Stock market manipulation insider trading

Post on: 16 Март, 2015 No Comment

Insider trading is an example!

Stock market manipulation is any activity that attempts to interfere with the proper operation of the stock market and create artificially distorted stock prices.

This type of activity is prohibited in the United States under Section 9(a)(2)[2] of the Securities Exchange Act of 1934.

In Australia a similar prohibition is covered under Sections 1041A of the Corporations Act 2001.

Types of Market Manipulation

Market manipulation can occur in a variety of ways including.

- Churning — when a trader places both buy and sell orders at about the same price. The increase in activity is intended to attract additional investors, and increase the price.

Insider Trading

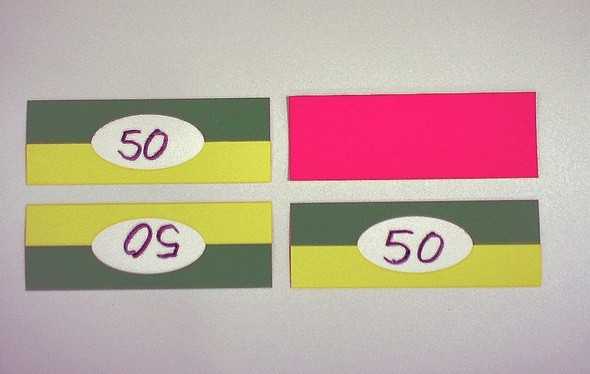

Insider trading refers to the buying or selling of a stock by someone who has access to non-public information of value about the stock.

Insider trading can be illegal or legal depending on when the insider makes the trade. It is illegal when the material information is still non-public.

Trading while having special knowledge is unfair to other investors who don’t have access to such knowledge.

Directors are not the only ones who have the potential to be convicted of insider trading. Brokers and even family members can potentially be guilty.

Insider trading is legal once the information has been made public, at which time the insider has no direct advantage over other investors.

The Securities and Exchange Commission (SEC), and regulatory bodies in many other countries however, still require all insiders to report all their transactions.

To Conclude

Stock market manipulation is an activity which is out of the control of value investors. They are reliant on the market regulators to enforce the law regarding this behavior.

Company insiders are required to report instances of insider trading to the regulator. Value investors should look at these trading reports to see how insiders are legally trading their stock.

The reason being that company insiders have the best insight into the workings of their company.