The One FACT About Trading That You NEED to Know NOW » Learn To Trade

Post on: 21 Июнь, 2015 No Comment

The One FACT About Trading You NEED to Know

One of the most important aspects of forex trading that many traders seem to be unaware of is that they should not expect any particular trade to be a winner or a loser. That’s right, it may sound a little strange, but it’s a fact. You see, even if you have a trading strategy that you know has a specific win rate, you still do not know when any given instance of your edge will result in a winning trade or a losing trade. Think about it, if you have a 60% win rate over the last year, do you ever know which trade is going to fall into the 60% winner column and which will fall into the 40% loser column? No. You don’t know, and you can never know, do you know why? It’s because in trading, there is a random distribution of winning and losing trades, no matter what your trading edge is.

Now, this might seem like something you already know, but the fact is that MOST traders do not trade as if they understand or are even aware of the fact that their winning and losing trades are randomly distributed. If you are still a little unclear as to what I mean by “randomly distributed”, it simply means that you never know when you’ll hit a winning trade and when youll hit a losing trade, EVEN IF you are following your high-probability trading strategy to the T. Thus, the outcomes of your trades will be randomly distributed, but if you ARE following your trading strategy to the T, over time, you should be profitable. The key here is ‘over time’, and it’s this part that most traders forget about or have trouble with; they simply don’t have the discipline and(or) the patience to stick with their trading edge and money management strategy over a large enough series of trades to see it become profitable.

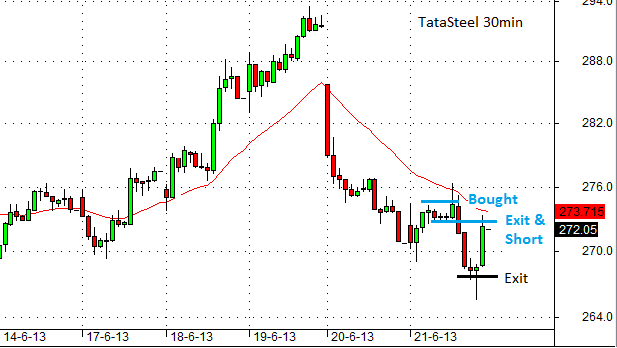

Here’s an example of what a random distribution of winning and losing trades might look like. Note that because the equity curve is increasing over time it means the trading strategy being used is an effective and profitable strategy over a period of time. The implications of this are profound:

The implications of randomly distributed trading results

Perhaps the biggest thing that you need to understand about the FACT that your forex trading results are randomly distributed is that if you REALLY understand this fact and accept it, you would never want to risk more money than you are comfortable with losing on any one trade. This is because traders who understand that they NEVER know when a losing or winning trade will pop up in their distribution of trades, would never behave as though they did.

Traders who risk more than they know they are comfortable with losing on a trade are behaving as if they KNOW they will win on THIS trade. It’s perhaps this attitude and belief that gets traders into more trouble than any other. If you trade in-line with the fact that your trading results are randomly distributed then you would always be consciously aware of how much you are risking and you would always weigh the potential risk reward of the trade before entering, rather than only thinking about the reward.

How your expectations are killing your trading account

You probably don’t enter very many trades and expect to lose on them; in fact, you probably expect to win on every trade you enter. It’s human nature to want to win on every trade you take; after all, we have an innate need to be right and to feel like we are in control. This is why most people are more afraid of flying than they are of driving, even though statistics show that flying is significantly safer; people like to feel like they are in control.

The problem with trading is that you need to release all of your expectations about any given trade, and for most traders this is nearly impossible. When you lose on a trade there are two things that happen; 1) You lose money, and 2) You are wrong about the direction of the market.

We have to learn that both losing money and being wrong about the direction of the market on a trade are both just ‘part of the game’. You need to remember that Forex trading is a business , but the costs are a little different than most other businesses. Your costs are very direct and in your face; losing money and having the market tell you that you were wrong on your trade. You have to learn to ignore these things and not let them make you emotional.

Expectations kill most traders. You have to learn to release ALL of your expectations about any given trade; instead you should have long-term expectations. For example, it’s good to expect to be profitable at the end of the year IF you follow your plan and trade with discipline and patience. However, it’s not good to expect to win on the next trade you take. The reason why it’s not good is because it simply doesn’t matter if you win on the next trade, what matters is if you are being disciplined and only trading when your edge is present and always controlling your risk. If you do those things consistently, you can expect to make money over a series of trades. But, most traders become emotional and up over-trading and blowing out their accounts because they expect every trade to be a winner. When you expect to win on every trade you are like a freight train of emotion heading towards a brick wall of reality; meaning when our expectations are not in-line with reality, we get emotional, and when we get emotional in the markets we lose money!

Real-world examples of randomly distributed trading results

Ok, we have had enough theory; now let’s get into the application of it. I want to go over a few charts of real-world recent examples of price action trade setups. I should first mention that these examples are just to present the point of random distribution and to prove the point that we never know when we’ll hit a winner or loser. I am not saying all these trades would have been taken in reality.

The chart below is the XAUDUSD daily chart, or the spot Gold market. We can see examples of three different price action trade setups that occurred recently in that market. Let’s go over them according to their number:

1: This setup was a large pin bar that formed off a key support level. Even though it was counter trend the setup was still valid and obvious, so this is a good representation of a valid instance of our price action trading edge. This particular pin bar would probably have resulted in a losing trade for most traders as we can see it briefly broke higher and then reversed to just below the pin bar low before forming another pin bar off that same support. Thus, even though the setup was valid and obvious it resulted in a losing trade; the point being that you need to release your expectations of winning on every trade!

2: Another pin bar, this time off the same support discussed in the previous setup; $1530.00 area. This setup was also a large pin bar off a key support, thus it was another valid instance of our trading edge. After briefly retracing to about the 50% level of the pin bar the market then launched higher and provided us with a winning trade. Again, no reason to expect it to be a winner, it was just a winning instance of our trading edge; price action .

3: Next, we can see a well-defined fakey setup that formed with a pin bar as the false-break. This was a well-defined setup that formed off a key resistance level, so certainly it was a valid instance of our price action trading edge. We can see price quickly fell lower and provided us with a nice profit, especially if you would have entered near the 50% level of the pin bar on a 50% retrace entry, one of the pin bar entry techniques I discuss in my price action trading course. All of these setups were valid examples of my price action trading edge, two of them happened to be winners and one happened to be a loser, but there was NO WAY we could have known for sure WHICH ONE would lose and which one would win before they came off.

The chart below is the AUDUSD daily chart. We can see examples of three different price action trade setups that occurred recently in that market. Let’s go over them according to their number:

1: This first setup was a pin bar setup, actually two nice pin bars formed consecutively, so even if you passed on the first one you may have taken the second one since they both formed showing rejection of a key long-term support. We can see quite a large winner could have resulted from these pin bars, depending on your stop placement you could have got a risk reward of 1:3 or 1:4 or maybe more. Again, many people may have ‘expected’ these pin bars to lose since they were counter to the recent downtrend. But the fact is that they were valid counter-trend setups, so we should just set up our trade and then let the market do the work. Don’t expect to win or lose on any one trade, just follow your trading edge and trading plan religiously and know that if you do that you will succeed over a large series of trades.

2: This was a well-defined bearish pin bar reversal setup which would have probably resulted in a losing trade for most traders who took it. Even though this trade lost we should not have become emotional or upset, because we KNOW that our winners and losers are randomly distributed, thus we have no expectations for any one trade .

3: This was a smaller pin bar but it was showing rejection of a solid resistance level and after the huge run higher that had just occurred it would have been a price action sell signal many traders would have taken. We can see the market ended up moving lower but then reversing higher to test the resistance again and this would have stopped most traders out for a 1R loss. So, on this chart we had one big winner that would have netted us 3 or 4R and then two losing trades of 1R each, and as you can see we would still be ahead even though we had no expectation as to which trade would lose and which would win.

The chart below is the EURJPY daily chart. We can see examples of three different price action trade setups that occurred recently in that market. Let’s go over them according to their number:

1: This setup was a long-tailed pin bar that was showing rejection of a long-term support level near 97.00 – 96.00. Note that price moved substantially higher off this pin bar providing us with a very nice risk reward potential.

2: This pin bar setup would have been a losing trade if you entered it at market after the close or on a limit entry near the 50% retrace of the pin. It was valid pin bar since it formed close to key support near 98.70 – 98.50 and had obvious pin bar definition. Still, no reason to expect it to be a winner or loser since we know our trading results are randomly distributed; just follow your plan and when a valid trade setup forms you enter it and then let the market do the ‘thinking’.

3: Next, we can see an inside bar setup that formed just under the resistance near 101.40 in this market when it was range bound recently. Note that this setup came off aggressively to the downside and if you placed your stop near the 50% of the mother bar you would have made a very nice risk reward return, and of this writing this market is still moving lower off that setup.

Stop expecting to win on every trade, and you just might become a winning trader

The reasons why so many people have trouble making consistent money in the markets can essentially be boiled down to the fact that they simply expect too much. Most traders try really hard to control all aspects of their trading, whether they realize it or not. In reality, the market cannot be controlled; all you can do is control yourself. But, it’s more difficult to control our own actions and thoughts than it is to over-trade or risk too much on a trade because you’ve convinced yourself that that ‘this’ trade will be a winner. People convince themselves they are right about their trades; it feels good to think we are right, indeed many traders actually become addicted to the feeling of entering a new trade, even though they have long histories of losing in the market.

You have got to learn to look at yourself as the root of your trading problems. It’s not your broker’s fault, it’s not the market’s fault, it’s your fault you are losing money. and you’re probably losing money because you expect to win on every trade and so you largely ignore the risk involved with trading. People tend to focus way too much on the potential reward of a trade and not enough on the risk. However, as we have already discussed, the potential to win or lose on ANY ONE trade is essentially equal. This is because your winners and losers are randomly distributed, you have to remember this. You can assign an overall winning percentage to your trade strategy over a long series of trades, but you can’t assign a winning percentage to any one specific instance of your trading strategy, this is a difficult concept to grasp at first, but it’s very important. I can help you learn an effective trading edge in my Forex price action trading course. but it’s up to you to understand the points discussed in today’s lesson. You need to understand them as well as trade in-line with them by not becoming emotionally attached to any one trade and by understanding that you can be a profitable trader if you stick to your trading edge and trade it with discipline over a series of trades .

I want you all to re-read this article and really think about its implications on your own trading, then leave me a comment below.