for a specific time. If no opportunities are identified in specified time, block off a position during loss.

- Set stop detriment boundary and block off a buy order, if a extent is hit

- Switch to an averaging techniquebuy some-more bonds during revoke prices to revoke a altogether price

The above is an instance of arbitrage where trade opportunities are brief lived. A lot of these forms of day trade activities can be setup by day trade module and so it becomes intensely critical to name a right one relating your needs.

Characteristics of good day trade software:

- Platform independence: Unless a merchant is regulating rarely formidable algorithms for day trade requiring high finish dedicated computers, it is advisable to go with a web formed module offering. Benefits include: connectivity from anywhere, no primer installations of upgrades, and no upkeep costs. However, if we are regulating rarely formidable algorithms that need modernized computing, afterwards it is improved to cruise dedicated computer-based installable software, nonetheless that will be costly.

- Your specific needs for day trading: Are we following a elementary day trade plan of relocating normal tracking on stocks, or are we looking to exercise a formidable delta-neutral trade plan including options and stocks? Do we need a forex feed or are we trade on specific products like binary options? Trusting a claims on batch brokers’ website calm is not adequate to know a offering. Ask for a hearing chronicle and entirely cruise it during a initial phase. Alternatively, check a shade by shade educational (if available) from a batch attorney or businessman to clearly know a right fit for your day trade needs.

- Additional Features: Day trade attempts to gain on brief tenure cost movements during a day. Such brief tenure cost movements are in spin driven essentially by news and supply/demand (among other factors). Does your day trade plan need News, Charts, Level 2 data, disdainful connectivity to sold markets (like OTC), specific information feeds, etc. If so, are these enclosed in a module or would a merchant have to concede to them alone from other sources, thereby augmenting a cost?

- Analytical Features: Pay courtesy to a set of methodical facilities it offers. Here are few of them:

- Technical Indicators/Pattern Recognition. For traders who try to advantage from presaging a destiny cost turn and direction, a resources of technical indicators is available. Once a merchant finalizes a technical indicators to follow, he/she should safeguard that a day trade module supports a compulsory automation for fit estimate of trades formed on a preferred technical indicator.

- Arbitrage Opportunities Recognition. To advantage from a slight cost disproportion of a twin listed share on mixed markets, coexisting shopping (at a low cost exchange) and offered (at a high cost market) enables distinction opportunities and is one of a ordinarily followed strategies regulating day trade software. This requires a tie to both markets, a ability to check cost differences as they start and govern trades in a timely manner.

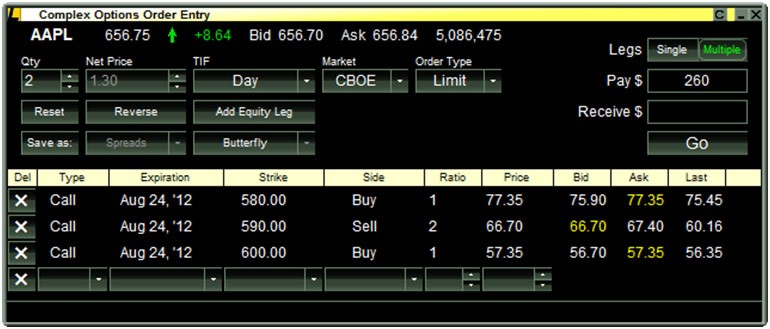

- Mathematical indication formed strategies: Few programmed trade strategies formed on mathematical models exist like a delta-neutral trade plan that concede trade on a multiple of options and a underlying security, where trades are placed to equivalent certain and disastrous deltas so that a portfolio delta is confirmed during zero. The day trade module should have a in-built comprehension to cruise a stream holdings, determine accessible marketplace prices and govern trades for both equity and options as needed.

- Trend following strategies. Another vast set of strategies ordinarily implemented by day trade software.

As can be celebrated from above list, a sky is a extent with mechanism programming and programmed module systems. Anything and all can be automated, with lots of customizations. Apart from selecting a right day trade software, it is really critical to exam a identified strategies on chronological information (discounting a brokerage costs), cruise a picturesque distinction intensity and a impact of day trade module costs and only then go for a subscription. This is another area to evaluate, as many brokers do offer backtesting functionality on their module platforms.

- Cost of day trade software: Is a module accessible as a partial of customary brokerage comment or does it come during an additional cost? Depending on your sold trade activity, a cost advantage research should be carried out. Care should be taken to cruise a accessible versions and their features. Most trade module comes giveaway by default with a customary brokerage account, though might not indispensably have all a compulsory facilities assembly your trade needs. Be certain to check a costs of aloft versions that might be significantly aloft than a customary one. These costs should be ignored in evaluating a earnings from trade and decisions done formed usually on a picturesque gains.

- Price Accuracy Does a attorney and day trade module support NBBO (National Best Bid and Offer)? Brokers who are NBBO participants are compulsory to govern a customer trades during a best accessible bid and ask price, ensuring cost competitiveness. Depending on a nation specific regulations, brokers might (or might not) be mandated to yield a best bid and ask prices. Traders trade general bonds with general brokers and module should cruise confirming on this for a specific market.

- Protective Features: It’s sparkling to have module make income for you, though insurance is paramount. With a enrichment of technology, there also exist “sniffing algorithms software” that try to brand a other side orders in a market. They are designed to concede their owners to advantage from it by “sensing” a orders on other side. It will be value deliberation if your day trade module is exposed to such sniffing or either it has surety facilities to censor bearing to other marketplace participants.

The Bottom Line

There are unconstrained horizons to try with trade regulating mechanism programs and programmed module systems. It might be intensely sparkling to make income during a click of a button, though one needs to be entirely wakeful of what’s going behind a stage – Is a programmed sequence is removing during right cost in a right market, is it following a right strategy, and so on. A lot of trade anomalies have been attributed to programmed trade systems. A consummate analysis of day trade module with a transparent bargain of your preferred trade plan can concede sold traders to reap a advantages of programmed day trading.