The New World Of Emerging Market Currencies

Post on: 16 Июль, 2015 No Comment

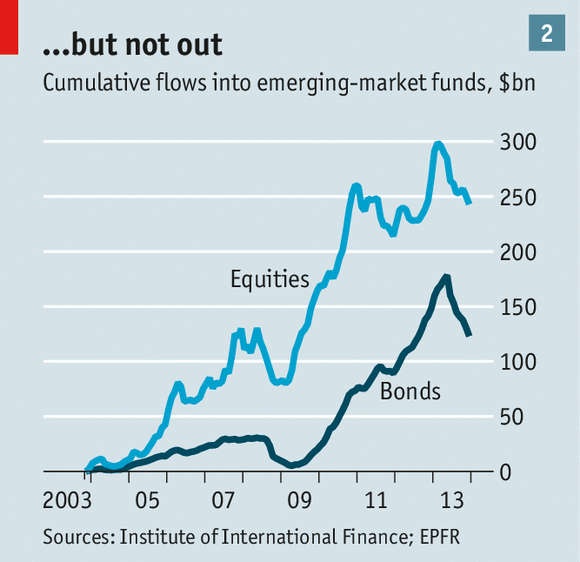

In the shadow of more industrialized economies, interest in emerging market assets has increased in recent years. Although these assets tend to be somewhat volatile, the return is often worth the risk, as emerging market funds have produced higher percentages of wealth than benchmark rates. (For the latest news and information on emerging markets, check out Emerging Market News at Forbes.com .)

Compared to the more domestic S&P 500 benchmark, emerging market fund returns have been higher and varied widely, from as little as 20% to as much as 189%, as managers dove into assets in Hong Kong, Singapore and South Africa. Interest in these emerging economies also spurred demand for the regions’ corresponding currencies: the Hong Kong dollar, Singapore dollar and South African rand. This presents opportunities not only for the hedge fund trader and larger institutional speculator, but also for retail investors, who are also privy to these assets as brokers open up their platforms to include such profitable, yet relatively unknown, currency pairs .

An opportunist’s dream, the emerging market currencies offer plenty of potential for the novice as well as the more tenured trader. These emerging market pairs act very similarly to their G7 counterparts, providing plenty of potential for profitability. Read on to travel through the world of emerging market currencies. (For related reading, see What Is An Emerging Market Economy? )

Emerging Characteristics

Emerging market currencies don’t trade much differently than the more recognized G7 currency pairs. Although these currencies do have some drastic differences, the overview is very similar to the fluctuations in the more common European euro, British pound and Japanese yen trades. Like other major economies, these emerging market economies are dictated by monetary policy as well as political considerations, including both external and internal factors. As a result, retail and novice forex traders can actually carry over the experience they have obtained in the major industrial currencies and apply it to emerging market currency pairs.

Monetary Policy

Monetary policy can be similar between emerging countries, as their economies are continually driven and adjusted by central bank decisions. For example, similarities in policy can be seen in South Africa and Mexico. In fact, the only noticeable nuance between the two is the institution of a trade weighted system. This simply means that the currency is stabilized against a basket of currencies that is issued by the biggest trade partners of the country. The creation of the basket helps to isolate the usually free floating or managed floating currency from wild speculative fluctuations that can wreak havoc on a country’s currency and its economy. In South Africa, the Reserve Bank of South Africa very loosely institutes this rule, allowing the South African rand to float freely versus other major currencies like the euro and U.S. dollar.

In order to protect the wild fluctuations in the market, a trade-weighted basket is instituted to back the currency. Recently, the central bank has loosened the policy considerably as interest rates have become a more focused concern for the markets. However, with considerations in consumer and producer prices, along with overall industrial production, the South African central bank tends to rule in favor of rate hikes or cuts, much like U.S. Federal Reserve Chairman Ben Bernanke, in adjusting the benchmark interest rate. The same is applied in Mexico, where the governor makes adjustments in the corto (central bank rate) at monthly meetings. (For more insight, see Formulating Monetary Policy .)