The Quest To Build A Unified Managed Account_1

Post on: 16 Март, 2015 No Comment

Tiburon Strategic Advisors, a market research & strategy consulting firm serving a wide variety of financial institutions and investment managers. released a newly updated research report addressing separately managed account & other fee-account programs earlier this year. One chapter of the report addresses the leading proprietary fee-account program sponsors overall and within each of the eight types of fee-account programs. This release provides a summary of that chapter.

Proprietary Fee-Account Program Sponsors

In analyzing the builders of fee-accounts programs – the proprietary sponsors – there are the wirehouses, and there is everybody else. The wirehouses have impressive, comprehensive fee-account platforms with nearly all of the eight types of fee-account programs, and not coincidentally, they control a huge share of the assets. There are only five players in this market – Merrill Lynch, Smith Barney, Morgan Stanley, UBS Financial Services, and Wachovia Securities. The everybody else category includes all other proprietary program sponsors, most notably the other national & regional broker/dealers and hundreds of other firms.

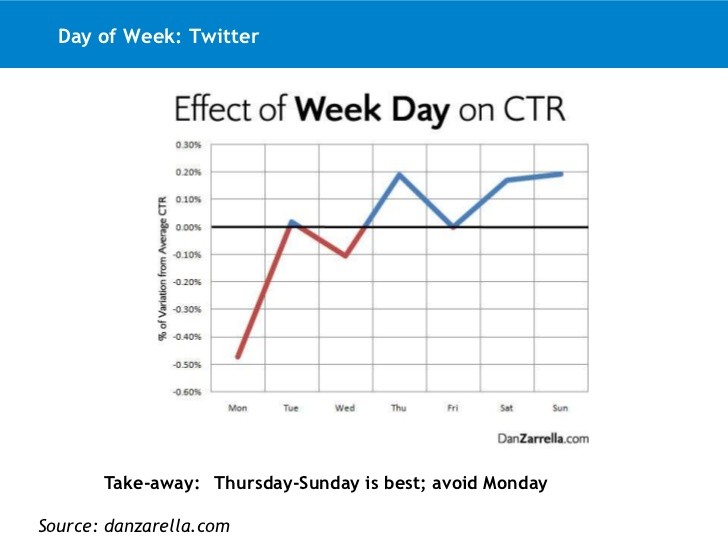

All five wirehouses have been moving toward offering a complete fee-accounts platform, complete with each of the eight types of fee-account programs; ETF wrap accounts, annuity wrap accounts, and unified managed accounts have been the newest entrants. All the wirehouses offer fee-based brokerage accounts, broker wrap accounts, mutual fund wrap accounts, and either (or both) a separately managed accounts or multiple style portfolio program. Smith Barney and UBS Financial Services are the only firms to have offer model UMAs; only Merrill Lynch has an annuity wrap account program; and only Morgan Stanley has an ETF wrap account program.

20-%20Research%20Release%20Images/07.02.23_Images/Slide2.gif /%

Overall Packaged Fee-Account Programs

Wirehouses dominate the packaged fee-accounts market today, controlling over two-thirds of all assets. Specifically, the wirehouses control 68% of the packaged fee-accounts market, compared to the 19% controlled by the other national & regional broker/dealers, 9% controlled by TAMPs, and 4% controlled by a long list of other firms, such as independent broker/dealers, insurance companies, and banks.

Merrill Lynch and Smith Barney dominate the other firms in total fee-accounts assets, each having over twice the assets of the third leading player. Smith Barney is now in the lead – having taken the top perch from Merrill Lynch over the past two years – with a total of $266 billion in fee-accounts. Merrill Lynch is not far behind with $261 billion. Morgan Stanley is in third place with $117 billion in fee-accounts assets. 20-%20Research%20Release%20Images/07.02.23_Images/Slide3.gif /% UBS Financial Services and Wachovia Securities recently swapped places on the leader board, and arent far behind Morgan Stanley with $115 billion and $100 billion, respectively. Other leaders include LPL with $57 billion, Prudential Financial with $44 billion, Ameriprise Financial with $39 billion, AG Edwards with $38 billion, Fidelity Investments with $36 billion, Envestnet with $34 billion, SEI with $34, Raymond James with $30 billion, Charles Schwab & Company with $30 billion, Advisor Port with $26 billion, Lockwood with $22 billion, and Russell with $21 billion. All other firms collectively have a total of $175 billion.

Smith Barney and Merrill Lynch control nearly half of the packaged fee-account programs market, with each holding about one-quarter of the assets. Smith Barney earned its market dominating position through its pioneering market moves, inherited asset base from EF Hutton, and continual strong commitment to consultative programs. The firms Consulting Services Division (CSD), based in Wilmington, Delaware, has significant resources. It controls 24% of the market. Merrill Lynch has earned its dominating position (23%) from rapid and leading-edge product development capabilities (including its leading-edge fee-based brokerage account Unlimited Advantage) and from the sheer power of its distribution system. Market shares of the other firms decline quickly with Morgan Stanley, UBS Financial Services, and Wachovia Securities leading the way at just 9%, 8%, and 6% respectively. All other firms control the remaining 30%.

Merrill Lynch & Smith Barney have built the most economic fee-account businesses in the wirehouse channel to date, based on the amount of assets on their platforms, compared to their number of fee-accounts programs. Smith Barney has its commanding assets with just five programs. Merrill Lynch has its commanding assets with about six programs. Wachovia traditionally had a less than efficient fee-accounts platform, with only about a third of the assets of those two, despite having had as many as fifteen separate fee-accounts programs. This is somewhat misleading, however, as that firm uniquely (for the wirehouses) uses Prudential Financials Managed Accounts Consulting Group, which is a TAMP. It is likely that this strategy has helped the firm improve its efficiency.

Separately Managed Accounts & Multiple Style Portfolios

The wirehouses market share of separately managed account assets has been declining over the past few years, but there is some evidence of a rebound. From a high of 86% in 1994, the wirehouses share of all separately managed accounts business slowly eroded to 66% in 2004. This data could easily be misinterpreted; the wirehouses have actually done quite well during this time period and continued to gather substantial assets and lead the industry in product innovation. The declining market share of the wirehouses was simply attributed to the emergence of dozens of new competitors, which were chipping away at their very substantial market share. Also, interestingly, in 2005, the wirehouses actually showed a significant rebound in market share (to 73% of assets) despite all the new entrants in the field.

Smith Barney and Merrill Lynch dominate the other players in separately managed account assets. Smith Barney has $192 billion (up from just $146 billion in 2004) and Merrill Lynch has $147 billion (up from $120 billion). Other players trail far behind, with Morgan Stanley at $61 billion, UBS Financial Services at $60 billion (having made the most significant jump, from just $41 billion in 2004), and Wachovia Securities with $37 billion. Other leaders included Charles Schwab & Company with $24 billion, Lockwood with $16 billion, Bank of America (which has seemingly come out of nowhere) with $16 billion, AG Edwards with $15 billion, Raymond James with $10 billion, DB Alex Brown with $9 billion, Sungard Advisor Technologies (formerly London Pacific Advisors) with $8 billion, and Wells Fargo with $7 billion. All other firms have $69 billion collectively.

20-%20Research%20Release%20Images/07.02.23_Images/Slide8.gif /%

The wirehouses are predominantly focused on separately managed accounts, with Wachovia Securities being the exception, while their other competitors are focused elsewhere. Both Smith Barney (about 75% of assets) and Merrill Lynch (about 45%) have a huge share of their fee-account asset in separately managed accounts. Morgan Stanley has about 60% of its fee-account assets in separately managed accounts, while UBS Financial Services has a dominant share of about 80% of its assets in such. On the flip side, Wachovia Securities has only about 35% of its fee-account assets in separately managed accounts. One last interesting example is LPL Financial Services, which although having a very robust fee-accounts offering, lags in separately managed accounts, which account for only 5% of its assets. LPL, and other traditional independent broker/dealers, are focused on mutual fund wrap accounts and other advisory products to serve their smaller average clients.

Separately managed accounts data usually includes multiple style portfolios and unified managed accounts; however, traditional separately managed accounts programs still have nearly all of the assets, with multiple style portfolios picking up some share. In 2005, across separately managed accounts, multiple style portfolios, and unified managed accounts, traditional separately managed account programs accounted for 87% of the assets, with multiple style portfolios at 10% and unified managed accounts (as defined by their firms) filling in the gap of 3%. Unified managed accounts stayed at 3% in 2006, but multiple style portfolios jumped to 12%, with separately managed accounts still accounting for 85% of their collective assets.

Mutual Fund Wrap Accounts

Wirehouses only control one-third of mutual fund wrap account assets, down significantly since the late 1990s. In 1999, the wirehouses controlled 48% of mutual fund wrap account assets. This share fell to 33% in 2006. Ameriprise Financial is the leader in mutual fund wrap accounts; the original innovator, Fidelity Investments is in a close second place. Specifically, Ameriprise Financial has $39 billion and Fidelity has $36 billion. The other leaders include SEI Investments ($30 billion), LPL ($28 billion), Wachovia Securities ($25 billion), UBS ($24 billion), Morgan Stanley ($20 billion), Merrill Lynch ($16 billion), Smith Barney ($15 billion), AG Edwards ($11 billion), BNP Paribas Fund Quest ($11 billion), ING Advisors ($6 billion), Asset Mark ($5 billion), and Bank of America ($5 billion). Other firms have $29 billion collectively.

20-%20Research%20Release%20Images/07.02.23_Images/Slide6.gif /%

The mutual fund wrap account industry is much more fractured than is the separately managed accounts market, with the top two firms controlling just one-quarter of the market. Consider that the top two competitors in separately managed accounts (Smith Barney & Merrill Lynch) control about half of that market. In mutual fund wrap accounts, Ameriprise Financial and Fidelity Investments control 13% and 12%, respectively, adding to one-quarter of all assets. The lack of share garnered by the top firms in mutual fund wrap accounts is due to the fact that many more players compete in mutual fund wrap accounts than in separately managed accounts, which are generally relegated to serving only the higher net worth clientele of the wirehouses. Another interesting point here is that the largest wirehouse in mutual fund wrap account assets – Wachovia Securities – has only 8% share.

The wirehouses have largely ignored mutual fund wrap accounts, leaving them to Ameriprise Financial, Fidelity Investments, and other firms. For instance, effectively all of the assets in those firms fee-account programs are in mutual fund wrap accounts. Then consider the wirehouses, with the mutual fund wrap account leader Wachovia Securities having only about 20% of its assets in such. Smith Barney and Merrill Lynch hardly register here, with less than 10% of assets in such.

In short, Mutual fund wrap accounts do very well in channels where smaller clients are served, and hence the wirehouses have much less control of the market than they do in separately managed accounts. The wirehouses have lost share in the market as they continue to focus on separately managed accounts. The independent broker/dealers are the traditional leaders in this market and the discount brokerage firms have also done very well here – namely, due to Fidelity Investments well priced PAS leading program with $36 billion. Moreover, watch the discount brokerage firms in the future as well – Charles Schwab & Company launched a deeply discounted online mutual fund wrap account program in 2006.

ETF Wrap Accounts

AG Edwards, TD Ameritrade, & Buckingham Asset Management might be ahead on ETF wrap account assets due to their early creation of such programs. Buckingham is a leading indexing TAMP, and has $8 billion in assets.

The only leading player yet focused on ETF wrap accounts is TD Ameritrade, far from a traditional fee-accounts powerhouse. Its Amerivest ETF wrap account program is its only extensive fee-accounts offering, so likely controls 100% of its assets.

Wirehouses have insofar shown only limited interest in entering the ETF wrap account market; leaders here have been the other national brokerage firms & other financial advisor channels. Morgan Stanley has a program.

Annuity Wrap Accounts

Merrill Lynch deserves mention because of its Consults Annuity product. None of the players are focused on annuity wrap accounts of yet; Merrill Lynch likely has only a few bucks in such. A few of the TAMPs are pushing this model.

Unified Managed Accounts

The unified managed accounts industry (as it is defined today) controls $24 billion in assets; some early movers include Genworth Financial, Ameriprise Financial, Lockwood, and Smith Barney. Genworth Financial has $4 billion in assets, Ameriprise has $2 billion, and both Lockwood and Smith Barney have $1 billion apiece. Again, these figures are growing (on a percentage basis), but any enthusiasm should be tempered until true unified managed accounts are defined and developed.

Broker Wrap Accounts

Although it is much smaller than the aforementioned markets, it is probably not surprising that Smith Barney dominates the broker wrap accounts market, with more than three times the assets of its nearest competitor at $31 billion. Envestnet (with its numerous independent broker/dealer clients) is second with $27 billion. Wachovia Securities edges out Merrill Lynch with $12 billion versus $8 billion for third place. UBS Financial Services and Raymond James come in close behind with $7 billion and $6 billion, respectively. Securities America and Morgan Stanley round out the leaders list, also with $3 billion each. All other firms have just $1 billion in assets in these programs.

20-%20Research%20Release%20Images/07.02.23_Images/Slide7.gif /%

In terms of market share, Smith Barney and Wachovia Securities control nearly half of the broker wrap account market, a market that has far fewer competitors. They have 35% and 13% of the market, respectively. Merrill Lynch has 9% and UBS Financial Services is on its heels with an 8% market share, with Morgan Stanley at 3%. Collectively, the wirehouses (along with Envestnet), control nearly three-quarters of this market.

Though the wirehouses dominate such, they do not have a huge share of their assets in broker wrap accounts. In relation to their overall fee-accounts offerings, broker wrap accounts are merely a blip. Smith Barney has the most focus here, yet has less than 15% of its assets in such.

Fee-Based Brokerage Accounts

Merrill Lynch leads in fee-based brokerage account assets at $89 billion, with almost three times the assets of its nearest competitor, which is Morgan Stanley with $33 billion. Morgan Stanley might have moved some of those assets, after it was disciplined by the SEC for fee-based brokerage account practices. Next is Smith Barney and LPL with $28 billion and $27 billion, respectively. UBS Financial Services and Wachovia Securities each has $24 billion in assets.

In terms of market share, Merrill Lynchs dominating position translates into one-third of the fee-based brokerage accounts market (31%). Morgan Stanley follows with 12%, and Smith Barney and LPL each have 10%. UBS Financial Services and Wachovia Securities each have 9%. All other firms control just 19% of the market. Overall, the wirehouses control almost three-quarters of the fee-based brokerage accounts market.

Though Merrill Lynch dominates in assets, LPL has the highest concentration of ita fee-account assets in fee-based brokerage accounts due to the success of its SAM program. Overall, nearly half of LPLs fee-account assets are in SAM, while Merrill has only about 25% of its fee-account assets in its Unlimited Advantage program.

Summary

The summary of this chapter of the report is two fold – one, the wirehouses completely dominate the packaged fee-accounts market. In effectively every important product but one, they control something nearing three-quarters of the markets, and their relative futility in mutual fund wrap account assets is due as much to their indifference as to anything else. The packaged fee-accounts market has been the playground of the wirehouses for a long time. Nevertheless, dominance is sometimes a breeding ground for feelings of impenetrability, and in that shadow one emerging competitor group has risen in relative obscurity. Those competitors are the turnkey asset management programs (TAMPs); specifically Envestnet seems to be outgrowing most competitors.