The FourHour Trader A Full Trading Plan

Post on: 9 Июль, 2015 No Comment

Talking Points:

- Traders can implement a well-heeled plan taking only four hours per week The four-hour chart can be ideal for Forex Traders looking to trade around the clock We outline a full plan based around Price Action that traders can begin using today

All of the sudden, the world has gotten very small; and life is moving faster than ever before.

The internet presents a lot of benefits to the human species; but time management is not one of them. As competition for page views, viewer numbers, and attendance continues to heat up, very little in this life emphasis a slow and steady approach.

But to the trader, in many cases, that is the best way to go about speculation in markets: Slow, steady, and consistent.

But being there as a trader, and getting there as a new speculator are completely different markets. In this article, were going to outline a complete trading plan that will take less than four hours of a traders time each week. And further, this is an approach that can be focused on longer-term moves, and swings.

If you have a day job, or any other pre-existing commitments that limits your time on charts, this is an approach that can offer quite a few benefits.

The Center of the Approach

The 4-hour chart plays a special role in the FX market.

Most equity markets are open between 8 and 9 hours each day, and as such, the four-hour chart might take on less importance. After all, a four-hour chart just shows two bars for each trading session, so traders might as well just look at the daily chart.

But in the Forex market, the four-hour time frame takes on special importance. The market never closes, and traders are literally Trading the World. The four-hour candle represents half of each geographic trading session. Each of these sessions can take on markedly different tones, and that is where traders can look for potential opportunities.

In the FX Market, traders are truly Trading the World

Traders can use the price movements and gyrations on these four-hour charts to analyze markets, and find potential pockets of opportunity.

Watch for the close of each 4-hour candle that you can. Using the New York close to define financial time means that were seeing candles close at 5, 9, and 1 AM and PM (based on ET). If youre using Central Time, thats 4, 8, and 12 AM/PM while Pacific Time is 2, 6, and 10 AM/PM.

If youre busy at the time, Mobile Applications can generally offer you what you need to perform the analysis at the close of each of these candles.

Traders can then take a ten-minute block of time upon the close of each of these four-hour candles to look for potential trade setups, while also using this as an opportunity to manage risk.

If the trader is awake for four of the six four-hour candles that form each day that would mean that the trader would need approximately 40 minutes per day to analyze charts. If time permits, an additional 10-15 minutes can be used at or around the daily close.

The total time commitment required is 40-50 minutes each day, for a total of 200-250 minutes per week (240 minutes is 4 hours).

Use Price Action to locate the strongest trends

Weve looked at how incredibly important price action can be to traders, and in Four Simple Ways to Become a Better Price Action Trader. we walk through how easily the art of technical analysis can be performed without the necessity of indicators.

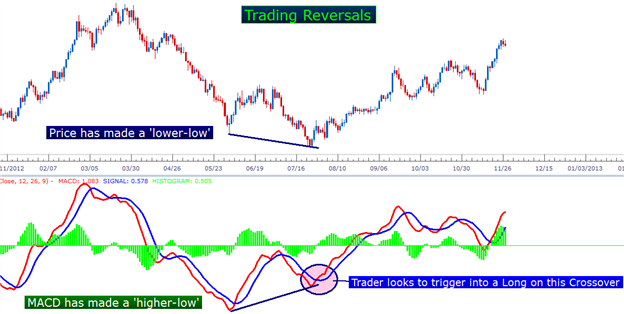

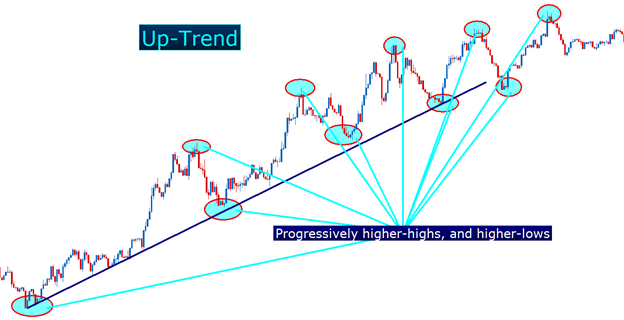

Trends in markets can be easily graded and seen with price action by simply looking for charts to make progressively higher-highs, and higher-lows (in the case of an uptrend), and lower-lows, and lower-highs (for downtrends).

Price Action can help traders locate the strongest trends

Higher-highs and Higher-lows denote an up-trend per Price Action

In the article Price Action, an Introduction we look at a way that traders can grade trends without the use of any indicator at all, using just past prices.

Traders want to look to trade in the direction of these trends; buying up-trends, and selling down-trends. But, is it enough to just buy up-trends or sell down-trends and hope that they continue? No. Traders can use price action to appropriate their entries into these positions.

Use Price Action to buy up-trends cheaply, and sell down-trends expensively

Once a strong trend has been located, the trader can then look to plot their entry by looking for a trigger into the position via price action.

Once again, traders want to look to efficiently buy up-trends when price is cheap, or near support. We looked at how traders can find this support in the article, Price Action Swings.

Traders can look to buy up-trends after a recent swing low

Traders buying up-trends can wait for a higher swing low to form before entering

Traders can look for additional confirmation of the entry by looking to the price action candles that form at or around those swings.

We looked at quite a few of these triggers in Trading Bearish Reversals (for down-trends). and The Hammer Trigger for Bullish Reversals (for up-trends).

Traders can look for bullish triggers at or around recently printed new lows

Use Stops and Limits to Enforce Favorable Risk-Reward Ratios

We talk about this a lot at DailyFX, and there is a reason for it: Its important!

One of the main premises of our price action education is that future prices are unpredictable, and as such, there is no such thing as a holy grail or cant lose strategy. In the Traits of Successful Traders, The Number One Mistake that Forex Traders Make was found to be sloppy risk-reward ratios.

We examined this topic, in depth, in the article How to Identify Positive Risk-Reward Ratios with Price Action.

Traders can trigger positions with a set stop and limit order

By adding a stop and limit, and letting the trade work the trader eliminates the possibility of making a knee-jerk reaction that they may end up regretting. It also enforces a favorable risk-reward ratio, and puts traders in the most promising spot to avoid the number one mistake that Forex traders make.

Trade Management

Since traders are looking at their charts for each four-hour bar, they have built-in trade management for each position that they take on.

Traders can use the close of each four-hour candle as an opportunity to adjust stops ( particularly the break-even stop ), or to take profits while also looking to trigger new positions.

Traders can take this a step further by trailing their stop in an effort to lock in gains in the event that the trend gets especially built-in. We looked at this premise in Trading Trends by Trailing Stops with Price Swings.

Traders can lock up gains to maximize trends

Created with Marketscope/Trading Station II

— Written by James Stanley

James is available on Twitter @JStanleyFX

To join James Stanleys distribution list, please click here.

Would you like to get better with Price Action? Please feel free to take our 15 minute course on the topic. Youll first be asked to sign the guestbook, which is completely free; and then you will be met with the video-based lesson via Brainshark.

Weve recently begun to record a series of Forex Videos on a variety of topics. Wed greatly appreciate any feedback or input you might be able to offer on these Forex videos:

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.