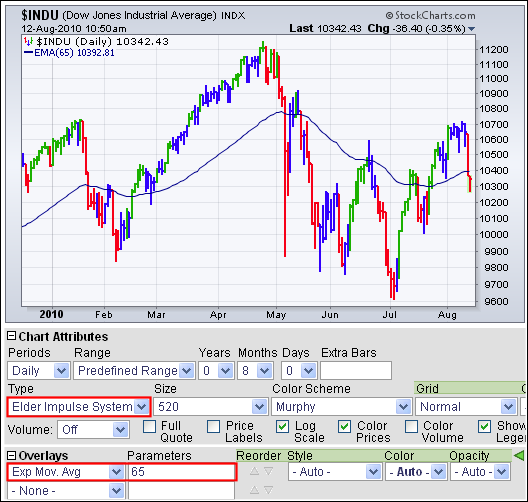

System of three screens Elder

Post on: 20 Август, 2015 No Comment

strategy set of three screens

most simple, understandable and logical trading system was developed by an American trader, fondovikom Alexander Elder to play in the stock and commodity markets, but in many cases it can be successfully applied in the foreign exchange market. The basic principle of this system is the market analysis on three time scales, and therefore it is called a system of triple screen — you build a schedule 3 and consistently analyze them.

How does the choice of time scales for the analysis of each screen:

first selects the average screen — that this time scale, which corresponds to the duration of the preservation of the most opened position. For example, if you plan to maintain an open position for several days or even weeks, the average screen is given daily charts — dnevki, where each candle — one day. If the deal will last for several hours or on the strength of 4-7 days, it is better as a middle screen to select the time schedule.

then selected long-term and short-term scale, that an order of magnitude different from the mean for the average screen dnevok are, respectively, weekly and hourly charts.

analysis in the triple screen starts with a long-term schedule. The system refers to the trend, and the first problem, which is worth it — the basic definition of long-term trend in the direction of which is worth playing, and his condition — a beginning, middle or end. Accordingly, on this chart is necessary to use trend indicators, the main one being the MACD-Histogram. The trend is determined by the last two lines or points of histograms: a rising bar chart when the last point above the previous one, shows an upward trend, downward histogram indicates the need to play to sell.

Please note that:

- rotate or decline says about the end of the histogram and the trend is going.

- turns up, occurring below the zero line, give stronger signals to buy, what turns above the line.

- turns down occurring above the zero line, give stronger signals to sell, what turns below the zero line.

is recommended to use several indicators of trends to avoid false alarms.

basic rule:

play only in the direction of the trend identified in the first long-term screen.

On the second screen average is necessary to identify the movement against the major trend — the wave that runs against the current. It’s like yellow lights — need to start preparing for the transaction, a reversal of the trend correction will point to the possibility of buying or selling. In the main uptrend on the first screen, for example, the weekly chart, daily declines point to the possibility of purchase, at a weekly downtrend daily ups indicate the potential for sales at the end of the identified correction.

On the second screen to use signalers such as RSI, Stochastic, etc. Here:

- buy signal sounds when the first screen of the trend is up, as a signalman on the second screen, such as RSI, has fallen below the oversold line 20% and is beginning to recover;

- sell signal sounds when the first screen of a downward trend, but the RSI is on the second screen up above the overbought 80% and begins to fall.

third screen is not even a timetable — this method of placing orders to buy or sell depending on the location of indicators for the previous two graphs. Elder calls it moving the order.

So:

- If the main trend is up, and adjustment — down, then moving to buy signals capture the moment of the top breaks a resistance level. The method of moving about the purchase order is triggered when, for example, the screen for long-term weekly trend is up, as a signalman on the second day the screen is falling. Place an order to purchase a little above the previous day. With the rise in prices to buy position should be opened as soon as the price rises above the crest of the previous day to put up the level. If prices continue to decline, it will not affect the order of purchase. Then lower the order the next day at one tick above the last high prices. Continue down the order on every purchase, until it is touched, or until a light week, turning down, do not cancel the signal of the purchase.

- if the primary trend is down, and correction — up and moving sell signal capture time of the lower support level breaks. At week’s downward trend, wait until the rise of day signalman does not employ the method of moving the order of sale. Place an order to sell a little below the low of the last day. As soon as the market will turn down, you will automatically open position for a fall. If prices continue slide daily rate of the order to sell a few ticks below the low of the last candle. The purpose of the method of moving an order to sell — to capture the moment an intraday low breakthrough. The order comes to power when the daily uptrend breaks and week-long downward trend again comes into its own.

Summary:

resort to methods of moving the order of purchase, when the weekly trend of increases and decreases Signalman day. Resort to the method of moving the order of sale, when the weekly trend is reduced, and the daily Signalman increases.

how to place the protective order in the triple screen.

stop order on the fixation loss in the position to increase should be placed slightly below the low of the previous game or the day — at least two.

stop order to lock in the loss position in the fall should be placed slightly above the maximum of this or the previous day’s play — at most two. Further orders can be shifted in the course of the market.

A. Elder. How to play and win at the stock exchange.

Use this strategy at your own risk. Forex-Utility.com not responsible for any damages that may result to you when using any strategy, presented on the site. It is not recommended to use this strategy on a live account, without testing it to start a demo account.