The Australian Dollar What Every Forex Trader Needs To Know

Post on: 3 Июль, 2015 No Comment

Foreign exchange, or forex, trading is an increasingly popular market for investors and speculators. The markets are huge and liquid, trading occurs on a 24-hour basis, and there is enormous leverage available to even a small individual trader. Moreover, it is opportunity to trade on the relative fortunes of countries and economies as opposed to the idiosyncrasies of companies.

Despite many attractive characteristics, the foreign exchange market is vast, complicated, and ruthlessly competitive. Major banks, trading houses and funds dominate the market and quickly incorporate any new information into the price and it is all but impossible for a currency trader to know who they are trading with at any particular moment.

Foreign exchange is not a market for the unprepared or ignorant. To effectively trade foreign currencies on a fundamental basis, traders must be knowledgeable when it comes to the seven major currencies. This knowledge should include not only the current economic stats for a country, but also the underpinnings of the respective economies and the special factors that can influence the currencies. (The pound is one of the world’s most popular traded currencies, and is heavily impacted by these factors. Check out 5 Reports That Affect The British Pound .)

Introduction to the Australian Dollar

Australia is not an especially large country, and as of 2009 it was number 13 in the world in terms of GDP and less than one-tenth the size of the United States, number 50 in terms of population and number 19 in terms of the value of its exports. Nevertheless, the Australian dollar is one of the five most frequently traded currencies in the market. Interestingly, the Aussie dollar has only been a free-floating currency since 1983.

Australia owes its popularity among currency traders to 3 G’s – geology, geography and government policy. Geology has given the company a wealth of natural resources that are in high demand, including oil, gold, agricultural products, diamonds, iron ore, uranium, nickel and coal. Geography has positioned the company as a choice trading partner for many fast-growing Asian economies with nearly insatiable resource demands. Government policy has led to fairly stable high interest rates, a stable government and economy, a lack of intervention in the currency markets, and a Western approach to business and the rule of law that has not always been typical in the region.

Each of the major trading currencies in the world is controlled (or at least strongly influenced) by the central bank of the issuing country. In the case of the Australian dollar it is the Reserve Bank of Australia (RBA). The RBA is a rather conservative institution, and it has not made a habit of very frequent interventions in the currency market. Moreover, while almost all reserve banks have a mandate to control inflation, the RBA takes it rather seriously, and Australia frequently has some of the highest interest rates in the developed world.

That said, even those relatively high rates were not enough to prevent a housing bubble in Australia. It is also worth noting that the RBA is often challenged by the unpredictability of the commodity cycle and its impact upon the county’s trade balance and capital account .

The Economy Behind the Australian Dollar

In terms of GDP (measured in U.S. dollars), Australia is well down the list among the major currencies, with the 13th-largest economy. Among the developed countries, Australia strands out for its heavy reliance upon commodities. Mining (including energy) represents over 5% of country’s GDP, with a heavy emphasis on nickel. Farming is also a critical component, as around 12% of the GDP is tied to agriculture (and related sectors), with a large percentage of the output going outside the country.

Australia’s resource wealth has not had a universally positive impact on the country’s economy. Even with a policy of economic liberalization dating back to the early 1980s, Australia has never managed to develop a thriving domestic manufacturing sector. Instead, the country has a large current account deficit and a rather high level of foreign debt. Australia has also suffered its own national housing bubble, and Australia sports some of the highest interest rates in the developed world. (Knowing the factors and indicators to watch will help you keep pace in the competitive and fast-moving world of forex. Refer to Economic Factors That Affect The Forex Market .)

Drivers of the Australian Dollar

Economic models designed to calculate the right foreign currency exchange rates are notoriously inaccurate when compared to real market rates, due in part to the fact that economic models are typically based on a very small number of economic variables (sometimes just a single variable like interest rates). Traders, however, incorporate a much larger range of economic data into their trading decisions and their speculative outlooks can themselves move rates just as investor optimism or pessimism can move a stock above or below the value its fundamentals suggest.

Major economic data includes the release of GDP, retail sales, industrial production, inflation. and trade balances. These come out at regular intervals and many brokers, as well as many financial information sources like the Wall Street Journal and Bloomberg, make this information freely available. Investors should also take note of information on employment, interest rates (including scheduled meetings of the central bank), and the daily news flow – natural disasters, elections, and new government policies can all have significant impacts on exchange rates.

With Australia, though, there are other factors that also need watching. Australia’s economy is driven by commodities (both metals and grains), and reports on crop planting, weather, harvests, mine output and metal prices all can move the Aussie dollar. Fortunately, this data is not hard to find – Australia’s Bureau of Agricultural and Resource Economics and Sciences (ABARES) produces regular reports that are freely available on the internet.

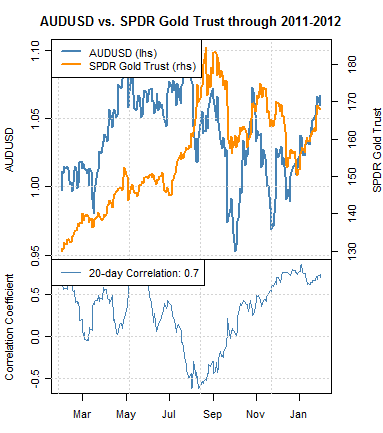

Along those lines, the strength of the Aussie dollar is closely tied to its exposure to Asia and the commodity cycle, as well as a somewhat counter-cyclical position relative to the currencies of other major currencies. The demand in China, India and to a lesser extent Japan, for natural resources has pushed the Aussie dollar up in past cycles, only to fall later as commodity demand wanes.

Generally speaking, higher commodity prices create recessionary (or at least inflationary) pressures in most developed economies. So when high resource prices lead traders to concerns for the health and growth sustainability of economies in Europe, North America and Japan, the Australian economy usually looks healthier. That positions the Australian dollar as a popular alternative for traders looking to go long on commodity exposure and/or Asian resource demand, while going short on countries likely to suffer due to higher input costs.

Unique Factors for the Australian Dollar

Controlling interest rates and inflation in Australia is also complicated by the country’s very heavy reliance on commodities and relatively small domestic industrial base. This has led to large and persistent current account deficits for most of Australia’s post-World War 2 history. Though Australia’s debt is not large as a percentage of GDP, increases in government spending are putting this on the table as a potential concern.

Australia’s currency is also uncommonly counter-cyclical and volatile. Most of the major developed economies trade in tandem with each other (due at least in part to the extensive trade linkages between them), but Australia’s economy is different. Australia produces relatively little in the way of manufacturing exports and most of the country’s exports go to the growing economies of Asia. That said, while Australia enjoys a certain degree of independence from the other major world economies, its health is much more closely tied to the price of commodities and the volatility there has created a great deal of volatility in the currency in the past.

Carry Trade

Australia is often the other half of carry trades originated in Japanese yen. Because Japanese interest rates are so low, Australian rates are so high, and the regions more or less overlap in terms of time zones, Australian dollar-denominated assets have been attractive holdings for carry traders. Because of that linkage, speculation about interest rate moves in either country can have a disproportionate impact on the currency. (This strategy can provide returns even if the currency pair doesn’t move a cent. Check out Currency Carry Trades 101 .)

Regional Factors

Australia often stands out in its region for its exceptionally stable government and its generally pro-business environment. That said, the rise of China is impacting Australia’s role in the region; China is a more viable destination for investors in Southeast Asia who wish to move assets outside their home countries. China and India also have significant impacts on Australia’s trade and economic performance. India and China are both large importers of commodities produced in Australia and Australia in turn is a large importer of machinery and consumer goods produced in those countries.

The Bottom Line