Support Resistance Basics Risk

Post on: 3 Август, 2015 No Comment

This lesson aims to explain the logic of the reward to risk ratio in trading, going on to outline the principle “Every trader should choose a risk / reward ratio he feels comfortable with.”

The reward to risk ratio is a simple concept. If a trade’s stop loss is 50 pips and its profit target is 150 pips, its reward to risk ratio is 150:50 i.e. 3:1. The trade aims for a profit three times as large as its risk.

It might sound somewhat confusing to say that every trader should choose a reward to risk ratio they feel comfortable with (the words reward and risk are often used interchangeably, do not worry as the principle is the same). We need to explain a little about the nature of the Forex market before this will make sense.

It is a well-known principle of all speculative financial markets that there are a disproportionately large number of huge moves up and down. This means that in Forex, the easiest way to make the most profit over a long period of time is to aim for a small amount of huge winners, instead of aiming for a large amount of small winners. However, this can involve a lot of psychological discomfort, and a good money management strategy for coping with the inevitable losing streaks becomes essential, as compounding winners becomes less possible.

It is up to the individual trader to decide whether he or she will aim to win most of their trades with small profits, or instead go for a lower win rate but aim for higher profit targets. Over longer periods of time the higher reward to risk strategies will emerge with more profit, but will perform badly under certain market conditions.

It is not necessarily as simple as always aiming for a fixed reward to risk ratio on every trade. Profit targets can be adjusted according to market conditions.

Nor is it compulsory to enter every trade at or close to support / resistance points, although this can be a profitable trading style.

The lesson’s video outlines the following points:

- Reward to risk ratios are the key to finding and executing high yield, low risk trades

- Make as much as you can when you are right

- Lose as little as possible when you are wrong

- Defining the maximum risk on each trade helps protect your account

- Setting fixed reward / risk ratios can help traders remain disciplined

- Losses are inevitable

- Exits are more important entries

- Reward to risk ratios should be adjusted according to market conditions

- It is not necessary to win most of your trades to be profitable, if your winning trades are big enough

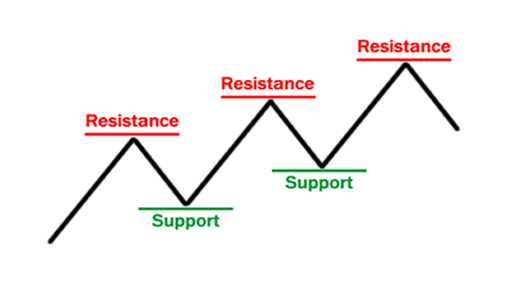

- It is beneficial to be able to identify support / resistance that is likely to be stronger rather than weaker

Risk/Reward Ratio

Choosing a risk/reward ratio before trading is an important move every trader should take.

One method of increasing a trader’s chances of profitability is to try to trade when he has the potential to make at least 3 times or more than what he is risking. If he gave himself a 3:1 reward-to-risk ratio, he would have a significantly greater chance of ending up profitable in the long run.

Reward-to-risk ratios are never guaranteed of course. They must be adjusted depending on the time frame, market environment, and one’s entry/exit points. A position trade could have a reward-to-risk ratio as high as 10:1 while a scalper could go for as little as 0.7:1.

Reward to Risk Ratio

In this lesson, we will focus on how to use support and resistance levels as a way to improve traders’ profits. According to their trading style (and of course based on the time frame that they use), every trader should choose a risk/reward ratio that he feels comfortable with. These reward-to-risk ratios are the key to finding and executing high yield, low risk trades, regardless of whether a trader is using daily, weekly or monthly graphs or charts, or any other form of indicator. Always bear in mind that every trade carries a certain level of risk and trading success is all about making as much as you can when you are right and losing as little as possible when you are wrong.

There are several different trade setups that offer profit. Although they use different indicators to analyze the price movements, They have two things in common:

Knowing the amount of risk on each trade is one way to limit your losses and to protect your trading account. It also means that you know your profit target. A disciplined trader will take an average system and make money with it but an arbitrary trader will take a brilliant system and wreck it. Since losing is an inevitable part of this game, a trader should learn how to minimize the risk and increase the reward.

Low Risk: if you choose your entry points near support / resistance. you will be reducing your risk because you can close your position with a small loss if that support / resistance is broken.

High Reward: perhaps exits are more important than entries because perfect entries are almost impossible. When you decide to open a position, you should make sure that prices have enough room to move. In the real world, reward-to-risk ratios aren’t set in stone. They must be adjusted depending on the time frame and market environment. However, some traders believe that the ideal should be 3:1. That means you are willing to lose 10 pips in order to gain 30 pips; or 100 pips for 300 pips.

The reason we try to trade only these high reward and low risk ratio situations is that we can be profitable without having a high percentage of winning trades.

The chart below shows an ideal setup where the reward-to risk ratio is 3:1. You may not recognize all of the terms or understand why we have strong support and resistance. For now, just know that the entry is at strong support, and the exit point is at strong resistance.

What does this chart illustrate?

On August 11, 2011, there is an opportunity to open a short position near the strong resistance formed by certain support and resistance indicators. We can set a reasonable stop loss order at the recent low of August 4 and 5 around 1.4060 for a maximum loss of 70 pips.

Strong resistance is formed by a combination of some other support / resistance indicators which all converge around the 1.4410 area, but we’d prefer a more conservative profit target below the closing price of August 9 around 1.4340.

Do we have a 3:1 RRR? Yes.