The Beginners Guide to Your Forex Tools Indicators and Price Action

Post on: 4 Май, 2015 No Comment

The Forex trader has a wide and complex variety of tools, indicators and price charts to their disposal. The choice is almost limitless and at times can be overwhelming to grasp. Questions start to balloon in our minds quicker than we can write:

What tools are the best trends? What indictors work best to identify reversals? Would a moving average work well as a filter? How would the Bollinger Band be best used? Can I mix tools and indicators to create a plan?

Forex traders are faced with tough choices when they start their FX trading career. Also experienced traders at times struggle to find the right answers and balance. In today’s post we explain why tools and indicators are important, how they can be used, what are the dangers, and explain the various types of tools and indicators.

THE IMPORTANCE OF TOOLS AND INDICATORS

A tool is an object on the chart which is manually placed each time by the Forex trader. Tools are often static and eventually removed from the chart when they are not useful anymore. For instance, when price is far away from a trend line then the value of keeping the tool is gone. Read here for more details on the relevance of a trend line tool here .

An indicator is an object on the chart which is automatically adjusted every new bar or candle (only of course after the trader chooses the indicator on the platform). Indicators are therefore dynamic and can stay on the chart forever, unless we decide to remove them.

Tools and indicators are very useful

They are useful in identifying trend, opportunity, filters, trigger, entry (TOFTEM ) and exits. They can assist in acting as an alert, providing a confirmation or assisting in predictions.

Tools and indicators help with:

- Identifying the trend, consolidation, and reversals;

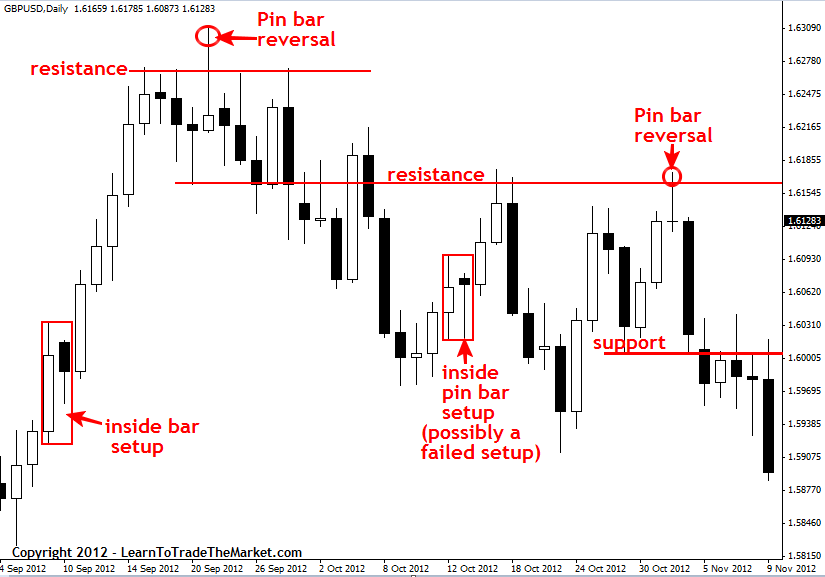

- Spotting support and resistance;

- Finding candlestick patterns, chart patterns, momentum and correction.

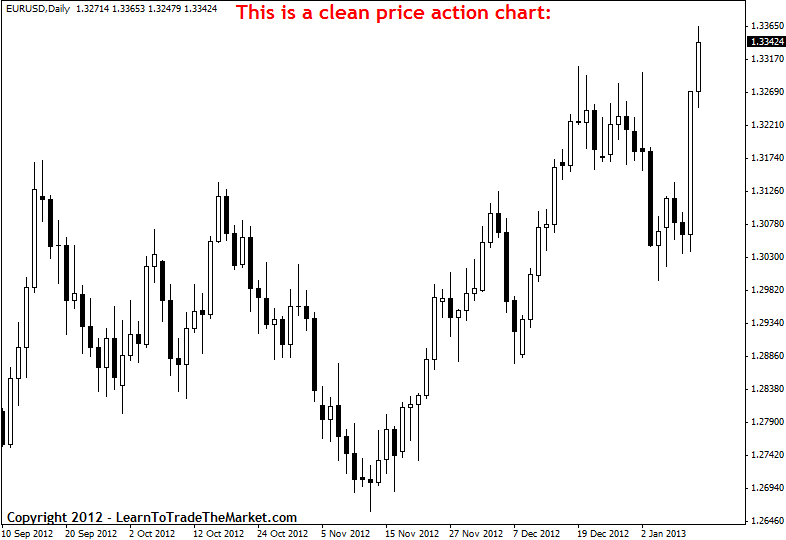

It is extremely important to make a balanced approach between price action, indicators and tools. otherwise you might quickly encounter problems (see warnings below).

Warning #1: use tools & indicators with caution

Tools and indicators can become addictive. Very addictive! Make sure that you do not become obsessed with them. Yes they are cool and can be helpful but they are not perfect. Also be careful not to run into the trap of paralysis of analysis, where too many indicators and tools clutter the chart and leave you clueless.

Practicing endless with tools and indicators could be considered a fun hobby but not a profitable business.

Warning #2: do not search for the perfect setup

Tools and indicators offer the hope of finding the perfect setup which can never fail. Unfortunately I have to burst the bubble: perfect 100% winning setups do not exist. Nothing is that perfect. Stop searching for them, now.

Searching for a perfect setup is a mirage and a figure of our imagination.

Warning #3: be cautious of bias

Did you ever test an indicator in the past and you saw great results while using it, but results were just disastrous when you traded it live? Almost everyone has gone through this process. Apparently the human brain is focused on confirmation and as we test an indicator, it is ‘natural’ to skip bad setups and see only the good ones.

Do not let you trick or foul yourself into believing that 1 indicator or tool is perfect and always works.

Warning #4: choose something that’s simple – and then don’t break the rules

Yes fancy and shining indicators could seem cool at first but be cautious when the ‘honeymoon’ period between you and your favorite indicator ends and you find out that you understand it. Remember, the indicator is only an aid or support, not a crutch. As traders we should work with things that are simple and understandable. Once we find them, then stick to it and follow the rules .

Do not fall in the trap that complicated is better or more profitable.

TOOLS AND INDICATORS SUMMARY

Examples of tools are trend lines, trend channels, Fibonacci retracement, Fibonacci target, Fibonacci expansion, Gann tools, horizontal levels, support and resistance zones, and even a pitch fork.

Examples of indicators can be divided into groups such as: volume, oscillators, trend following, custom made indictors. Oscillator examples could be the MACD and RSI. Trend examples could be the Bollinger bands and moving averages. Custom made indicators include Winners Edge’s own Strike Trader.

Read more here for a thorough account of potential indicators and tools. Remember, it is not the indicator itself but how we use it that will ultimately lead to losses or profits.

At the end of the day success is achieved by a trader’s capability of setting up a profitable trading plan with tools, indicators, price action or any other method followed by a trader’s discipline and patience in implementing it.

The best trading plans often have a well balanced mixture of candle stick patterns, price action, a trend indicator, and horizontals lines for support and resistance. Read more via these links how to use tools and indicators in your trading plan:

Are you just starting out in Forex? What topics do you need help on?

Do you have more experience in Forex trading? What tool or indicator do you find the most valuable?

Tim in fact shared his opinion on the matter – you can read his view via the following link.

Let us know down below in the comments section!

Thanks for sharing, Happy Hunting and wish you a great weekend!