The head and shoulders pattern_1

Post on: 24 Май, 2015 No Comment

The head and shoulders pattern

By Tyler Yell. Forex Trading Instructor

Article Summary: The head and shoulders pattern is a price reversal pattern that helps you

identify when a big reversal may be underway after a trend has exhausted

itself. The Head & Shoulders is currently shaping up on many EUR crosses in an inverted fashion which could pave the way for large moves higher. Head and shoulder patterns are complex in structure but easy in recognition which can help new and experienced traders’ a like jump in on the beginning of a new trend with well managed and defined risk.

What could be easier to recognize than the head and shoulders of a friend? It’s an odd question to start a trading article with but it’s meant place you into the mindset of how easy the recognition of this pattern can be. Identifying the Head & Shoulders reversal pattern on the chart will be just as easy to recognize as a dear friend once you’re finished with this article.

What Is A Reversal Pattern?

Reversal patterns appear after a trending market has lost its steam. Reversal patterns can be as simple as a trendline break or a little more complex like a Head & Shoulders pattern. Although reversal patterns often take a while to develop, once they are completed and the signal is generated you can find yourself on the front of a big move. What many traders enjoy about the Head & Shoulders pattern is the clear rules that follow entries and exits.

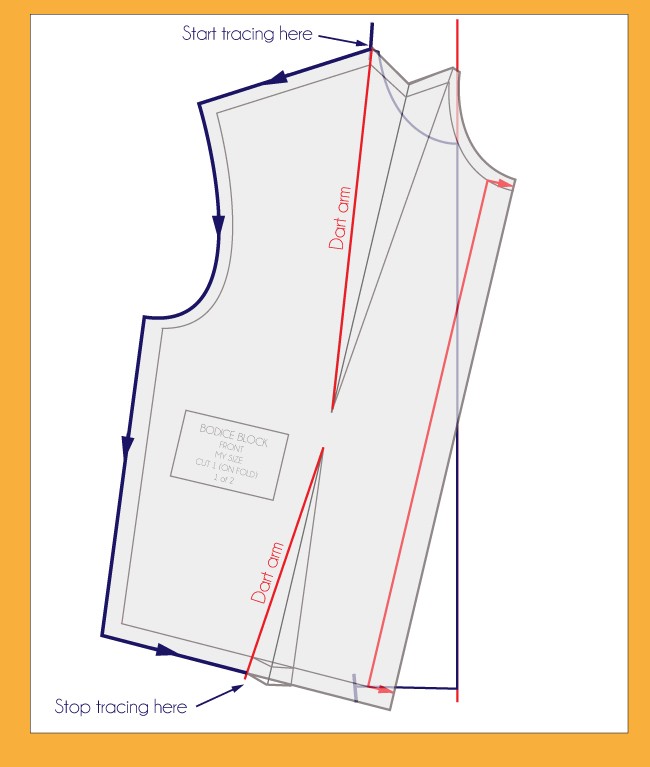

Learn Forex: Head & Shoulder and Inverted Head & Shoulders are Easy to Recognize & Powerful Too

Figure 1 — (Created using FXCM Marketscope 2.0)

How To Recognize The Pattern & What Does It Tell You About Potential Moves?

When viewing a price chart, a Head & Shoulders pattern will have the appearance of two shoulders and a head. In reality, you’re seeing three attempts or dives at a trend continuation that has failed. When three attempts of continuing a trend fail, then you can find yourself at the beginning stages of a reversing trend as the prior traders are likely exiting the trade as price is refusing to reach the new highs in an uptrend or lows in a down trend that they were expecting.

Why Should You Use The Head & Shoulders Pattern?

The Head & Shoulder pattern uses two simple concepts that any new trader can recognize. The two concepts are the three peaks with the middle peak being the greatest (the head) and the trendline which we call the neck line that offers a signal as to when we should enter the trade. The other benefit is that the Head & Shoulders Pattern can be used equally well in both up trending and down

trending markets.

What Is The Difference Between The Bearish and Bullish Head & Shoulders Pattern?

The Bearish Head & Shoulders (Figure 1) pattern looks like a normal head and shoulders with the middle peak being the highest price and the trendline at the base of the pattern as our entry

to sell if price breaks below. The Bullish Head & Shoulders (Figure 2) pattern is an inverted head & shoulder with the middle inverted peak being the lowest price with the trendline at the top of the

pattern. The trendline or neck acts as our signal to buy should price break above.

How Do You Trade The Head & Shoulders Pattern?

The recommended method to trade this pattern is to wait for pattern completion and enter upon a break of the trendline or neck line. Once the neckline has been broken, you can set a stop exit order

just below the neckline or preferably, above or below the previous shoulder depending on the direction. The reason for the shoulder based stop is that the pattern would be nullified if this point is broken and on the Head & Shoulder assumption, you would no longer want to be inthe trade.

(Created using FXCM Marketscope 2.0)

Closing Thoughts on Trading the Head & Shoulders Pattern

The Head & Shoulders reversal pattern is historically reliable and easy to recognize and should be utilized by new and experienced traders. You should wait to enter the trade until the pattern is completed with price breaking through the neckline. Once price breaks, you can expect a pull back so it is recommended to set your stop below the recent shoulder. Common profit targets are set at an equal distance from neckline to head and from neckline break in the direction of the reversal. However, you can set your profit target based on your goals and risk profile.

—Written by Tyler Yell, Trading Instructor