The Structure Of The Foreign Exchange Market

Post on: 12 Июль, 2015 No Comment

Among the financial markets, the structure of the Foreign Exchange Market is unique in a number of ways. The first unique feature is that the forex market was not used as an investment vehicle traditionally. It had and somewhat maintains a more utilitarian purpose. Most businesses in today’s globalized economy have international exposure that creates the need for the need to exchange one currency for another to facilitate completion of transactions.

For instance, Samsung makes its phones in South Korea and then exports them to the US where an American buyer exchanges a couple of hundred dollars in exchange for the new Samsung phone. Some of the money the American pays makes its way back to South Korea to pay the workers at the factory that built the phone. However, these dollars have to be exchanged for South Korean Won since it is the currency that the factory workers are paid in.

International banks facilitate these transactions through a mechanism known as the foreign exchange market. Since these banks are what facilitate these cross-border transactions, they obviously require some payment for this service. The payment they charge is in the form of a bid/ask spread. This means offering the desired currency at slightly less cost than they are willing to sell it and then pocketing the difference. If you consider the fact that over 4 trillion dollars moves through the market every day, these seemingly small fees quickly add up.

Free-floating exchange rate

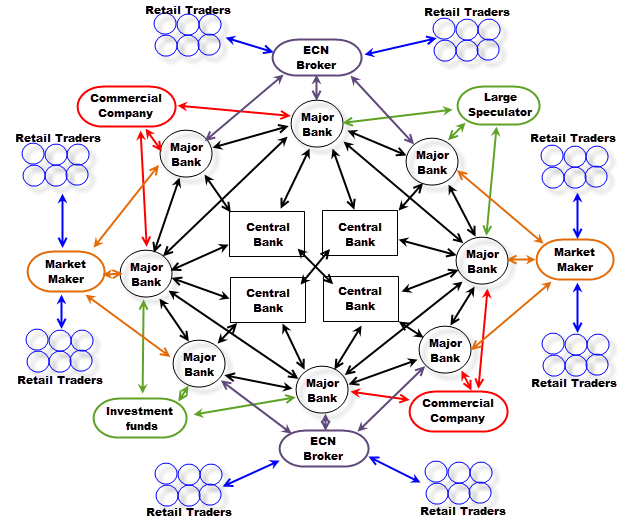

Since the 70’s majority of the world’s major currencies have been operating mostly on a free-floating exchange mechanism. This means that the forces of demand and supply or rather the market forces are what determine the exchange rates. The reason for the use of the word “mostly” is that there are times when central banks of countries intervene in the market to influence these exchange rates. How they achieve this is by either selling or buying large amounts of currency although this takes place in extreme situations.

Other central banks choose to manage their currencies much more strictly. However, such central banks are a minority in the developed nations. The free floating-rate exchange rate mechanism is the one used in most cases to determine exchange rates. Growth in the use of the floating rate allowed currencies to fluctuate more against each other, which led to further opening up of the door to speculation in the future movements of these exchange rates.

Initial speculators

The banks were the first speculators in the forex market because of their high levels of capitalization as well as their intimate knowledge of the forex market. One unfortunate consequence of this speculation is the scarcity of liquidity at times meaning that it was hard to complete some necessary transactions at times.

Additional speculators

As a solution to this liquidity problem, banks decided to expand the number of participants in the forex market to include non-bank actors. This expansion helped generate enough liquidity distribution to enable the banks complete their clients’ transactions as well as profit from the new and less experienced market participants. Originally, these non-bank actors included large funds but nowadays include even the local retail forex dealers.

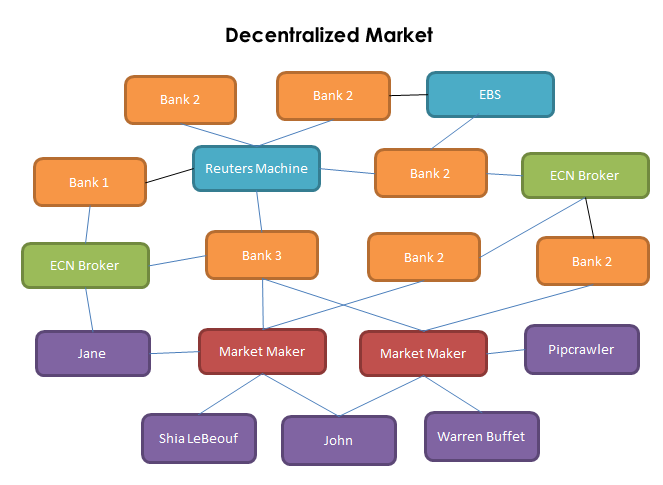

The foreign exchange market is also unique since it is an over-the-counter (OTC) market. This means that there is no central exchange like the stock market where transactions take place. Rather, top-tier transactions happen in the “interbank market.” The interbank market is a collection of the largest money center banks in the world.

All these banks are free to trade currencies amongst themselves at whichever rate they agree. It is of course quite difficult to navigate your way around such a maze and that is why the brilliant minds at the leading banks created the Electronic Broking System (EBS). The EBS enables participants in the market see what rates fellow participants are willing to deal at. Reuters D2 also developed a competing system. Currently, one system has gained preference over the other but mostly based on which currency pair you intend to trade.

The EBS is mostly used to trade the USD/JPY, USD/CHF, EUR/JPY, EUR/CHF, and EUR/USD. The Reuters D2 is used to trade all other currency pairs. In 2006, ICAP acquired EBS. It is good to note that even though these services provide a centralized structure for the information on pricing, they simply do not constitute a centralized exchange. The forex market remains for the near future as an OTC market.

Smaller bits of the larger multinational institutions make up the second tier of the forex market. An example is when a bank branch in the United States deals with another satellite branch in a different country, say the UK. When you go to your local branch wanting to exchange currency, your branch will give you a quote that is not exactly representative of the interbank exchange rate. You can choose to shop around for a better quote, which is advisable since the rates can vary greatly from one bank to the next .

The third tier of the forex market is where you will find most of the forex brokers. These brokers often deal with a single second tier liquidity provider. However, this is not always the case since some retail brokers have direct access to multiple liquidity providers making themselves part of the second tier. This often happens when brokers use the Electronic Communications Networks (ECN) that normally route orders from retail traders directly into the interbank market.