Stop Loss Hunting And Market Liquidity

Post on: 26 Июнь, 2015 No Comment

Market liquidity is considered to be “an assets ability to be sold without causing a significant movement in the price and with minimum loss of value”. Big market players with huge orders are not able to trade like the smaller retail traders. When they initiate a position a substantial order often needs to be filled and price can easily go against them; this comes as they create a large imbalance in the supply and demand. Markets move as a consequence of the liquidity between the bid and ask prices.

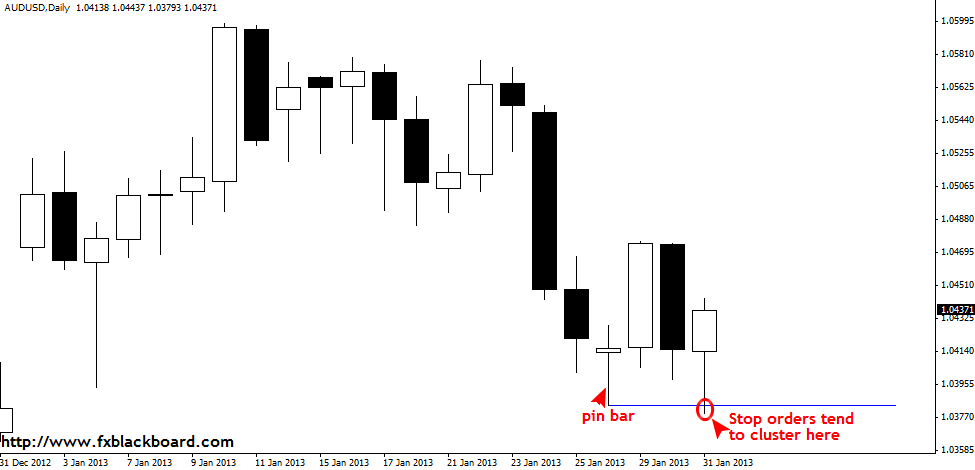

What these big traders need is a location where theyd be capable of filling orders with no/minimal slippage. What about our previously referenced accumulation of stop loss orders? Running the stops here would likely help them fill a large position with enough traders taking the opposite side in order to prevent major slippage; therefore provide the large traders with a better average fill.

So lets say this huge trader (or a big group of traders) has pushed price through a major round number; they do this knowing there is a good chance that stop loss/buy stop orders will be there as some traders exit bad trades and other speculate on higher prices and trade accordingly. If there are maybe 75 million dollars worth of orders at a given level the large traders may be keen to drive the underlying price up to set off the stop orders and subsequently get a fill for their orders.

If substantial offers appear at a given price, but relatively small volume is transacted, what is this saying to you? With this in mind do you think that there are benefits to reading order flow in short-term trading?

Making money going long and short

So lets look at the scenario above again. In the process of moving the market to the upside the astute large traders are often able to generate profits while initially going long as they squeeze the weak shorts out of their trades; these large speculators then get rid of the position they procured as price reaches a desired level and sell another say 50 million as per the original intention to find the required liquidity and go short with a good fill.

These large traders will not execute this strategy without ever losing a trade of course. Sometimes the accumulated stop loss/ speculative buy orders will eat up their short orders and the market will then see a breakout of the area. If this wasnt the case then inside day breakouts and similar strategies would never work out. These traders need to be in tune with underlying market sentiment in order to ascertain whether to fade a break of levels or not.

Price action analysis and order flow

The following example chart shows how price has taken out a low on the EURUSD currency pair. What happens when a low is taken out? Traders enter short positions So in this example the shorts are trapped as price moves against them. Price action analysis traders will notice that the 1 hour chart gives a bullish engulfing candle and the 4 hour gives a bullish hammer/pinbar.

In the next chart, which follows from the above; we can see that price continued to the upside after trapping the shorts. This is often referred to as a bear trap . The price action analysis gave a heads up as to a potential long trade. There will be many times that the market will continue to the downside despite giving a price action signal like the one shown. Nonetheless, this is the kind of scenario that price action traders often look for as the PA signal is in a logical place with potential order flow . If the bears have to liquidate their positions the bulls can benefit.

How does the hunt for liquidity affect your strategy?

Most experienced forex traders aim to trade in the same direction as the hedge funds and large institutional traders. This is why the COT report is so popular after all. There are a huge amount of variables in play when we trade the forex market but depth of liquidity is an essential element that large traders need to have in place; it therefore makes sense that they would try to hunt for liquidity in order to profit from it. Do you pay attention to the order flow when trading? There are news services that provide information regarding potential clusters of orders and options boundaries. If the average holding period for your trades is very low it may be even more important to gain an understanding of where the bids and offers may be residing.

Related search terms: Do forex brokers hunt for stops? Contrarian trading strategies, Forex stop run, Stop loss definition.