Starting a Green Business Appeals to the Socially Responsible Investor

Post on: 12 Май, 2015 No Comment

Starting a Green Business Appeals to the Socially Responsible Investor

Guest contribution provided by Forex Traders

The “Green Revolution” has established a beachhead and is here to stay, unless you truly believe that fossil fuels will last forever. As a result, our lexicon of terms has been modified to include common phrases such as environmentally friendly, renewable energy resources, and socially responsible investment principles. If there is to be a future without carbon induced greenhouse effects or the potential for exorbitant prices for gasoline at the pump, then an entirely new industry must spring forth and expand before our very eyes.

This revolution in green-oriented enterprises has been ongoing for decades. However, the unfortunate fact is that excitement for products and services in this industry seems to be tied to the ever-changing price of oil in our society. When oil prices rise, interest in alternative energy sources, especially wind and solar in recent years, jumps off the charts, but when gasoline prices fall, people and investors tend to look the other way. Both federal and state governments have created a base of subsidies to spur development, but these programs also come under pressure from lobbyists for “Big Oil” that attempt to shift priorities back to off shore drilling projects.

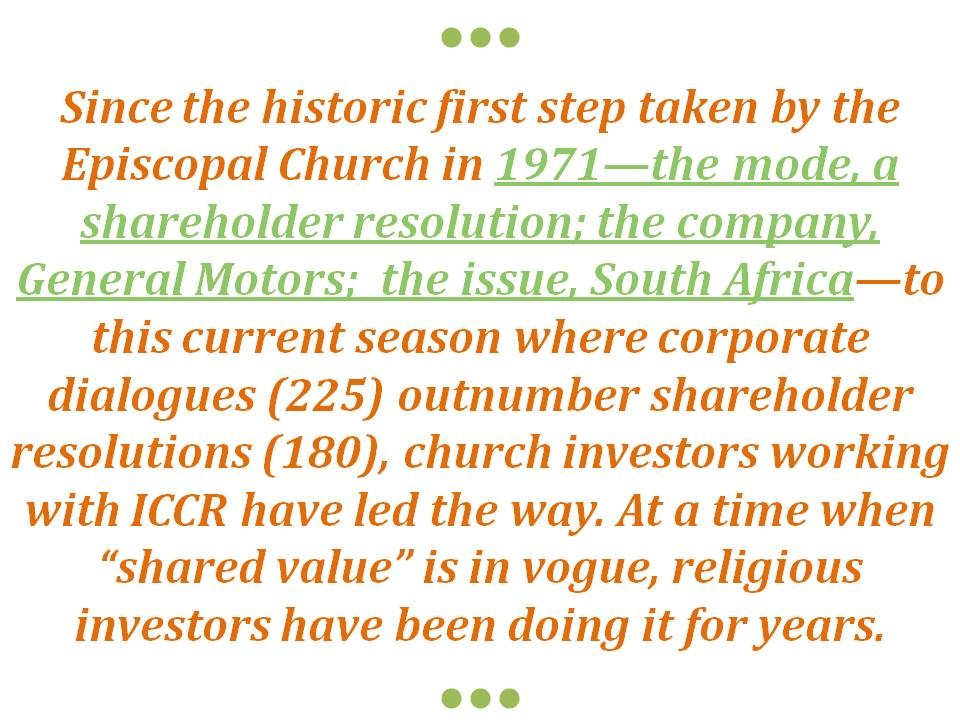

There is additional support, however, growing from institutional investors in the form of socially responsible investing, or “SRI”, that seeks to maximize both financial return and social good. Studies from a few years back, before the recent recession took hold, determined that nearly $2.7 trillion under management in the U. S. or 11%, and $2.2 trillion in Europe, or 17%, are invested in “SRI” defined assets. Recent figures have declined a bit, but the overall interest is supportive and growing amongst pension fund managers.

How does an entrepreneur go about starting a new business in this environment? The primary reason that new business ventures fail in any economic sector is due to inadequate funding for hard assets and working capital. In order to appeal to investors, one must not only have a worthy idea, but must also address the key concerns that will drive an investment decision in your chosen area. Here are a few of those key areas worthy of consideration early on:

- Your Idea. You must have an idea for a new product or service that is exciting and that will have a broad market appeal. If you can obtain a patent or industry certifications. start that process early. Gather data and commentary to support your sizing of your market opportunity;

Growth: The Green energy sector will experience double-digit growth for years to come. Investors understand this trend, but they will focus more on areas where growth is more certain. Wind, solar, and geothermal sub-sectors are top on their list, and Biofuels have aggressive goals that suggest a twenty-fold increase in the next decade alone.

A Green business venture does appeal to socially conscious investors, your best bet for adequate funding capital.