Swing Trading An antidote for frustrated traders

Post on: 29 Июнь, 2015 No Comment

Forex trading – the most frustrating endeavor you will probably ever face in your lifetime. Most traders dissolve their hard earned money to the market which fills the pocket of successful traders. We believe the level of success depends heavily on the individual trader’s methodology.

Today I wanted to talk with you about swing trading, a medium term strategy. I strongly believe short term trading strategies, like scalping and day trading, will poison your mind. These types of strategies encourage very bad habits in your trading technique and your approach to money management. Swing trading could be the simple solution youve needed to remedy how you approach and think about the markets as a whole.

A trader’s ‘style’ can be broken down into four main categories.

- Scalpers (Short term, quick in-and-out trading)

- Day Traders (Intraday trading, no overnight positions)

- Swing Traders (Medium term, trend momentum trading)

- Position Traders (Long term, buy and hold trading )

Swing trading is a type of methodology that sits in a ‘sweet spot’ between the caffeine-fuelled day trader and the ‘buy and hold’ position trader. Swing trading is a medium term approach to the market centered around momentum trading. When you’re swing trading, you let your trades run and think on a bigger scale in terms of profit.

Swing trading strategies dont normally appeal to many traders on first impression. They look too boring to most new traders because they want trade signals rolled out at high frequency. This mentality pushes the majority of the herd towards toxic day trading and scalping systems.

Let me share with you why swing trading is one of the most effective approaches, and my favorite methodology of Forex trading

Less effort required

Swing traders have the advantage of getting the biggest ‘bang for their buck’. What I mean here is that swing traders don’t have to invest a lot of time in front of the charts to be able to trade effectively.

Most swing traders, including myself, use the daily time frame to perform technical market analysis. More aggressive swing traders will switch to the 4 hour time frame to ‘tweak’ trade entries. The main focus of a swing trader’s market analysis is the closing price for the day. The official closing price for the market is the New York close. Having said that, it’s always recommended to use brokers with a New York close price feed so you get the correct closing price on the daily candles.

Swing traders use the New York closing price to perform their market analysis when the daily candle closes and use this opportunity to scan the markets for any swing trade opportunities. If a trade signal is found, swing traders can setup up their trade order by inputting entry, stop and target prices and then walk away from the computer to go about their business.

This is called set and forget, and it is the most time effective way to handle your positions. By setting and forgetting your swing trade positions, you only have to check the markets once per day for about 20 mins. This ‘hands off’ approach helps smooth out the emotional roller coaster that many traders struggle with. The idea is let the trade run its course, not fret over every minor move the chart makes.

Develop Strong chart reading abilities

Swing traders can become master chart readers by shifting their attention to the higher timeframes. One of the benefits of the daily time frame is the fact that it filters out a lot of intraday noise. By getting rid of the noise and focusing on higher time frames, the charts will offer you true clarity, probably for the first time in your trading.

Swing trading time frames allow you to focus on the core market movement and identify trend momentum easily. It only takes a couple of seconds to get your bias on a swing trading time frame. Trade signals like price action patterns are much more easily defined in contrast to the lower timeframes, where price is very ‘messy’.

Human behavior rarely changes. As a collected group, we keep doing the same thing over and over again in the markets. The market continues responding the same way to certain situations. The market psychology is visible in the candlesticks thus unique situations present themselves as price action patterns. An example of a price action pattern is the pin bar reversal which predictably produces the same response from the market as it has in the past. By using historical data and observing the past behavior of pin bars, we can start to identify low risk trading opportunities at key turning points in current markets.

As a swing trader, you will eventually be able to read the ‘herd mentality’ in the candlesticks and accurately anticipate future price movements based on observations in the past .

The Art of Swing Trading

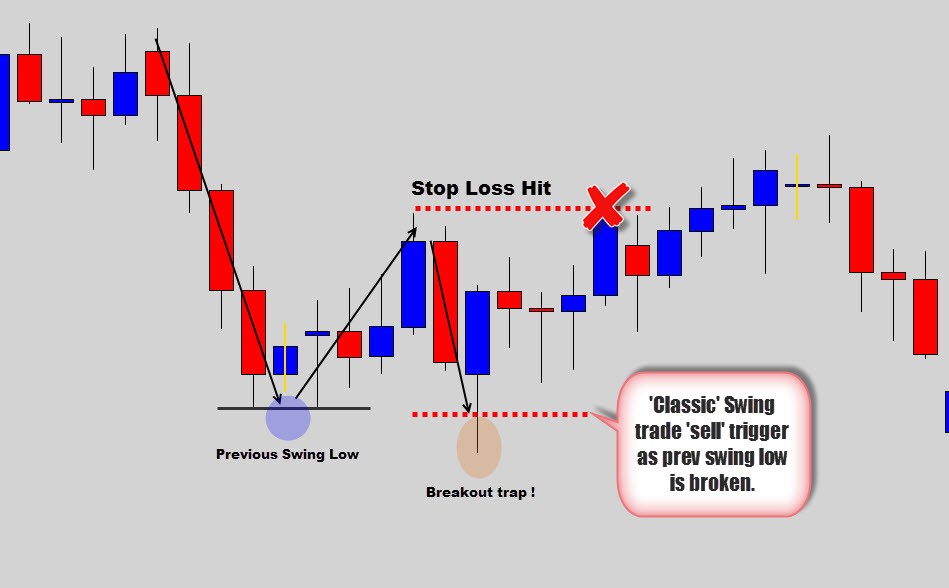

Swing trading is the skill of catching trend momentum at the right moment. A lot of swing trading ‘gurus’ say to take the breakout of previous swing highs or lows I dont like this approach because these recommended entry levels are consistent turning points in the market and are prone to breakout traps.

The smart way to approach swing trading is to look for short term oscillations (counter trend movements) within in a trend to take advantage of good buying or selling opportunities.

First you need to identify ‘swing levels’ where old resistance becomes new support, or the other way around.

When a swing level is tested, swing traders can look for buy or sell signals generated by their trading system. In our case we look for price action reversal patterns to enter us into a trade.

The idea is to buy on weakness and sell on strength to get you into the trend at the best possible prices.

Read that again…

The example above demonstrates the advantages of buying on weakness in an uptrend. Smart swing trading is exploiting those short term oscillations (counter trend movements) to enter into the trend momentum at these swing levels.

Swing trading allows you to catch the ’meat’ of the move by generally holding a position that can last anywhere from a few days to a few weeks, sometimes months. Much better than day traders and scalpers who spend hours in front of the screen to pick up breadcrumbs.

Slow and steady wins the race with swing trading. The advantage here is you dont need any sophisticated computer setups or ultra-high speed connections. Spreads don’t become an issue either, when youre pulling in 150-200 pip or more on each trade, you’re not going to kick and scream about a spread charge greater than 3 pips.

Managing trading with your life

Let’s face it, we all have busy lives. Most of us have full time day jobs, studying or looking after kids at home. That doesnt free up a lot of time to allocate to spend in front of the computer Forex trading.

Most new traders gravitate toward high frequency trading. but find it hard to mold it into their busy lifestyle. Location can be a problem for some people as well. Their time zone may not be a good fit for intraday systems, especially if you have to get up at 3 am to when volatility is high enough.

This is where swing trading really shines. Because you only have to focus on the closing price for the day, you really only need 10-20 minutes per day to analyse the markets or check your trades.

By using the set and forget approach, there is no need to ‘babysit’ your trade or watch over it. Once your trade is set, the market takes over and you go live your life. So, it’s possible to trade on a more casual timetable but still reap the benefits of a full time trader.

In a Nutshell

Swing trading may not appeal to everyone at first. Some traders need time to adapt to certain methods, or try others systems before deciding swing trading is a suitable fit for them.

Traders who are interested in maximizing their profits for the minimal amount of time invested should really consider making the switch to swing trading strategies.

The goal of a swing trader is to take advantage of momentum until it has run its course. We use price action trading strategies and combine them with swing trading methodologies to capture the bulk of trend movements.

The benefits of price action trading and swing trading marry well together and create a symbiotic relationship which produces a stress free, simple and stable trading approach to the market.

If you would like to know more about price action swing trading, gain an edge in the market and be one step ahead of the crowd, you may be interested in joining our exclusive group of swing traders who utilize low risk high reward trade opportunities from our price action protocol trading course. To find out, see War Room Trader Membership for price action traders.