Technical Analysis 101 EXPLOITING THE STOCHASTICS

Post on: 26 Июнь, 2015 No Comment

Real time trade alerts made in OUR VERY OWN ACCOUNTS sent to you in REAL TIME with daily updated technical charts & trading plans issued DAILY to members

EXPLOITING THE STOCHASTICS INDICATORS

April 12, 2013 6.13 AM — New York NY

T he Stochastics indicator is a popular indicator of the Oscillator family of

technical indicators that we exploit. George Lane created the Stochastics

oscillator when he observed that, as markets reach a peak, the closing prices

tend to approach the daily highs, and vice-versa. The Stochastics indicator is said

to be leading since it generates signals before they appear in pricing behavior.

As PRO Traders we use the indicator to determine overbought and oversold

conditions and the beginnings and endings of cycles in the stock market.

The Stochastics indicator is classified as an oscillator since the values fluctuate

between zero and 100. The indicator chart typically has lines drawn at both the

20 and 80 values as warning signals. Values exceeding 80 are interpreted

as a strong overbought condition, or selling signal, and if the curve dips below

20, a strong oversold condition, or buying signal, is generated..

Introducing Technical Analysis 101 by DayTradersGroup.com

The Stochastics indicator is common on most stock trading softwares, and the calculation formula sequence involves these straightforward steps:

Stochastics consist of two lines formed by %K and %D;

Choose a period N for %K, X for %D (Standard settings = 9,3);

%K = 100 * (CCL LN)/(HN LN) where CCL = Current Closing Price, LN = lowest low of past N periods, HN = highest high of past N periods;

%D = 100 * (HX /LX) where HX = X-period sum of (CCL LN), LX = X-period sum of (HN LN).

The Stochastics indicator is composed of two fluctuating curves the Green %K line, and the Red %D signal line. Forex traders prefer a slower version of this indicator because

they believe the signals are more accurate. For Slow Stochastics, %K becomes the old %D line, and the new %D is derived from the new %K. The chart above is the slower version, a

setting selection on the charting platform of your choice. The Stochastics oscillator is viewed as a leading indicator, in that its signals foretell that a change in trend is imminent,

especially when lines cross into extreme regions. The weakness in the indicator is that it is difficult to discern how long in advance the signal truly is.

The Slow Stochastics oscillator with settings of 9, 3, 3 is presented on the bottom portion of the above 15 Minute chart for the AUD/USD currency pair. In the example above, the

Green line is the Stochastics %K value, while the Red line represents the %D signal line that acts like a moving average. Stochastics values below 20 and over 80 are worthy of

attention.

Welcome to the Stochastics Rollercoaster

The key points of reference are highpoints, lowpoints, divergences, and occasionally crossovers. The slow Stochastics Rollercoaster tends to be more sensitive and is favored by

PRO traders. The Stochastics oscillator attempts to convey pricing momentum direction changes. Typical oversold and overbought conditions are noted on the chart, and line

crossings confirm these trading signals. Divergences are also important as seen in the noted overbought condition. Prices are reaching new highs, but the Stochastics are already

receding from previous highs, a sign to sell or short.

As with any technical indicator, a Stochastics chart will never be 100% correct. False signals can occur, but the positive signals are consistent enough to give a forex trader an edge.

Skill in interpreting and understanding Stochastics signals must be developed over time, and complementing the Stochastics tool with another indicator is always recommended for

further confirmation of potential trend changes.- A great indicator to confirm a signal is the RSI or the ADX

In the next article on the Stochastics indicator, we will put all of this information together to illustrate a simple trading system using this Stochastics oscillator.

Setting the correct parameters are essential to your trading success If you havent already, we suggest that you check out the above article about the Stochastics Indicator, we have

covered the background, the calculations involved, and how to use and read the Stochastics indicator. The Stochastics indicator is said to be leading since it generates signals

before they appear in pricing behavior. Traders use the indicator to determine overbought and oversold conditions and the beginnings and endings of cycles in the stock market.

Pro traders focus on the Stochastics key points of reference, which are highpoints, lowpoints, divergences, and occasionally crossovers. As with any technical indicator, a Stochastics

chart will never be 100% correct in the signals that it presents, but the signals are consistent enough to give a forex trader an edge. Skill in interpreting and understanding

Stochastics indicator signals must be developed over time. In the example below, lets develop a simple trading system based on Stochastics signals and alerts.

Our trading system is for educational purposes only. Technical analysis takes previous pricing behavior and attempts to forecast future prices, but, as we have all heard before, past

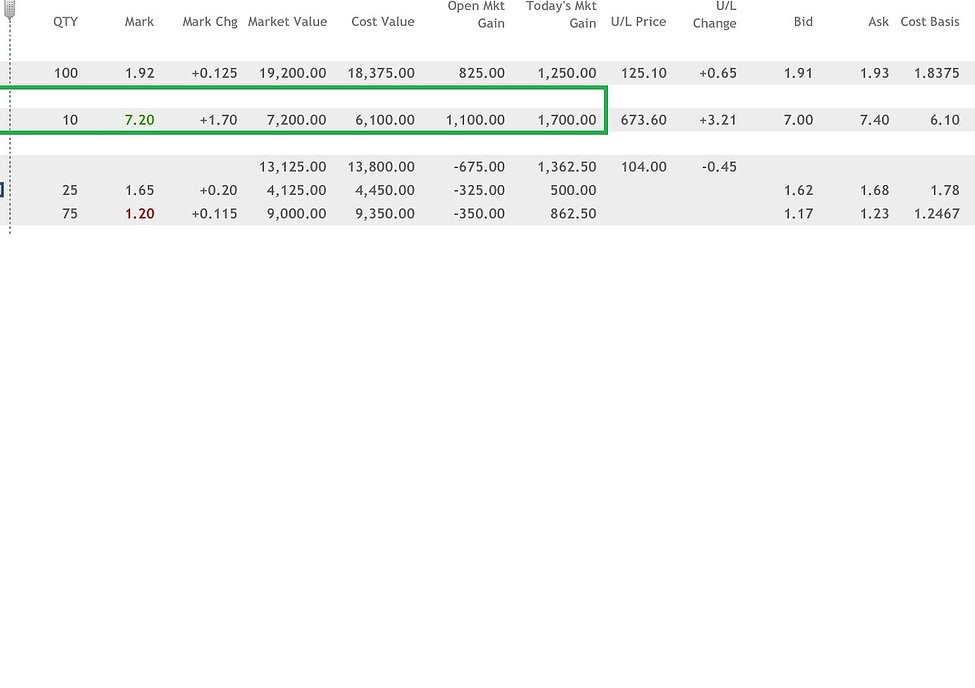

results are no guarantee of future performance. With that disclaimer in mind, the Green circles on the above chart illustrate optimal entry and exit points for a short-selling strategy

using Stochastics analysis in combination with the divergence noted at key decision points (Stochastics are moving counter to pricing behavior).

Determine your entry point after the Green Stochastics line crosses the upper extreme, diverges from pricing behavior, and the Red lines also crosses in an upward fashion;

Execute a Buy order for no more than 2% to 3% of your account;

Place a stop-loss order at 20 pips above your entry point;

Determine your exit point after the Green Stochastics line dips below an extreme lower value and is crossed by the Red line in a downward motion (delay closing the position if

divergence is noted).

Steps 2 and 3 represent prudent risk and money management principles that should be employed. This simple trading system would have yielded two profitable trades totaling 85

pips, but do remember that the past is no guarantee for the future. However, consistency is your objective, and hopefully, over time, Stochastics Technical Analysis will provide you

with an edge. To get an edge navigating the market do what some of the largest hedge funds on earth do, they hire this market timing technician