Strong Dollar or Weak Dollar Which Is Best

Post on: 16 Март, 2015 No Comment

U.S. Jobs at Stake

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Are you confused by the debate over a strong dollar verses a weak dollar? It is a very complicated question that mixes the stock market, politics, global gamesmanship and economics — in other words there are no easy answers.

However, it is somewhat easier to grasp the top-level aspects of the debate and this can be helpful to investors in the stock market.

Most of the world’s major currencies float in value relative to one another. The U.S. dollar is often the standard by which other currencies are measured. A strong dollar means that our currency buys more of a foreign county’s goods. This can be good for consumers and international travelers because things they want to buy (think electronics) and places they want to go are cheaper.

However, the downside is U.S. companies that sell goods to foreign customers suffer, because, relative to a weaker currency, our goods and services cost more. This may mean U.S. producers are at a disadvantage in the global market.

This can lead to manufacturers moving plants to foreign countries with lower costs so they can remain competitive — in other words a strong dollar can mean jobs lost in the U.S.

A weak dollar means our currency buys less of a foreign country’s goods or services. Prices on imported goods rise. Consumers must pay more for imports and foreign travelers may need to scale back a vacation because it is more expensive when the dollar is weak.

However, a weak dollar also means our exports are more competitive in the global market. perhaps saving U.S. jobs in the process.

When a large trading partner (our largest) like China artificially keeps it currency weak, it hurts the balance of payments. meaning its goods are cheaper than domestically produced products. While a short-term boom for the consumer, a weak currency of a foreign competitor means U.S. manufacturers have trouble competing.

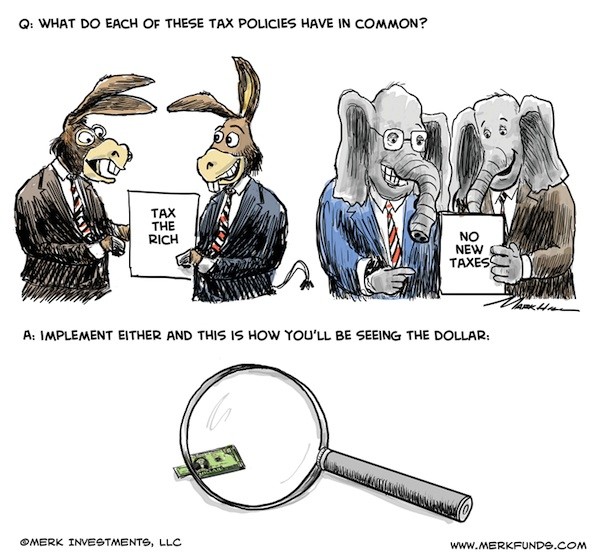

Conflicts over currency can (and have) led to trade wars where import tariffs are imposed in response to artificially weak currency of major trading partners. Trade wars are generally counter productive, but sometimes politicians are more concerned with what plays well with the home crowd rather than what it means to the overall economy.

As in most things, a balance between a strong dollar and a weak dollar is the best for our economy and stock investors. Consumers pay reasonable prices for imported goods and our manufacturers can compete in the global marketplace.