The 3 Step Range Trading Strategy

Post on: 16 Апрель, 2015 No Comment

Talking Points:

- Range strategies are used when the market lacks direction Find support and resistance to define your range As with any strategy manage your risk in the event of a breakout

Range trading is one of many viable trading strategies available to Forex traders. These strategies are generally associated with lack of market direction and can be a handy tool to have in the absence of a trend. At its core, range trading strategies can be broken down into three easy steps!

Find The Range

The first step of range trading is to find the range. This can be done through the establishment of using support and resistance zones. These zones can be created by finding a series of short term highs and lows and connecting the areas using horizontal lines. Resistance is the overhead range where we will look to sell a range, and support is the area where price is held up with traders looking to buy the market.

Below we see an example of a trading range on the Dow Jones FXCM US Dollar Index on a 4Hr chart. The US dollar is currently trading near the marked zone of resistance which begins near 10,5800 Now that price has crossed into this area, range traders will need a plan to enter into the market and sell towards support.

Learn Forex: US Dollar Range

(Created using FXCMs Marketscope charts)

Time Your Entry

Traders can time range based entries using a series of methods. One of the most popular and simplest ways is through the use of an oscillator. Some of the most popular oscillators include RSI, CCI, and Stochastics. These technical indicators are designed to track price by a mathematical calculation which causes the indicator to fluctuate around a centerline. Traders will wait for the indicator to reach an extreme as price reaches a zone of support or resistance. Then execution will occur in the event momentum turns price in the opposing direction.

Below we again can see the US Dollar, this time with the CCI indicator added to the graph. To trade the range, traders wait for CCI to reach an extreme as price test the 10,580 line of resistance. Traders may enter the market as CCI moves back from overbought values!

Trading with oscillators may be new for some traders. For more information on CCI be sure to take advantage of DailyFXs training course through Brainshark. The course is free and after clicking the link below sign into our Guestbook. You will be met with a series of videos including other strategies involving the CCI Indicator!

Learn Forex: Overbought & Oversold with CCI

(Created using FXCMs Marketscope charts)

Manage Risk

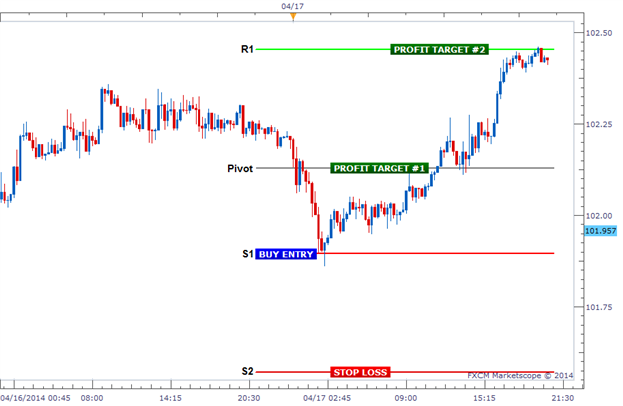

The Last part of any successful range based strategy is to manage risk. In the event a level of support or resistance breaks, traders will wish to exit any range based positions. The easiest way to do this is through the use of a stop loss above the previous high when selling the resistance zone of a range. The process can be inverted with a stop below the current low when buying support.

Areas to take profit are just as easy to find when range trading. If selling a range, limit orders to take profit should be placed down near support. Likewise, when buying support, take profit orders should be placed at previously identified resistance. Below we can see a completed setup on our example with the US Dollar. As an order to sell resistance, a stop order is placed over the current high. A limit order has been placed to take profit near support at 10,500.

Learn Forex: Stop & Limit Placement

(Created using FXCMs Marketscope charts)

As you can now see trading ranges can be a straight forward three step process. When you are ready to practice your range trading skills, register for a Free Forex Demo account with FXCM. This way you can become comfortable with the market and finding range trading setups in real time!

—Written by Walker England, Trading Instructor

To contact Walker, email wengland@fxcm.com. Follow me on Twitter at @WEnglandFX.

To be added to Walkers e-mail distribution list, CLICK HERE and enter in your email information

New to the FX market? Save hours in figuring out w hat FOREX trading is all about. Take this free 20 minute New to FX course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HERE to start your FOREX learning now!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.