Stocks Options Taxes Part I Introduction Investor V

Post on: 30 Июнь, 2015 No Comment

Objective / Scope of the Series

After considerable study and evaluation, I am presenting my findings and interpretations regarding the entire gamut of tax considerations that investors in stocks and options need to be aware of. This article series should be timely, as tax season approaches once again. This has not been a trivial undertaking. Understandably, knowledgeable, tax-aware individuals reading this introduction are probably skeptical that the article series will deliver as promised, considering it has been prepared by a non-professional. In fact, most would consider it highly unlikely to be accurate, with the result being that instead of useful knowledge being provided, yet more misinformation will likely be disseminated. While I will admit that there is that risk, I believe I have grasped the key concepts, and that fellow investors in similar circumstances will benefit from a structured, organized presentation of these topics. An additional benefit is that I will identify resources that I believe will be useful to those who seek further clarity and detail.

The scope of this series is limited to the subject of tax considerations for stocks and options on stocks. Related topics, which may be alluded to but not specifically addressed, are tax considerations for Mutual Funds, Bonds, Exchange Traded Funds (ETFs), Master Limited Partnerships (MLPs), Futures, Forex, and Options on Futures, Stock Indexes, and ETFs. Also, the discussion will be limited to commonly occurring situations that investors in publicly traded stocks and options experience, when positions are held in street name in brokerage accounts. Readers need to be aware that the information as presented is not all-inclusive, and that there are many exception conditions and special cases that are not discussed. An outline of the complete article series is as follows:

Part I — Introduction, Investor vs. Trader

The remainder of the series, Parts II, III, IV, V, and VI, only applies to investors, or traders who have not elected mark-to-market (MTM) status. The articles will be released throughout the rest of this month, roughly every few days or so. For perspective as to what this series is all about, the remaining articles planned are as follows:

Part II — Dividends

Part III — Capital Gains and Losses — Basics

Part IV — Wash Sales, Short Sales, Constructive Sale Rules

Part V — Options - Tax Basics

Part VI — Options, Tax Straddles, Covered Calls

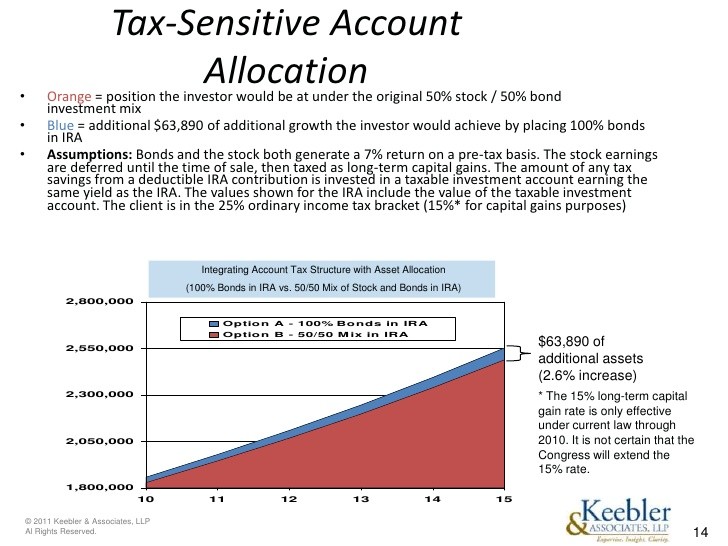

Tax Changes Affecting Investors in 2012 and Beyond

Most investors are aware that the preferential tax rate for qualified dividends, whereby such dividends are taxed at capital gains rates, are scheduled to be eliminated after tax year 2012. Further, the rates on long-term capital gains are scheduled to increase after 2012 as well. Currently, for 2012, a 0% capital gains rate applies for 10% and 15% bracket taxpayers, and a 15% capital gains rate applies, at most, to taxpayers in higher brackets. Some higher bracket taxpayers may still have some qualified dividends and long-term capital gains taxed at 0%, which is to say they are not taxed, and the remainder at 15%. The exact breakdown depends upon total taxable income, filing status, and the amount of qualified dividends and long-term capital gains to be reported.

Assuming Congress does not extend the Bush-era tax rates on qualified dividends and long-term capital gains for years after 2012, and allows the prior rules to resume unchanged, dividends will revert to being taxed at ordinary income rates, and long-term capital gains rates will revert to 10% for taxpayers in the lowest bracket (which will be 15%, as the 10% bracket goes away), and to 20% for taxpayers in higher brackets. For completeness, note that under the prior rules, the 10% and 20% capital gains rates are reduced to 8% and 18% for assets held over five years.

Presumably, all taxpayers affected are aware that, starting with the 2011 tax year, brokerages have been required to report the cost-basis and holding period (for securities acquired after 2010) for all stock and bond trades to the IRS, as well as to the taxpayer, on Form 1099-B. For securities acquired before 2011, only the sales proceeds are reported, as had been the requirement before 2011. Also starting with 2011, taxpayers were introduced to the new Form 8949, which must be completed in such a way that it is a reconcilement of the information shown on Form 1099-B. The summarized results of multiple Forms 8949 are then transferred onto Schedule D. For tax year 2012, brokerages are required to expand Form 1099-B cost-basis and holding period reporting to include redemptions of mutual fund shares and shares acquired via dividend reinvestment through the brokerage. The fun will really begin with tax year 2013, when 1099-B reporting of cost-basis and holding period is scheduled to be expanded to include options trades.

Finally, starting in 2013, for taxpayers with modified gross income over $200,000 (single filers) or over $250,000 (joint filers), an additional 3.8% tax will be levied on net investment income.

Investor vs. Trader, Investor Limitations

Most individuals buying and selling stocks are investors — their objectives are to collect dividends and benefit from stock appreciation on a long-term basis, as firms grow and prosper. The IRS assumes buyers and sellers of stocks and options are investors unless a taxpayer can present a compelling case to be treated as a trader, and that the stock and options trading activity is a business. While there are some guidelines, there are no definitive IRS-approved benchmarks that define the nature and level of activity required to be considered a trader. For those whose emphasis and activity level justifies trader status, there can be some tax advantages, especially if a mark-to-market (MTM) election is made. Before discussing some guidelines whereby a case might be able to be made to be treated as a trader, and how to go about it, consider the status of the investor, and the limitations on deductibility of expenses associated with being an investor that can be used to reduce taxes.

Interest expenses for investors, such as margin interest or interest on debt to carry investments, is only deductible to the extent that the investor has offsetting investment income, which is usually confined to interest or non-qualified dividends. Form 4952 must be completed to deduct investment interest expense.

Costs of education, newsletters, computers, a home office, seminars, and many other expenses that are deductible business expenses for a trading business, if handled properly, are not deductible at all for investors. The few investment expenses, other than interest as noted above, that are allowable can only be combined with other miscellaneous itemized deductions and deducted on Schedule A. This means that only the excess over 2% of adjusted gross income is deductible.

Capital losses in excess of capital gains can only be used to reduce other taxable income up to a maximum of $1500 (for single filers) or $3000 (for joint filers). While the excess can be carried over and used to reduce taxable income in later years, it might take a very long time indeed to use up significant capital losses suffered in a bad year.

Finally, there are many complications, such as wash sale restrictions, constructive sale rules, straddle rules, and options impacts on stock positions, to name a few, which can trip up an investor and result in adverse tax consequences. If the level of trading activity justifies being considered to have a trading business operation, a taxpayer can sidestep most of these complications by electing MTM trader status.

Qualifying for Trader Status

A trader, in contrast to an investor, seeks to buy and sell securities to profit from short-term market movements, often as frequently as intraday. Buying and selling activity must be frequent, continuous, and substantial. In order for trading activity to be considered a business, the taxpayer must demonstrate intent to produce income from trading as a livelihood. Some potential guidelines are:

- Must trade full-time or nearly so every market day, spending at least four or more hours per day trading. A trader holding a full-time job with W-2 income to report will have a more difficult time convincing the IRS that the trading activity is a serious business.

- Must have none or very few lapses in trading activity during the year. Traders can still get sick or take a short vacation, but they cannot take months at a time away from trading and still be convincing to the IRS that they have a business operation.

- Should execute trades on more than 75% of available trading days.

- Should make over 500 round-turn trades per year, either day trades, or short-term trades which might be termed swing trades, with duration measured in days, not months.

- Should have a substantial dollar amount of gross proceeds in a year — trading for pennies is not going to be convincing to the IRS that one was attempting to make a living at it.

- Must have significant business tools, education, and business expenses related to trading, with either a home office or a separate place of business.

- Must have a material account size, over $25,000 for stock traders, with pattern day trader (NYSE:PDT ) status in a taxable brokerage account. Trading activity in retirement accounts does not qualify as business trading activity for purposes of claiming trader status.

Note that a trader can still have investment positions as well — they just need to be segregated from trading activity, most easily achieved by holding in separate accounts.

Two Types of Traders from a Tax Standpoint

There are two types of traders, as far as taxes are concerned; those who have not made a MTM election for the tax year, and those who have. A MTM election for a tax year, also termed a Section 475 MTM Election, must be made by the tax return filing date of the prior tax year. In other words, one must elect MTM status for a given year by notifying the IRS three and one-half months into that year. If this is not done, the trader can still claim that the trading activity for said year is a business, assuming the guidelines above are met, and file a Schedule C as a sole-proprietor of the business, to claim justifiable trading business expenses. However, other than that, there is really no advantage to being a non-MTM trader vs. just being an investor. The non-MTM status trader must still report trading gains and losses on Form 8949 and Schedule D, and is still subject to wash sale rules, constructive sale rules, straddle loss disqualifications, and so on. A MTM trader, by contrast, avoids most of these issues, and if trading losses exceed gains, can deduct the excess against other income, and is not limited to $1500 (single) or $3000 (joint) per year. The MTM trader also can deduct trading business expenses in the same fashion as a non-MTM trader. While a MTM trader can remain a sole-proprietor, and deduct expenses using Schedule C, it may be advisable to establish a separate tax entity for the trading business. If a separate entity is established for the trading business, the trader can actually set up health and retirement plans under the entity as well, and benefit accordingly. If this is done, separate trading accounts need to be used for trading, specifying the new entity Tax Identification Number (TIN) instead of the trader’s Social Security Number. If a separate, new entity is not established for the trading business, a Form 3115 must be filed with the tax return for the first year of trading as a MTM trader. Form 3115 provides for an adjustment of all trading positions held when entering the year, as the taxpayer is by definition changing accounting methods, from cash accounting to annual MTM accounting. Note that even with MTM status, the taxpayer still must report each and every trade, line by line. It is done in the case of a MTM trader using Form 4797 instead of Form 8949.

Final Thoughts — Investor vs. Trader

A decision to establish one’s trading as a business, and eventually to become a MTM status trader, should not be made without a great deal of forethought and evaluation. The normal progression would be to file taxes initially as a non-MTM trader for a given year, make a MTM election in time to file as a MTM trader the next year, and then file a Form 3115 along with that year’s tax filing, to reflect the change in accounting method. It is possible to short-cut this process by establishing a new tax entity for the trading business. Professional advice and guidance is essential. There is much to consider before taking this step, and missteps can be very costly. An excellent resource for individuals considering seeking trader status is Green & Company Inc. The publishing operation produces an annually-updated Trader Tax Guide, available for purchase from the firm. A link is provided under Resources. below. A related CPA firm provides tax consulting and planning services. Software is also available from Green & Company on an annual subscription basis, which is purported to handle the tax complexities mentioned. Other than being aware that the software exists, this author has no knowledge regarding the utility of the software, but as will be evident at the conclusion of this series of articles, if it works, it could be a life-saver.

A first step for an investor considering trader status would be to purchase and thoroughly review the current Trader Tax Guide, available from Green & Company for a modest sum, and then proceed from there, if establishing a trading business seems like the best way forward. Note that the author has purchased this guide, and has found it quite informative. Other than that, I have no affiliation with Green & Company.

Resources and Disclaimer

All of the preceding, and indeed most of the entire series, is based on my review of the following resources:

Trader Tax Guide from Green & Company, Inc. available for purchase at www.greencompany.com .

J.K. Lasser’s Your Income Tax for 2013, available from bookstores everywhere.

Taxes and Investing Brochure from the Options Clearing Corporation (OIC), available as a PDF file online here .

Various IRS Publications, particularly the 1040 instruction booklet, plus instructions for Schedules A, B, C, D, and E, and Publication 550, Investment Income and Expenses. All IRS forms and instructions are available from the IRS website here .

Links to additional online resources referenced in researching specific topics will be provided as appropriate in the Resources section of the subsequent articles.

While I have made a good faith effort to understand and present the topics discussed in this article series, relying upon the resources cited, I want to reiterate that I am not a financial professional, nor am I certified in any way as a financial advisor or tax expert. I am an independent, individual investor, focusing on dividend-paying stocks exclusively. I am always seeking to become more knowledgeable regarding investments and related topics, and on sharing what I learn with other investors in similar circumstances. One thing I have learned is, the deeper into this subject you go, the less consensus you find, with various experts differing occasionally on specific fine points, and the IRS providing minimal clarity.

Investors are advised to seek professional tax advice and assistance in handling their own tax situation. However, becoming a knowledgeable and conversant client on tax issues affecting investors will save time and money, and will improve the likelihood of correct tax filings.

The remainder of this article series only applies to investors, or as noted above, to non-MTM traders, which are subject to the same rules as investors, as far as handling and reporting stock and option trades is concerned.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.